Hi Friendos,

Last week I wrote about mutual fund fees and the importance of keeping costs low in your investing. This week I’ll do the same but for home mortgages. My message is: Shop your mortgage! Shop your mortgage! Shop your mortgage! This matters because the dollar impact can be so huge.

Think about the last time you bought a television, a computer, a cell phone, a car, or some other item with multiple features and options. Focus on an item that you cared about, where you knew that getting the wrong features would annoy or trouble you, and getting it right would enhance your life in some way. You probably did some research to make sure you understood the different product offerings on the market and their various characteristics. You probably read some reviews, maybe talked to some people you knew about their experiences with this type of product. You might have talked to some sales people about the offerings from their company. Or maybe you already had a strong view about what you wanted based on your own prior experiences. Did you find out the price of a single product offering from one company, buy that one, and call it a day?

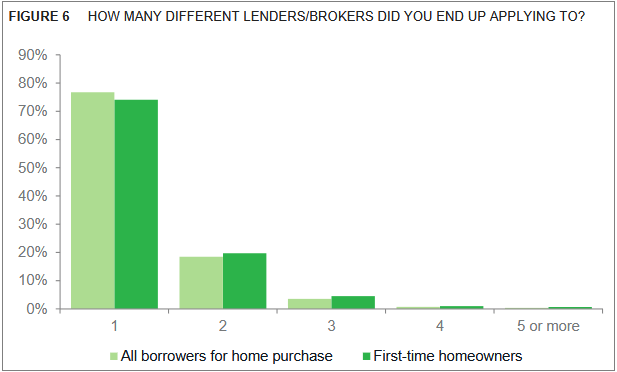

A 2015 study based on the National Survey of Mortgage Borrowers shows this is exactly what most people do when they get a mortgage: learn the price from a single company and call it a day. Here’s one of their charts:

This says that more than 7 in 10 people get an actual price quote for a mortgage from only one place, and this is true for both first-time and experienced home buyers. We are talking about the largest financial transaction in people’s lives and they aren’t shopping around.

I purchased a condo a few years ago. It was a new construction building so I purchased directly from the developer (the “sponsor”). The offering documents had a clause that said the purchase contract would not be contingent on my obtaining a mortgage unless I got my mortgage from a specific bank:

Based on my general research, I was extremely skeptical that TD Bank was offering the best rates, so we asked our lawyer to get that requirement excluded from the contract. The seller asked if we would be willing to apply at TD Bank, even if we ultimately decided to get our mortgage elsewhere. Fine. It would be a hassle to go through the process at an additional bank, but after pulling together all my documents to submit to one bank, applying to a second or third or fourth bank would not be that much incremental work.

I did all my mortgage shopping over a 2-day period with full applications at three banks. Those two days were very tiring and annoying. For a 30-year, fixed-rate mortgage, TD Bank came in 0.75% higher than Chase and Bank of America! OMG! Three quarters of a point! And, their closing costs were higher by more than $2,000!

Oh…maybe you think it’s just my weird New York City housing market where such a thing would happen? Mortgage rates differ by half a point or more all the time. Check out this chart from Freddie Mac that shows the typical spread between lower vs higher mortgage rates over the 2020-2022 period – not the max vs. min rates, but a typical spread capturing around two thirds of mortgage rates on offer, just looking at 30-year fixed-rate loans for borrowers with a FICO score of 740+, putting down 20-25% on a home priced between $330k and $470k. In other words, pretty apples-to-apples data points. These researchers looked at daily mortgage rates from all over the country:

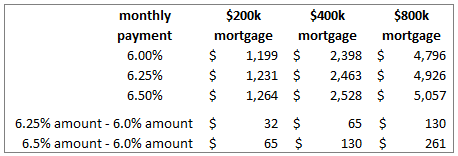

But let’s not talk in percents because what we actually pay is dollars. If you look at homes valued at $250k, $500k, and $1 million, assume someone puts 20% down, and has a 30-year fixed-rate mortgage, here are monthly payments at 6.0%, 6.25%, and 6.5%. This table only shows principal and interest, excluding property taxes and homeowners’ insurance, to give a clean comparison:

I don’t know about you, but looking at those bottom two rows, showing differences between loans at different rates….it don’t feel all that big to me. I mean, I’d rather have that extra every month vs not, but…it is that big a deal? So let’s see how things add up over time – look at the total interest paid on these loans over the first 5 years:

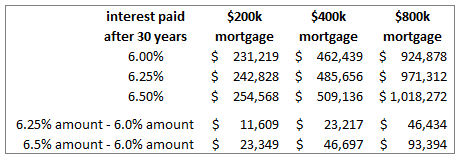

And over the full 30-years:

Yeah, that’s real money, no question. Think about how many paychecks it would take you to save up that amount of money. Wouldn’t it be a lot easier to comparison shop your mortgage?

One quarter of a point is a significant difference in mortgage rates. Half a point is enormous. Shop your mortgage!

-Stephanie

One reply on “The Boring Newsletter, 3/8/2025 🏠”

[…] 1% is not very much. In other settings (investment fund fees), 1% is really a lot. Sometimes (mortgages), it is absolutely enormous! You get perspective by translating percent into after-tax […]

LikeLike