Hi Friendos,

Today I am giving you yet another installment of Emergency Fund Hot Talk. Last week I talked about why a Roth IRA is not a great spot to stash your emergency fund, and last December I talked about some emergency fund core concepts.

______

A brief programming note…I am trying out Substack as my new email tool, so if you are an email subscriber, this one may look a little different. I am hoping this will slay some tech dragons I could never quite address with my old tools. 🤞

______

My clients and I talk about emergency funds pretty often and usually they seem worried about getting the absolute very best possible interest rate on their money. I tell them: open an account with a decent rate and then don’t worry about it because it doesn’t matter. By “doesn’t matter” I mean that any difference between a “good” rate and the “very best” rate won’t amount to much in dollars, and I walk through the math to explain this. Perfect optimization is not the goal and is not needed for financial success.

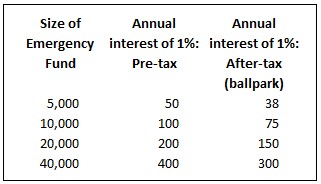

These days I am telling clients that a high yield account with a rate of 4% or better is a great home for their emergency fund. Well, they say, shouldn’t I try to get a higher rate if I can? “Sure,” I say, “but don’t worry about it too much.” Take a look at the table below, showing emergency funds that range in size from $5k (call that a 3 months of a very small household budget) to $40k (call that 6 months of a pretty generous household budget).

The middle column shows 1% of each size of emergency fund in dollars. So let’s say I could earn 4% on my emergency fund at Bank #1, but could earn a more impressive 5% at a Bank #2. The 1% difference is what I forego by sticking with Bank #1. The thing is, I will have to pay income tax on that interest, so I need to reduce the amount to reflect that. I assume a 25% tax burden, and show the after-tax amount in dollars in the right-most column. For the larger-sized emergency funds, the applicable income tax rate is probably higher, (maybe 50% with state and local taxes), so the after-tax amounts are even smaller (maybe half as much).

This table is saying that if a person with a $10k emergency fund earns a rate of 4% instead of 5%, they are giving up $75. Of course I’d rather have an extra $75, but I’m not going to stress over it. There are a lot of ways I can improve my financial position by $75!

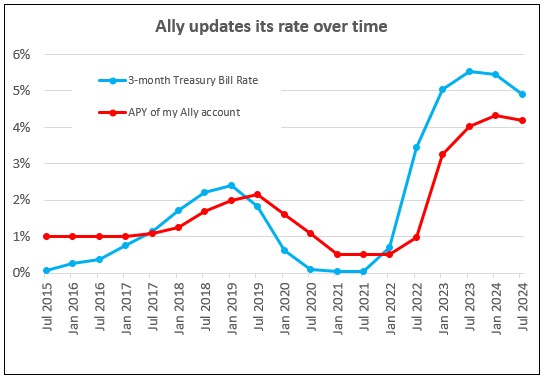

Realistically, if you open an account at a place with a good interest rate, any gap to the best available rate at any given time will be less than 1%. First, understand that as interest rates change over time, the rate on your high-yield account should change to reflect that. Financial institutions don’t want to pay too much if rates drop, obviously, but they also want to stay competitive and not pay too little if rates increase. I’ve had a high-yield savings account at Ally since 2015, so I looked back at my old account statements to compare the rate I earned with rates on 3-month U.S. Treasuries. I pulled Treasury rates from the Federal Reserve Bank of St. Louis:

This chart plots rates every July and every January, from July 2015 to July 2024. You can see that when Treasury rates increase or decrease, Ally’s rates also increase or decrease, albeit with a bit of a lag.

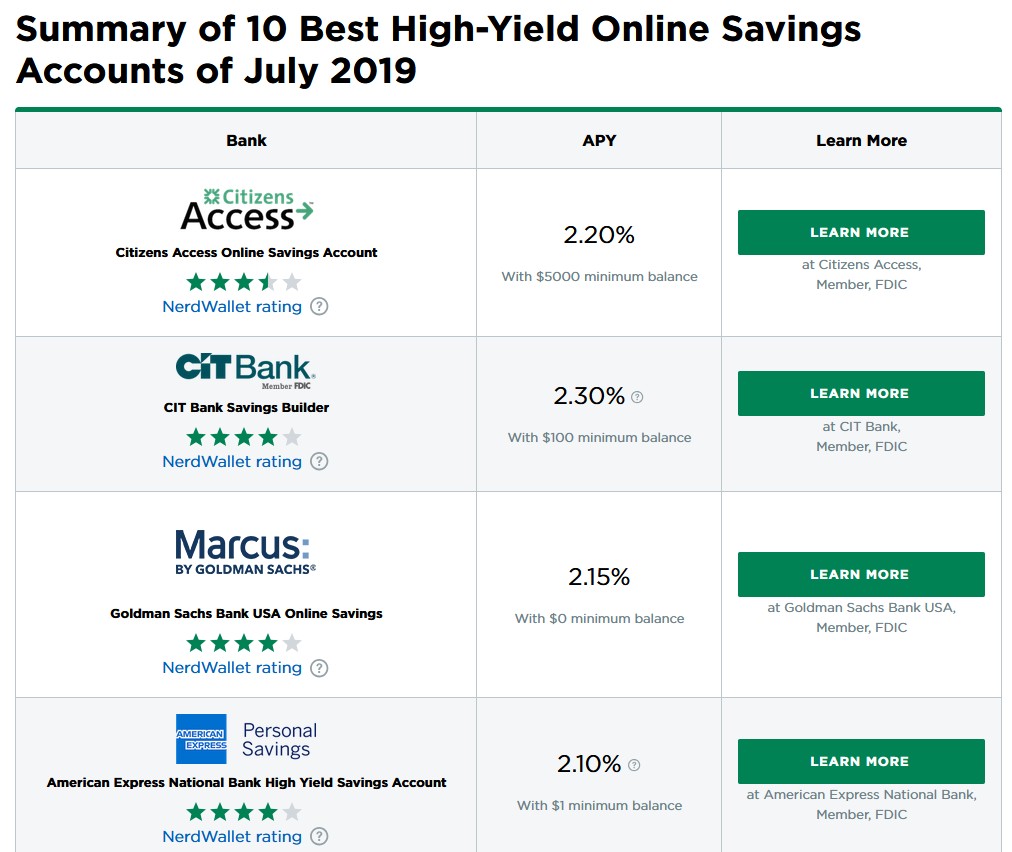

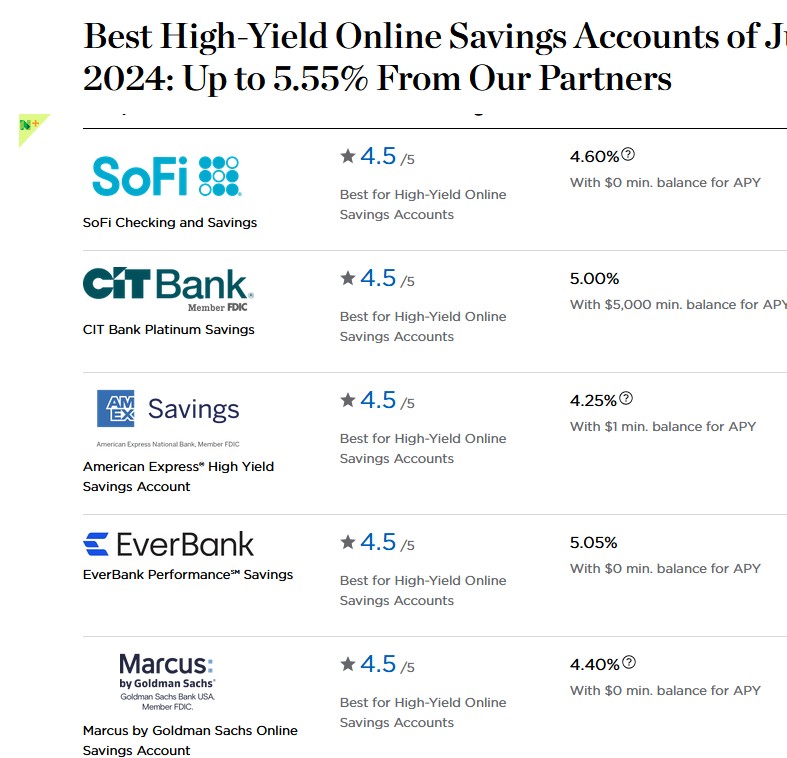

In order to compare Ally to “the best” rates available over time, I used the Internet Archive to look at historical versions of the Nerdwallet page showing the best available rates on high-yield savings accounts.

In July 2019, Ally paid me 2%. This was a bit less than the best rates featured by Nerdwallet, but the largest gap was only 0.3%:

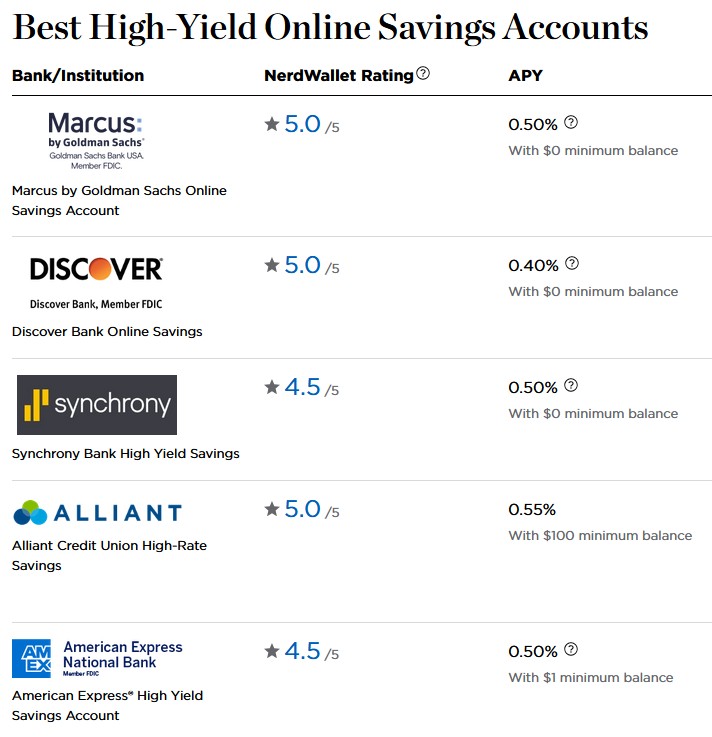

Then I checked January 2022, when Ally paid me 0.5%, which slightly exceeded, matched, or slightly fell short of the best rates featured:

Finally, I checked July 2024, when Ally paid me 4.2%, which was 0.85% less than the very best rate shown:

This tells me that while Ally usually does not offer the absolutely best rate, it’s pretty competitive with the best rates, and the dollars I forego are not that much. Further, the banks offering the very best rates change over time, and I am not going to spend my time moving my account around to chase such a small amount of after-tax money. I find the Ally website easy to use, and I like certain of its features, like being able to change my account “nicknames” to reflect my current top saving priorities. It’s good enough.

This just goes to show that sometimes, 1% is not very much. In other settings (investment fund fees), 1% is really a lot. Sometimes (mortgages), it is absolutely enormous! You get perspective by translating percent into after-tax dollars.

-Stephanie

p.s. Are you searching for the perfect graduation gift? 🎓 An hour of financial coaching sounds spot on to me! We could talk about emergency funds, budgeting, employee benefits, and more.