It’s a Snow Day! Hi Friendos, It looks like my city is about to get some serious-for-us snowfall, so I’m declaring today a snow day for Frequently Taxed Questions. I’m on shoveling duty! During last month’s snowstorm, this guy came in looking like he got dusted with powdered sugar. He gets very excited and bouncy […]

The Boring Newsletter, 2/14/2026

If You Love (or Even Mildly Like) Yourself, Get an IP PIN Hi Friendos, Today is another newsletter about Identity Protection PINs that are issued by the IRS. I’ve written about them before, but today can provide some quantitative insight into just how important they are. As I wrote last year: It’s a 6-digit number […]

The Boring Newsletter, 2/8/2026 👀

An Eye Doctor Can Be In-Network AND Out-of-Network At the Same Time Hi Friendos, Next Saturday, Feb 14, I am hosting my free monthly Zoom at 11am ET / 8am PT; the meeting ID is 897 1710 3456 and you can join in the Zoom app or at https://www.zoom.com/. What could be more romantic? Today […]

The Boring Newsletter, 2/1/2026

This Year, Keep Those Donation Receipts Hi Friendos, This condo treasurer spent a big chunk of her day working on financial analysis for her building, so today you are getting a quick tax tip about a change in tax law for charitable giving. In a prior newsletter, I said it is (effectively) a myth that […]

The Boring Newsletter, 1/25/2026

Get the Reference Number. There is Always a Reference Number. Hi Friendos, Today’s newsletter is about getting an insurance company to reprocess your claim when they did it wrong the first time. I have 3 examples from my own life to share where I was 3 out of 3 on getting this done. I learned […]

The Boring Newsletter, 1/18/2026 🤕🚑

In-Network? Don’t Pay Until Your Claim is Processed Hi Friendos, Today’s newsletter is about medical bills and financial self-defense because I had wrist surgery on Tuesday (recovery is good so far!), so that’s top of mind. My tip is a repeat of one from last year where a little repetition may be helpful: If you […]

The Boring Newsletter, 1/11/2026

Knowing When to Ask and Then Having the Language Hi Friendos, Last week I was talking to a family member who mentioned they needed $250 of work done on their gutters. A big limb had fallen off a tree in front of their house. Thankfully nobody was hurt and the branch didn’t break any windows […]

The Boring Newsletter, 1/4/2026

10 Fabulous Ideas for A Financially Boring New Year Hello Friendos and Happy New Year! I am kicking off a new year of Boring Newsletters with a list of 10 boring financial-type chores for your consideration. It’s nice to have these things handled and for your money matters to be boring. Also, mark your calendar, […]

The Boring Newsletter, 12/20/2025

If You Will Itemize This Year But Not Next Year, Accelerate Deduction Items Like Property Tax Payments Hi Friendos, I know I said I wasn’t going to send out any more newsletters this year…but I had to do this one! Today I have for you a possible tax maneuver for homeowners that illustrates a technique […]

The Boring Newsletter, 11/16/2025

Year End Edition! In mid-November! Hi Friendos, I looked at my calendar for the next several weeks and realized that between gearing up for next year’s tax season and some upcoming travel, this newsletter needs to start its year-end break a little on the early side. So today I bring you thoughts for year-end financial […]

The Boring Newsletter, 11/8/2025

Not Your Deductible, Not Your Co-Insurance. Just Your Co-Pay. Hi Friendos, Recently I had a minor ultrasound-guided procedure at a Manhattan location of Lenox Hill Radiology. I knew the procedure was fully covered by my insurance, because I checked on this in advance, but Lenox Hill’s admin errors led them to disagree. I arrived 15 […]

The Boring Newsletter, 11/2/2025

It is not the LLC structure itself that can offer tax savings, it is electing tax treatment as an S-Corp Hi Friendos, Last week I wrote about my top advice for people starting out with self-employment income. I claimed that most do not need to worry about forming an LLC, which takes some administrative doing […]

The Boring Newsletter, 10/26/2025

My Top Advice for People New to Self-Employment Income: Learn About Quarterly Estimated Taxes, Don’t Sweat the LLC Hi Friendos, People who are first starting with self-employment income run into all kinds of advice, good and bad. Typical advice includes “Choose the Right Business Structure.” People focus their energy on researching how to establish an […]

Hi Friendos, Today I have cooperatives on my mind. I’ll bet you participate in the cooperative economy even if you don’t know it! And for my NYC friendos, you know that housing co-ops comprise a huge proportion of real estate in the city. Study agriculture and electricity in the U.S. and you’ll run into a […]

The Boring Newsletter, 10/12/2025

Planning my services for the 2025 tax season Hi Friendos, I cannot predict when the federal government shutdown will end, but I can say that you still are required to file your tax return on time! If you got an automatic extension on your 2024 tax return, the October 15th deadline is almost here. I […]

The Boring Newsletter, 10/4/2025🫂

Today is the Perfect Day to Give Money to a Food Bank Hi Friendos, Today I’d like to share a selection of recent news from around the country: And in my city, visits to food pantries and soup kitchens are up 85% vs 2019. Wherever you live in the U.S., there are hungry kids and […]

The Boring Newsletter, 9/28/2025

Saving, Spending and Counting up the Month Hi Friendos, A couple weeks ago I was talking to a neighbor about budgeting and FIRE. She was trying to figure out how much money their household actually spends each month but getting a bit stuck in the mud with accounting for certain medical spending. They put money […]

The Boring Newsletter, 9/21/2025

Social Security credits are more interesting and a lot more complicated than you might think Hi Friendos, Today’s topic is Social Security credits – how you earn them and what you get when you do. Earning one Social Security “credit” Earning a credit is like a pass/fail class, you either make it or you don’t. […]

The Boring Newsletter, 9/14/2025

In which I provide a tax reminder, a call for maintenance, and admit my time got derailed this week. Hi Friendos, A reminder! Tomorrow, September 15th, is the deadline for quarterly estimated tax payments. This week I am not sending a regular newsletter because I had a few things come up recently that took a […]

The Boring Newsletter, 9/7/2025

You Should Understand Your Largest Asset: Social Security Hi Friendos, The very first article I wrote for this website was called “You Should Understand Your Largest Expense.” I asserted that most people think their largest expense is housing, but in fact it is usually taxes. Well, it turns out that most Americans think their largest […]

The Boring Newsletter, 8/31/2025 😬

It is a hassle to price shop a dentist but it’s worth it if you’ll stick around a while Hi Friendos, I’ve written quite a bit about my recent deep dive into dental insurance and today am going to wrap it up with a discussion of the cost of basic teeth cleanings. I know, not […]

Don’t feed the trolls. Tell Congress: no tax prep bridge trolls! Hi Friendos, Last week my business received a letter (my official LLC name is Levinson Lee Consulting and my registered “doing business as” name is Frequently Taxed Questions). I opened the letter and thought, “oh yeah, that thing I have to file every other […]

The Boring Newsletter, 8/17/2025

Charity care and other strategies to reduce medical bills, and organizing paperwork for bills you do have to pay Hi Friendos, Last week I promised to discuss practical considerations for using FSAs and HSAs, and tracking medical expenses in general. Before I get to that, I want to talk about steps you can take to […]

The Boring Newsletter, 8/9/2025

For tax purposes, a “Qualified Medical Expense” is mostly what you think, plus a bit more Being an adult in the U.S. means sometimes dealing with things that are both dull and important, like taxes and medical insurance. Today I focus on the intersection of these: what constitutes a “qualified medical expense” for tax purposes. […]

The Boring Newsletter, 8/2/2025

Pet Medicine is Also Cheaper Abroad? Hi Friendos, I’m taking a little time off this week, so today’s newsletter is short and sweet. You are surely familiar with the way pharmaceutical companies charge U.S. consumers more than for the exact same drug as what they charge people in other countries. They are milking us to […]

The Boring Newsletter, 7/26/2025

I learned that a provider who “takes my insurance” may not be “in-network” Hi Friendos, Today I am sharing how I’ve ended up, over the last couple decades, paying a lot more for dental care than I needed to. I’ve always tried to be a careful steward of my money but my ignorance of how […]

The Boring Newsletter, 7/20/2025

When you ask Cigna if your dentist is in-network and discover they hired George Orwell as a consultant Hi Friendos, As you know from prior newsletters, I’ve been learning a lot about health insurance this summer. Today I am writing about something that I’ve learned is not at all a new topic, but was new-to-me: […]

The Boring Newsletter, 7/12/2025 💞

Come correct on money stuff when you get married Hi Friendos, This week, I wanted to think about a nice thing that is nice: when people are in love and want to get married. It’s so nice! I was thinking about this because of a recent “Tax Tip” newsletter I got from the IRS called […]

The Boring Newsletter, 7/6/2025 🦷 🪥

Your Dental Insurance Has an Annual Max: Get the Most Out of It Hi Friendos, This week I am here with two ideas to help you get the most out of dental insurance. Both involve understanding your annual coverage limit, assuming your policy has one. In the last 10+ years, I’ve had dental insurance from […]

The Boring Newsletter, 6/28/2025

Hi Friendos, I am happy to report that since I wrote last week’s very personal newsletter, it looks like we have some rays of sunshine breaking through the clouds. More upcoming tests and doctor visits will provide additional information. In the meantime, I have been giving myself a crash course on insurance and been learning […]

The Boring Newsletter, 6/22/2025

Dear Friends, Today’s newsletter is personal and a bit of a rant. I promise, this is also a little bit about taxes. And social murder. And war. Please indulge me this week, I’m in a vulnerable place. ~~~ If you’ve been here for a while, you know that my husband has medullary thyroid cancer. Last […]

The Boring Newsletter, 6/14/2025

Hi Friendos, Today I am going to share a little tax “trick” that could help some people avoid an underpayment penalty if they did not make quarterly estimated payments on schedule. Maybe it will help you out. The scenario: You received some income where taxes were not withheld, like self-employment income or interest income. You […]

The Boring Newsletter, 6/7/2025

Hi Friendos, Today’s topic is the backdoor Roth IRA. Before diving in, I have a couple of reminders: Ok, now on to the “backdoor Roth.” Last week I discussed IRA contributions, and how they come in traditional and Roth flavors. But, I said, “Roth IRA contributions have their own income limitation, but that only prevents […]

The Boring Newsletter, 5/31/2025

Hi Friendos, Today’s newsletter is all about IRA contributions. Back when I was in business school (20 years ago!) I gave a presentation to the Women in Business club called “Who is Roth and What is He Doing with My IRA?” I looked it over recently and was surprised at how few updates it would […]

The Boring Newsletter, 5/26/2025 🇺🇸

Hi Friendos, I hope you are having a relaxing holiday weekend whether you are remembering those who served, working, enjoying time outdoors, catching up with friends, shopping, or just taking a nap. When I moved to my current neighborhood, I was surprised at how many people put out flags in front of their homes. There […]

The Boring Newsletter, 5/18/2024

Hi Friendos, I recently listened to an interview with a financial journalist who says that people don’t need a budget and that budgeting doesn’t work. She published a book called “You Don’t Need a Budget” which I won’t link to because…come on. She says budget culture is toxic, just like diet culture. She says “Money […]

The Boring Newsletter, 5/11/2025

Hi Friendos, You’ve seen lots of discussion about people with subscriptions to streaming services they don’t use. Yesterday I saw a headline about people’s newsletter subscriptions getting out of hand, focused specifically on Substack. I just started using Substack for this newsletter! I was legally required to read the article. The reporter interviewed dozens of […]

The Boring Newsletter, 5/4/2025

Does 1% matter?

The Boring Newsletter, 4/27/2025

Hi Friendos, Today is another installment of Everything Emergency Funds with a focus on whether it’s a good idea to use a Roth IRA as your emergency fund. Many otherwise high–quality sources tout the possibility of using a Roth IRA as a source for need-quick-cash, but I think this is a bad plan. If you […]

Hi Friendos, Today I have homeowner’s insurance on my mind. That’s because I recently did a comprehensive review of my condo building’s insurance after I became our Treasurer earlier this year. In a multi-family condo building like mine, the common elements of the building, like the roof, are covered by the condo’s commercial insurance, and […]

The Boring Newsletter, 4/13/2025

Hi Friendos, March 29, 2025 was the 50th anniversary of the Earned Income Tax Credit (“EITC”). I doubt any of you reading this have ever qualified for or received this tax credit. Today I want to talk about some of the specific rules around the EITC that got me thinking about a smoldering talk by […]

The Boring Newsletter, 4/6/2025

Hi Friendos, I don’t know if you heard, but the stock market took a tumble last week! Today I’ll share three ideas for productive things you could do as a result. We all want to “do something” when things feel crazy, so the key is to keep it productive and not be our own worst […]

The Boring Newsletter, 3/30/2025

Hi Friendos, A couple weeks ago I wrote about the potentially huge payoff of shopping a mortgage. Today is about the potentially huge payoff of prepaying a mortgage. I’ll discuss some of the “math” aspects of this but my view is that the non-math considerations are far more important. I hear a lot of people […]

The Boring Newsletter, 3/22/2025

Hi Friendos, Today’s newsletter is about a pretty boring topic: helpful info available at your IRS.gov account. Will that continue to exist in the future? Ha ha, I have no clue! Oh no really…I’m fine. But for now…here it is…my favorite new part of the IRS website: the Transcripts page. You can pull, at no […]

The Boring Newsletter, 3/16/2025

Hi Friendos, Today I am discussing tax gain harvesting, the less-famous buddy of tax loss harvesting that some people do with their investments. This technique only applies to regular brokerage accounts, not retirement accounts like a 401K or an IRA. To understand and implement this technique, you must fully absorb how taxes on capital gains […]

The Boring Newsletter, 3/8/2025 🏠

Hi Friendos, Last week I wrote about mutual fund fees and the importance of keeping costs low in your investing. This week I’ll do the same but for home mortgages. My message is: Shop your mortgage! Shop your mortgage! Shop your mortgage! This matters because the dollar impact can be so huge. Think about the […]

The Boring Newsletter, 3/2/2025

Hi Friendos, Today I want to talk about investment fees because you will be wealthier if you stop financial firms from skimming your cream. I think this is so important that your written financial plan should include a statement like the following: “Stephanie will strive to minimize the effects of expenses on her investment returns.” […]

The Boring Newsletter, 2/23/2025

Hi Friendos, Anton Chekhov said, “Only entropy is easy.” That’s right. It’s easy for things to get messy and effortful to put them in order. It’s easy to have 4 different retirement accounts from 4 different jobs. Oh and you opened one account when you started working with a financial advisor, but kept some money […]

View post to subscribe to the site’s newsletter.

The Boring Newsletter, 2/16/2025

Hi Friendos, Last week I suggested that everyone should have a written financial plan. In this and future newsletters, I’ll discuss selected elements I think your plan should consider. Today’s topic is taxes and your asset allocation. Let’s say you’ve decided that you want an asset allocation of 60% stocks and 40% bonds/cash. Consistent with […]

The Boring Newsletter, 2/9/2025

Hi Friendos, Today’s newsletter ends with a single recommended personal finance to-do: create a written financial plan. Scoping out your future financial needs is full of uncertainty and unknowns. You’ll still be better off with a plan than without one. In business school, I took an accounting class called “Financial Reporting and Analysis.” The entire […]

The Boring Newsletter, 2/2/2025

Hi Friendos, If you work as an employee, you should have received your W-2(s) by now, which will help you file your tax return. If you’ve ever looked at a W-2 and felt uneasy at seeing a bunch of different numbers about your own income that you don’t really understand, today’s newsletter is for you. […]

The Boring Newsletter, 1/25/2025

Hi Friendos, Today’s newsletter is about why you should get an identity protection PIN (“IP PIN”) from the IRS. It’s boring and annoying! You should do it anyway! The last time I wrote about IP PINs was nearly 2 years ago. Back then, when I requested an IP PIN, the IRS sent it via snail […]

The Boring Newsletter, 1/18/2025

Hi Friendos, Today I am tackling a topic that lives up to this newsletter’s “boring” moniker: recordkeeping. If you have federal student loans and are on income-driven repayment, please read this TODAY before the new administration takes office. First, a personal anecdote that illustrates the importance of good recordkeeping. A couple months ago my spouse […]

The Boring Newsletter, 1/11/2025

Hi Friendos, We’re about two weeks away from the beginning of tax season, which starts on January 27th. Let’s me try that again. It’s almost tax season! It’s almost tax season! That’s a little more fun. I’m going to touch on 5 ways I know of to prepare your tax return at no out-of-pocket cost: […]

The Boring Newsletter, 1/5/2025

Hi Friendos, Happy New Year! As usual at the beginning of the year, I am tackling an update to my Family Finances Binder, which includes running through a financial checklist (rebalance my investment portfolio? done!) as well as an annual checklist with some non-financial items. It will surprise exactly zero of you to hear that […]

Hi Friendos, Happy almost New Year! This week I am leaning hard into some winter cozy by making herbal tea and doing a jigsaw puzzle, a year-end tradition in my house. I am also thinking about what my goals should be for 2025. I don’t like “resolutions” because I have never once actually accomplished something […]

The Boring Newsletter, 12/22/2024

Hi Friendos, Today’s topic is the all-important emergency fund. If you have your emergency fund totally dialed in, this one is not for you, but if not, read on! What is it? A chunk of money that is set aside in case of “emergency.” Emergency is an unanticipated expense that you must pay for but […]

The Boring Newsletter, 12/15/2024

Hi Friendos, Today’s topic is “hobby income” and how this differs from “business income” for tax purposes. If you earn money from a small side activity you might wonder if you have a “real” business where you need to keep records, report it on your taxes, and do other boring business things vs. if you […]

The Boring Newsletter, 12/8/2024

Hi Friendos, I rarely say this but I was excited by an ad I saw on the subway. A company called Back Market promises iPhones for “up to 70% less than new” and encourages people to “Downgrade now.” I have been buying refurbished iPhones for years so naturally I loved an ad that seemed to […]

The Boring Newsletter, 12/1/2024

Hi Friendos, I hope you had a nice Thanksgiving holiday if you celebrate. I am pleased to report that my apple pie turned out great, though the cranberry curd tart was hopelessly stuck to the pan (it still tasted great). Today I’m expanding my prior discussion of auto insurance based on a reader suggestion to […]

The Boring Newsletter, 11/24/2024 🎁

Hi Friendos, Where I live, it feels like Christmas has already started and I am (silently or less silently) shouting, “We haven’t had Thanksgiving don’t skip Thanksgiving it is great and I love pie and cranberry relish!” No matter, the catalogs and emails are arriving and I’m planning out gifts and taking advantage of early […]

The Boring Newsletter, 11/17/2024 🚗

Hi Friendos, +14%. That is inflation in motor vehicle insurance over the last 12 months (Oct 2023 to Oct 2024), according to the Bureau of Labor Statistics’ news release last week regarding the Consumer Price Index (CPI). A few other categories with outsize numbers were eggs (+30%) and motor fuel (-12.5%). While I find overall […]

The Boring Newsletter, 11/9/2024

Hi Friendos, Today I am writing and thinking about fiscal policy and taxes and personal finance, I promise, even though it takes me a minute to get there. Thank you for bearing with me. On Tuesday afternoon, I was walking home from an errand and allowed myself a little fantasy. I thought, “Tomorrow morning I […]

The Boring Newsletter, 11/2/2024

Hi Friendos, A lot of writing and thinking about personal finance topics, including my own, focuses on mathematical and technical topics like the benefits of using tax-advantaged investing accounts and low-cost index funds. These are important, but so are emotional and behavioral factors. I have had multiple times in my life when I intentionally made […]

The Boring Newsletter, 10/26/2024🐩🐾

Hi Friendos, This newsletter is for the pet owners out there. I am a dog lover and people who meet me tend to learn about this guy pretty quickly: His name is Ollie and he has the best hair in our household. He likes to look at birds, take naps, and eat street garbage that […]

The Boring Newsletter 10/20/2024💸👻

Hi Friendos, Today is yet another newsletter about HSAs, this one focused on a scary topic suitable for this Halloween month: creeping investment admin fees and one way to mitigate them. I opened my HSA account at the end of 2019 when I first got on a high deductible health plan through my employer. My […]

The Boring Newsletter, 10/13/2024📝

Hi Friendos, Today we are 6.5 weeks from Thanksgiving and 10.5 weeks from Christmas; most companies have open enrollment for benefits in November. Pretty soon you will be busy with holiday activities and obligations and lose the will to engage in boring calculations – or you might spend all your $ on gifts, travel, and […]

The Boring Newsletter, 10/6/2024 🎃🫣

Hi Friendos, This is the first weekend of Shocktober and my neighborhood is coming out hard with the Halloween decor! With that in mind, I’m here to talk about three supposedly scary money things and what people should actually be scared of instead. One: People don’t invest because they’re afraid of losing money in the […]

The Boring Newsletter, 9/29/2024

Hi Friendos, Today we are talking life insurance. If you die, would the people who depend on your income/labor be financially ok? Here are some common scenarios people (should) worry about: If you need life insurance, you should consider: (1) the amount of coverage you need, (2) how long you need the coverage, and (3) […]

The Boring Newsletter, 9/22/2024

Hi Friendos, A recent episode of Gabe Dunn’s excellent Bad with Money podcast discussed money questions that people don’t even know they can ask, like: I wanted to share an example from my own life when asking a question paid off. So far this has saved us at least $920. If you have examples of […]

The Boring Newsletter, 9/15/2024 📚

Hi Friendos, Usually when people talk about taxes, the focus is on paying them. Today, I’d like to talk about taking advantage of what we receive from them. First up: local libraries, paid for by taxes. Around 2010 I learned about the zero-waste movement at the same time I was recognizing that I was simply […]

The Boring Newsletter, 9/8/2024 🎓💸

Hi Friendos, I hope you had a wonderful Labor Day weekend! After my August break, we have a back-to-school theme this week: student loans. Of course there is a lot of media coverage on this topic, including of the recent Supreme Court decision to keep the SAVE plan on ice, impacting ~8 million Americans currently […]

The Boring Newsletter, 7/28/2024🏖️

Hi Friendos, The Boring Newsletter is going on summer break. Frequently Taxed Questions is open for business and actively meeting with clients, just taking a break from the newsletter through Labor Day. During this time, I challenge you to do some boring money tasks. Don’t think you have any that need doing? Hmm…what about all […]

The Boring Newsletter, 7/21/2024

Hi Friendos, Last week I wrote about the maximum amount you can contribute to an HSA and an IRA each year. I said: “HSA and IRA contribution limits are separate from each other and from job-based account limits. In general, the max you can contribute across types of accounts is: HSA max + IRA max […]

The Boring Newsletter, 7/14/2024

Hi Friendos, Today’s topic is for people who are very dialed in on saving and wonder: How much can I put into retirement savings accounts each year if I have more than one type of account? Lots of people have an IRA and a 401k, or an IRA and a 403b. Some people have a […]

The Boring Newsletter, 7/7/2024

Hi Friendos, If you’ve been reading this newsletter for a while, you’ve heard me say things like “charitable donations probably have no impact on your taxes (so just decide what’s best for you on the merits).” I was discussing the fact that most people take the standard deduction on their taxes, and do not itemize, […]

The Boring Newsletter, 6/30/2024

Hi Friendos, Today’s topic is a new corporate reporting requirement that applies to most companies in the U.S. If you run a small business or live in a home with an HOA, check it out to make sure you’ll comply. What is this requirement? The Corporate Transparency Act became effective at the beginning of this […]

The Boring Newsletter, 6/23/2024

Hi Friendos, I have a friend who owns a home in a development with an HOA. After buying the home, they had an arborist examine certain trees on the property. The trees were dead and needed to be removed before they fell over, potentially right into the house. They had the arborist remove the trees. […]

The Boring Newsletter, 6/16/2024

Hi Friendos, Today I will share my experience taking paid family leave in 2020 when my father was sick. Because I work for a company with HR people who are great at their jobs, live in a state (New York) with stronger benefits than the federally required minimums, and had a doctor who quickly handled […]

The Boring Newsletter, 6/8/2024

Hi Friendos, Today’s topic is the real hourly wage. I first learned of this concept from the personal finance classic Your Money or Your Life, a book that was first published in 1992, but I first came across in 2010. For jobs that pay by the hour, people think of their stated hourly wage (pre-tax) […]

The Boring Newsletter, 6/2/2024

Hi Friendos, Today I am writing about positive news out of the IRS. Janet Yellen, Secretary of the Treasury, accepted the recommendation from Danny Werfel, IRS Commissioner, to make the Direct File program permanent! Direct File was a trial program that ran earlier this year, allowing taxpayers in 12 states to file their 2023 tax […]

The Boring Newsletter, 5/26/2024

Hi Friendos, I hope you are enjoying a wonderful holiday weekend. Last week I wrote about an article co-authored by Alicia Munnell, “The Case for Using Subsidies for Retirement Plans to Fix Social Security.” Part of what the authors do is consider changes to the current rules around tax-advantaged retirement accounts, such as 401ks, and […]

The Boring Newsletter, 5/19/2024

Hi Friendos, The last few weeks I’ve discussed the benefits of saving for retirement into one type of tax-sheltered account vs. another. I wrote: “I believe the existence of such accounts is terrible policy and we should get rid of all of them!” Today I’d like to spotlight some research that supports my perspective. I […]

The Boring Newsletter, 5/12/2024

Hi Friendos, Today I am continuing the discussion of tax-advantaged accounts to save for retirement, and how to pick the type of account that is best for you. Two weeks ago, I discussed weighing HSA vs 401k vs IRA and last week I discussed Roth vs traditional. Today’s installment is for you if you have […]

The Boring Newsletter, 5/5/2024

Hi Friendos, Today I will continue the discussion about types of tax-advantaged investment accounts, like 401k’s and IRAs, and how to decide which type of account you should put your money in. At some point, nearly everyone saving for retirement will grapple with whether to put money into a Roth account or a traditional account. […]

The Boring Newsletter, 4/28/2024

Hi Friendos, Today I would like to start a discussion about types of tax-advantaged investment accounts, like 401k’s, IRAs, and HSAs, and how to decide which type of account you should put your money in. I have always been a huge booster of such accounts, so it may surprise you to learn that I believe […]

The Boring Newsletter, 4/21/2024

Hi Friendos, Today’s discussion is about interest on saving accounts, and ties to the discussion two weeks ago about sinking funds. For some of you, this interest rate math may be easy peasy because you already understand it – great! For others, it will be helpful to walk through this step by step. I described […]

The Boring Newsletter, 4/14/2024

Hi Friendos, I hope you are not spending this fine spring weekend indoors working on a last-minute tax return. If you are and need a second opinion on something or just have a question, don’t hesitate to reply to this email. At my full-time job, I recently had the opportunity to work with an economics […]

The Boring Newsletter, 4/7/2024

Hi Friendos, I hope everyone is having a lovely beginning-of-spring. I recently took a trip and was delighted to return and find that the chives I planted last year decided to come back! I paid for the trip with money in my “travel fund” which is just my personal label for one of my high-yield […]

The Boring Newsletter, 3/16/2024

Hi Friendos, A lot of people would like to get a tax break for their home office or work from home space but don’t know how this works. The very short summary is: I was curious how many people claim this deduction and what it’s worth to them, so I spent some time with IRS […]

The Boring Newsletter, 3/9/2024

Hi Friendos, Today I am here to bring you: Five Common Myths About Taxes. These are the most common misconceptions I’ve encountered about the U.S. tax system. Got others? Please share them with me! I think we should have some required education on taxes in all high schools. People need to know this stuff! Myth […]

The Boring Newsletter, 3/2/2024

Hi Friendos, Today I want to talk about fruit. Specifically, the expression “apples to apples” and how it relates to investments, taxes, and risk. I am inspired by a recent article in the New York Times, “Keeping a Mortgage After 65: A ‘No Brainer’ or a Big Risk?” One person interviewed said it was a […]

The Boring Newsletter, 2/25/2024

Hi Friendos, Last week I wrote about tax withholding, and possibly adjusting yours if you end up owing more, or receiving a larger refund, than what you prefer. Today’s newsletter is about paying quarterly estimated taxes, an alternative to increasing withholding. What causes the need for quarterly estimated payments? Self-employed people (whether full-time or part-time […]

The Boring Newsletter, 2/18/2024

Hi Friendos, If you’ve done your 2023 taxes already, you may have run into a situation where you were surprised at the result–either surprised at a big amount owed or surprised about a big refund. Some people love getting a big tax refund as it feels like a wonderful windfall. Personally, I prefer to have […]

The Boring Newsletter, 2/10/2024

Hi Friendos, Tax season is here! Tax season is here! I am on track to finish my federal and state returns today and I am here to encourage you to tackle your taxes earlier rather than later in the spring. Here are my top thoughts on getting it done once you have all your forms […]

The Boring Newsletter, 2/4/2024 🧊

Hi Friendos, This is called The Boring Newsletter and this week I am here to deliver! First up: tax season has officially begun! This past Monday, January 29th was opening day. That means if you’ve received all your necessary tax forms (like W-2’s and 1099’s), you can go ahead and file. You could Direct File […]

The Boring Newsletter, 1/28/2024

Hi Friendos, Today I’m going to wrap up last week’s discussion of the Social Security “trust funds.” Last week we discussed how Social Security benefits are not paid for from general revenues of the federal government, but instead are paid for from so-called trust funds. The government accounting works like this: each year the level […]

The Boring Newsletter, 1/21/2024

Hi Friendos, Today we’ll continue our discussion of Social Security. We’ve talked about how you can establish an online account with the SSA (Social Security Administration) to review your earnings history, and last week we did a very high-level walk through of how monthly retirement benefits are calculated (the $ size of your future Social […]

The Boring Newsletter, 1/13/2024

Hi Friendos, Last month I started a discussion about Social Security retirement benefits. I’ll continue on this theme for a few weeks, exploring different aspects of the program, including why claims that it is “running out of money” are wrong. I suggested that it’s a good idea to establish an account with the Social Security […]

The Boring Newsletter, 1/7/2024

Hi Friendos, Happy new year! I hope you had a nice holiday season. Because it is January, I am updating my family finances binder, including working through its checklist, and developing my savings/investing plan for the year. Don’t all rush to invite me to your parties! I am also thinking about how tax season will […]

The Boring Newsletter, 12/17/2023

Dear Friends, The Boring Newsletter is beginning an end-of-year break this week. Douglas Lee was born in Waco, Texas in December 1947. He died in Potomac, Maryland in November 2021. Barbara Levinson-Lee was born in Charlevoix, Michigan in September 1948 and died in Potomac, Maryland in December 2023. They were married for nearly 50 years. […]

The Boring Newsletter, 12/10/2023🏦🫰

Hi Friendos, In September I wrote about my family finances binder. The “Social Security” tab has my and my spouse’s most recent statements from the Social Security Administration (“SSA”). Social Security is an incredibly popular program among Americans of all political leanings and helps millions live above our official poverty line. You will get Social […]

Hi Friendos, I remember reading years ago about a person who wanted to exercise more. I’m hazy on the details but it went something like this: The first week their entire fitness routine consisted of nothing but getting in their car, driving to the gym, sitting in the parking lot for 5 minutes, and then […]

Hi Friendos, Today I am pleased to bring to you a tax-avoidance technique that is only available to low and moderate earners – high income people, you are excused! This technique is called capital gains harvesting and takes advantage of the 0% capital gains tax bracket. There is never a bad time to do this, […]

The Boring Newsletter, 11/19/2023🎁

Hi Friendos, Happy almost Thanksgiving! The last two weeks I’ve been getting some holiday catalogs in the mail and I am eager to get my year-end gift buying handled. If you are looking for some ideas of boring, secretly awesome, and pretty affordable items to purchase, read on. I personally use and love every single […]

The Boring Newsletter, 11/11/2023 🍂

Hi Friendos, Last week I claimed that “nobody advertises boring” when it comes to personal finance. This week I want to talk about something that is advertised: overly complicated investment portfolios. I’m going to pick on Wealthfront because it has such a pretty website, but it’s just one example among many. First, Wealthfront wants you […]

The Boring Newsletter, 11/5/2023

Hi Friendos, I recently saw a couple ads for investment firms that reminded me: Nobody Advertises Boring. Here is one example: Here’s another: Also consider ubiquitous car ads talking up sweet, sweet financing terms: “This car will give you this fabulous life pictured here, at a monthly payment you can afford!” Nobody runs ads saying […]

The Boring Newsletter, 10/29/2023 🩺

Hi Friendos, Today is our fourth installment discussing tax-advantaged medical accounts (HSAs and FSAs) where we’ll look at how these fit into the overall selection of a health insurance plan. I am always grateful to have insurance (really grateful) but I *hate* that choosing a plan is so complicated. My approach is to consider the […]

The Boring Newsletter, 10/22/2023

Hi Friendos, With open enrollment for medical insurance coming up, I’ve been talking about FSAs and HSAs. Last week we looked at quantifying the tax benefit of using an FSA. This week we do it for HSAs. Next week we’ll put it together with choosing a medical plan. If you have questions about this or […]

The Boring Newsletter, 10/15/2023

Hi Friendos, Last week I wrote about how FSAs and HSAs save you money (lowering your taxes), and I promised to talk this week about how much they can save you, so you can decide if putting your $ in one is worth it to you. This week is a deep dive on FSAs. Next […]

The Boring Newsletter, 10/8/2023

Hi Friendos, Health insurance open enrollment is coming up in a few weeks so this month I’ll write about some related topics. This week is about explaining the financial benefit from FSAs and HSAs (“flexible spending account,” “health savings account”), specifically, how they save you money. Next week I’ll talk about how much. This helps […]

The Boring Newsletter, 9/30/2023 ⛈️

Hi Friendos, While my city is trying to dry out this weekend, it feels like the perfect time to wade into tax brackets. We talked about these a bit during Summer School, but today I want to go a bit deeper. If you have any control over when you receive your income, understanding tax brackets […]

The Boring Newsletter, 9/24/2023 🎓

Hi Friendos, My dad was Texas and had a way of peppering conversation with colorful sayings. That dog doesn’t just run fast, he runs faster than greased lightning! That gal isn’t just tough, she’s tougher than a pine knot! So I kind of love little expressions that capture the essence of things. Today we contemplate: […]

The Boring Newsletter, 9/17/2023

Hi Friendos, Last April I wrote about The Checklist I go through each January as a sort of household financial tune up. The Checklist lives in a “Family Finances Binder” I promised I’d write more about. That fine day has finally arrived! When I was a single gal in my early 20s, I heard a […]

The Boring Newsletter, 9/10/2023

Hi Friendos, A lot of financial writing discusses how to save and invest money. There is much less discussion of the income side of things. Sometimes a person has an income problem: they don’t earn enough of it. Recently I was helping someone prep for a job interview (where they would earn more) and reviewed […]

The Boring Newsletter, 9/4/2023

Hi Friendos, Happy Labor Day! This week’s Boring Newsletter is late and will be short as I was traveling. I thought I could one small finance technique I used on my trip and also share some photos from my travels. A few years back, I was worried I would mix up my credit and ATM […]

The Boring Newsletter, 8/27/2023

Hi Friendos, Today I am thinking about cash management and accounts and money flows. My last few clients have all wanted to talk about this and I understand why. I think lots of us start out with one checking account and one credit card and management of our small incomes is simple and fast, a […]

The Boring Newsletter, 8/20/2023

Anatomy of a 1040, Class 10 Hi Friendos, Welcome to our tenth and final summer school class for Anatomy of a 1040! Today’s lesson is about the actual payment or refund that goes along with filing a 1040. Here’s an overview of everything we’ve covered this summer: So the first 9 lessons were about page […]

The Boring Newsletter, 8/13/2023

Anatomy of a 1040, Class 9 Hi Friendos, It’s the middle of August, the tomatoes are on point, you’re havin’ a summah, and it’s the perfect time to talk deductions. Student loan interest. Self-employed health insurance. Certain HSA contributions. And the biggie: Itemized vs standard. This one teaches you why mortgage debt and charitable donations […]

The Boring Newsletter, 8/6/2023

Anatomy of a 1040, Class 8 Hi Friendos! Today, Summer School Lesson 8 is all about self-employment income, and our last discussion of the “income” portion of the tax return. We’re in the home stretch: next week we’ll talk about the standard and itemized deductions, and then our final lesson will be about tax payments […]

The Boring Newsletter, 7/29/2023

Anatomy of a 1040, Class 7 Hi Friendos, Today in our seventh summer school class, we’ll discuss just one line of Form 1040. Line 8 sounds so simple, “Other income from Schedule 1, line 10,” but there is so much action there! By the time we get to line 8, we’ve already provided information about […]

The Boring Newsletter, 7/23/2023

Anatomy of a 1040, Class 6 Hi Friendos, Welcome to week 6 of our summer school course on the 1040. Last week we talked about interest income; this week we’ll discuss the two other members of the investment income trifecta: dividends and capital gains. If you have a regular brokerage account (an investment account that […]

The Boring Newsletter, 7/16/2023

Anatomy of a 1040, Class 5 Hi Friendos, Today’s summer school class is a short one! Last week we talked about W-2 income that gets reported on line 1 of Form 1040. This week we’re going to line 2 and covering interest income. (Don’t worry, we’re not going to do one line per week the […]

The Boring Newsletter, 7/9/2023

Anatomy of a 1040, Class 4 Hi Friendos, Welcome to our fourth summer school class. During our first three classes, we discussed the top half of Form 1040 p. 1, which gathers tax-relevant information about you. Now we’re ready to move on to the next section, which gathers information about your income. Lines 1-8, and […]

The Boring Newsletter, 7/2/2023 🎇

Anatomy of a 1040, Class 3 Hi Friendos, Welcome to our third session of summer school! Last week we discussed the top section of Form 1040, which gathers tax-relevant information. We discussed “filing status,” the very first item at the top of the form, as well as how taxpayers without social security numbers can use […]

The Boring Newsletter, 6/25/2023

Anatomy of a 1040, Class 2 Hi Friendos, Welcome to our second session of summer school! Last week we ended with an overview of the Form 1040, and broke it down into six areas: [A] gathers tax-relevant info about you, [B] gathers info about your income, [C] determines the total taxes you owe for the […]

The Boring Newsletter, 6/17/2023

Anatomy of a 1040, Class 1 Hi Friendos, Welcome to your first summer school class, Anatomy of a 1040. Each week we’ll break down an aspect of U.S. federal taxes by examining a different part of the Form 1040, which is the form you or your tax preparer fills out at tax time each year. […]

The Boring Newsletter, 6/11/2023

Hi Friendos, I was watching Kelly Reichert’s latest film, Showing Up, and some scenes with a pigeon brought back visceral memories of an incident in my old coop apartment building. One afternoon a neighbor knocked on my door, wondering if I could help her install some pigeon spikes on her windowsills. Installing pigeon spikes requires […]

The Boring Newsletter, 6/4/2023

Hi Friendos, If you have student loans you have probably read that the recent debt ceiling deal included a restart to student loan payments around September 1st. Student loans are a complicated area and I am not an expert in this but can share a couple thoughts: (1) If you are someone who will need […]

The Boring Newsletter, 5/27/2023 🎖️

Hi Friendos, Happy Memorial Day weekend. Many people will pause to remember loved ones who died in military service. I have many relatives who have served, including my paternal grandfather, Robert (Bob) Lee. He’s the fellow on the right here: That photo was scanned by his cousin who spent 10 years in the Air Force. […]

The Boring Newsletter, 5/20/2023

Hi Friendos, This week’s topic is vesting and 401k matching. It sounds so sartorial. I’m going to walk through a very detailed (and boring) example of this with a 401k. This is a long one, so stay with me now! Setup: The matching part: So with this particular matching formula and your given salary, you […]

The Boring Newsletter, 5/13/2023

Hi Friendos, A few weeks ago I said the “stock market is not a good match for every investment time horizon.” That’s because there can be long stretches of negative or flat returns, and at the beginning you don’t know how a particular time period will pan out. So what if you are setting money […]

The Boring Newsletter, 5/6/2023

Hi Friendos! Investing can feel complicated and overwhelming. There is so much jargon out there, tax issues and fees to consider, types of investments to figure out…And you don’t want your own investing to make the world a worse place! Today we have a smoking hot discussion about socially conscious investing” (aka ESG investing – […]

The Boring Newsletter, 4/29/2023

Hi Friendos, Would you be willing to send me questions you have about taxes? This summer I am sending all y’all to summer school for a class called Anatomy of a 1040, a multi-part series about how various aspects of taxes work and why it matters. The curriculum will be even stronger if I make […]

The Boring Newsletter, 4/22/2023

Hi Friendos, There’s a podcast about cleaning that I love. Hanna, one of the hosts, says that a lot of times, the problem isn’t that someone is “bad” at cleaning, they just need a better system. I am all about systems for preventing problems and making life easier (automating finances is a superpower), and part […]

The Boring Newsletter, 4/16/2023 🌿

Hello Friendos, I do a little container gardening here in Brooklyn. Last weekend I planted my seeds so now I am in waiting mode to see if it all germinates. Some seeds only take 5 days. Some a week or two. If my strawberry seeds take, it could be 45 days. Maybe some birds snuck […]

The Boring Newsletter, 4/8/2023 🐰 🍷

Hello Friendos! Have you filed your taxes yet? Well if not, put down that basket of eggs (or egg matzo) and get to it! Make sure to take advantage of the IRS Free File program if you’re self-preparing and qualify. What is more boring than filing taxes? Monitoring your checking account? I do that a […]

The Boring Newsletter, 4/1/2023

Hello Friendos, This week I am thinking about debt. Partly because I’ve been reading David Graeber’s book Debt: The First 5,000 Years (excellent!) and also because of a recent conversation about how to get out of debt. Here is my recipe: Step 1. Decide you want to get out of debt. This mindset is key […]

The Boring Newsletter, 3/25/2023

Hello Friendos! What with all the recent excitement around Silicon Valley Bank, a couple of other bank collapses, and the Federal Reserve raising rates this week, I thought this was the perfect time to really go deep on paystubs (from a W-2 job). That’s right, I’m giving you my sizzling hot take on paystubs and […]

The Boring Newsletter, 3/18/2023 🍀

Hello Friendos! Today we’re talking tax write-offs. Have you ever heard someone talk about tax-write offs like they were getting something for free, as if the government was handing them a big bag of money? It might go like: Or maybe it sounds like this: I just smile and nod, smile and nod, but what […]

The Boring Newsletter, 3/11/2023

Hello Friendos! This week we have…a pop quiz! It’s a math quiz and a word problem…nnnnooooooooooo. Don’t worry, I think you’ll pass even if you didn’t study. Ok, here it is. Imagine you are getting ready for a road trip and want to buy a deluxe first aid kit ($40) and a couple tubes of […]

The Boring Newsletter, 3/4/2023

Hello Friendos! Last week I waxed rhapsodic about investing in low-cost index funds. I promised in a future newsletter I would explain exactly what I meant by “low-cost.” The day has arrived! Now, this is usually when a financial writer would launch into a mathematical example to demonstrate that if you invest for decades and […]

The Boring Newsletter, 2/26/2023

Hi Friendos! In honor of the newly released 50th anniversary edition of Burton Malkiel’s book, A Random Walk Down Wall Street, this week’s topic is index funds. It’s a bit longer than usual due to the paramount importance of the topic. I prefer investing in stocks and bonds using low-cost index funds, not expensive actively […]

The Boring Newsletter, 2/18/2023

Hello Friendos! I hope you are having a nice holiday weekend. This week I’d like to sing the praises of a boring and often overlooked component of financial strength: maintenance (of your things). I once had a colleague who was maybe 22 years old at the time, and somehow we got to chatting about shoes. […]

Hello Friendos! Valentine’s Day is next week, so I wanted to take this opportunity to remind you that…one day, we’ll all be dead! (Too dark? Eh, let’s press on.) Have you ever known someone with strife in their family around inheritance? The deceased may not have done a great job with the estate planning. If […]

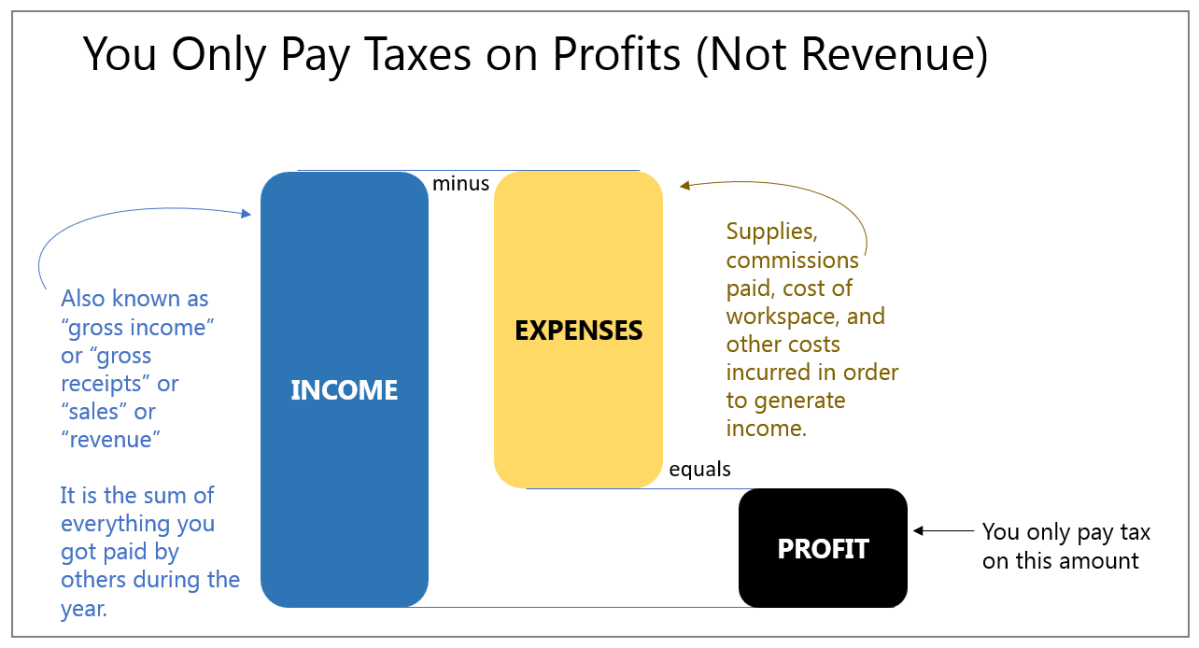

Pay As You Go, or You Will Owe

Or…why do I have to pay more money in April when I’ve been paying all year long? The U.S. income tax system is pay-as-you-go, meaning, the IRS expects you to pay taxes on your income as you earn it throughout the year. In fact, if you owe too much at tax time (relative to your […]

File Your Taxes For Free If You Can

Did you know there are a number of ways to file your taxes for free? By “free” I mean where you don’t have to pay a tax preparer, you don’t have to pay for tax software, and you don’t pay for any other out of pocket costs. “Free” probably does mean using some of your […]

(aka: explaining the Standard Deduction and Itemized Deductions in Three Easy Steps) “Everybody knows” that charitable donations are tax-deductible. “Everybody knows” that you get a tax break on your home mortgage. Everybody is mostly wrong. Here’s why: Step 1: In the U.S., it basically works like this: Step 2: You have two options for that […]

Oh, you thought housing was your biggest expense? I doubt it. Most Americans spend more on taxes than anything else. Federal income tax, state income tax, local income tax, Social Security tax, Medicare tax, capital gains tax, tax for paid family leave, sales tax, utterly indecipherable taxes on cell phone and utility bills, tolls for […]