Hi Friendos,

Last week I suggested that everyone should have a written financial plan. In this and future newsletters, I’ll discuss selected elements I think your plan should consider. Today’s topic is taxes and your asset allocation.

Let’s say you’ve decided that you want an asset allocation of 60% stocks and 40% bonds/cash. Consistent with that, your written financial plan has a section called Asset Allocation and Liquidity that states, “My asset allocation will be 60% equity investments and 40% investments in bonds and cash investments.”

You know that the stock market has had an amazing couple of years and suspect you might need to rebalance (sell some stocks and buy some bonds) to bring things back in line with your target allocation.

Here’s what your current investments look like, across your three different accounts:

- Traditional 401k at your current job: $20 in stocks, $30 in bonds.

- Roth IRA: $40 in stocks, $10 in bonds.

- Regular brokerage: $35 in stocks, no bonds.

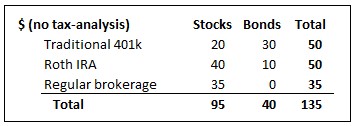

Here’s that information arranged in a table:

You can imagine those numbers multiplied by 100 or 1,000 or 10,000 so they feel realistic to you.

Now you calculate that you have 70% in stocks and 30% in bonds, because 95/135=70% and 40/135=30%. You conclude that you are 10 percentage points away from your target allocation of 60% stocks, 40% bonds. Your suspicion was correct – you do need to rebalance your portfolio.

But then you start thinking about taxes and how you plan to fund your retirement with these accounts.

- You’ll owe federal and state income tax when you pull money out of your traditional 401k. Assume those add up to 30%.

- You won’t have to pay any tax on withdrawals from your Roth account.

- You’ll owe capital gains tax when you sell investments in your regular brokerage account – you’ve held everything for more than one year, so nothing is taxed as “short-term.” Assume you’re in the 15% bracket for capital gains and that your investments have doubled in price since you bought them.

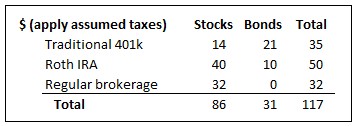

After applying those tax assumptions, here’s what your portfolio looks like:

You calculate that you have 74% in stocks and 26% in bonds, because 86/117=74% and 31/117=26%. After considering the impact of taxes, you now conclude that you are 14 percentage points away from your target allocation of 60% stocks and 40% in bonds. You need to rebalance more than you first thought!

If you do this analysis with your real investment account numbers, your mileage may vary. It depends on the tax rates that apply to you and the allocation within each of your investment accounts. If you need to rebalance, make sure you are doing so in the right amount by considering the impact of taxes.

-Stephanie

One reply on “The Boring Newsletter, 2/16/2025”

[…] you have a written financial plan it surely includes your after-tax target asset allocation, so you too can take a look to see if you are currently on-target. Unless you are invested entirely […]

LikeLike