Hi Friendos,

I don’t know if you heard, but the stock market took a tumble last week! Today I’ll share three ideas for productive things you could do as a result. We all want to “do something” when things feel crazy, so the key is to keep it productive and not be our own worst enemy, selling investments at exactly the worst time and locking in losses.

I don’t endeavor to time the market but it just so happened that this is the first weekend after calendar Q1, so my phone reminder popped up telling me to review my portfolio for potential rebalancing. Once per quarter I calculate my current asset allocation between stocks and bonds. If the % of my portfolio in stocks and the % in bonds is more than a couple percentage points from my target allocation, I sell some of whatever is “too much” and use the proceeds to buy whatever is “too little” relative to my target percentages.

If you have a written financial plan it surely includes your after-tax target asset allocation, so you too can take a look to see if you are currently on-target. Unless you are invested entirely in target date funds, where a portfolio manager will handle things for you, you might be due for a rebalancing. I always do rebalancing trades inside one of my retirement accounts. That way, there are no tax consequences like there could be in a regular brokerage account.

This morning, I identified the dollar amount of bond investments I want to sell on Monday. More precisely, inside my traditional IRA I will “exchange” some shares of a bond mutual fund for shares of a stock mutual fund. I will place the order for this trade before 4pm and it will take place at Monday’s share price for each of the funds.

My second action item, for my regular brokerage account, will be a couple of trades for tax loss harvesting (cousin of tax gain harvesting that I wrote about last month). In general, when you sell investments at a loss, you can offset that loss against realized gains (from selling other investments) that would otherwise be taxable and against up to $3,000 of ordinary income (like W-2 income). You still lost the money on the investment, but at least you shield a bit of income from taxes with it.

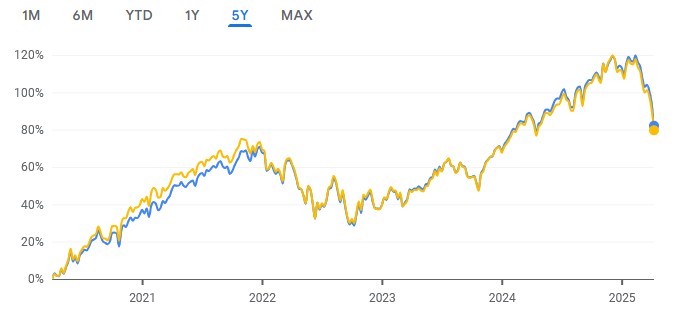

If your financial plan does not call for you to sell investments, you can take advantage of tax loss harvesting by finding an investment that “pairs” with the thing you already own. Example: you own the Fidelity S&P 500 Index Fund, which is down since you purchased it. You would like to sell it and have a realized loss that helps reduce your taxes, but then repurchase it immediately so you don’t miss out on future positive returns in the market. The problem with repurchasing right away is that the IRS will call this a “wash sale” and the loss won’t count for tax reduction purposes. Solution: instead of repurchasing the exact thing you sold, buy something that has highly correlated investment returns, but not identical investment returns. In this case the Fidelity Total Market Index Fund would be a great choice. Here’s a chart of these two funds over the last 5 years:

Pretty much the same if you ask me, so these two are a tax-loss-pair in my own portfolio.

After you handle these two chores, if and only if they make sense for you, my third action item is to think about other things and do something nice! I am preparing my containers for the tomato seedlings I’ve been nurturing indoors and thinking about which flower seeds to put in which pots. Seeing flowering trees around my neighborhood this week, I was reminded of this time 5 years ago. In April 2020, it felt completely impossible that spring could arrive with all the sickness and death from COVID. We had a massive stock market selloff at that time also. This year brings its own challenges but nevertheless spring is here. Here are a few selections from the Windsor Terrace neighborhood in Central Brooklyn.

I hope you can do something nice this week.

-Stephanie