Hi Friendos,

Today’s newsletter is about why you should get an identity protection PIN (“IP PIN”) from the IRS. It’s boring and annoying! You should do it anyway!

The last time I wrote about IP PINs was nearly 2 years ago. Back then, when I requested an IP PIN, the IRS sent it via snail mail. This year I just logged in to my online IRS account and my IP PIN was right there – a nice improvement.

What is an IP PIN?

It’s a 6-digit number that is known only to you and to the IRS. Having an IP PIN is optional but I recommend it. Each year you get an IP PIN that is valid for that calendar year. You only need to opt in to the program once and then will be assigned a fresh IP PIN every year.

Why would I want one?

It prevents an identity thief from filing a fraudulent tax return using your Social Security number.

The IRS estimates that in 2023, over 5 million tax returns were filed with stolen identities. That’s more than 5 million out of 162 million total returns received by the IRS, a rate of over 3%. In any given year you will probably not be the victim of identity theft tax fraud, but over a lifetime of filing taxes, and frequent data breaches, your cumulative risk is much higher.

Here’s how the fraud works: Someone uses your social security number to file a false tax return (often early in the tax season), claim a refund, and have the money sent to their bank account.

Then when you go to file your real tax return, you get rejected by the IRS as having already filed. You have to submit an identity theft affidavit and then wait. And wait. In fiscal 2024, the IRS took an average of 22 months to resolve identity theft cases. The IRS is working on getting this wait time down, but improvements require effort and funding. I am not optimistic that the current administration or Congress will support proper funding of the IRS so I never want to have a fraud case that needs resolving.

Especially for lower income people, the consequences of not receiving a refund in a timely way can be severe. Here is what one fraud victim said to the ringleader of a stolen identity theft ring who was sentenced to more than 12 years in prison:

What your intentional theft did to me was so much more than just stealing money. As a law student, a part-time employee and a full time mom[,] you stole time from me, time I will never get back, time spen[t] crying because of the avalanche effect of not receiving my income tax check back which I depended on and budgeted for, time checking my mailbox daily, time worrying about whether it was ever going to come…Time spen[t] explaining to our youngest that she won’t be getting her braces this year to fix her extremely crooked teeth. Time explaining that Christmas may have to be put on hold this year…We had to borrow money to buy law school books because the tax return was not coming. Financially it was a serious hardship because when you do not have money for necessities[,] it puts an emotional strain on every part of your life.

Here are examples of two knock-on problems that people have had when they were victims of tax fraud identity theft:

- The IRS won’t send tax transcripts directly to lenders, so people had to request transcripts themselves and send them over to lenders, stretching out timelines for things like mortgage applications.

- People opted to apply a prior year’s tax refund to payment of the current year’s taxes, but the IRS hadn’t applied it due to the unresolved fraud issue. The tax had not been paid and the IRS began to issue collection notices.

The solution to all this is to get an IP PIN. If you have an IP PIN, the IRS will only accept your tax return if the IP PIN is included. Identity theft: thwarted.

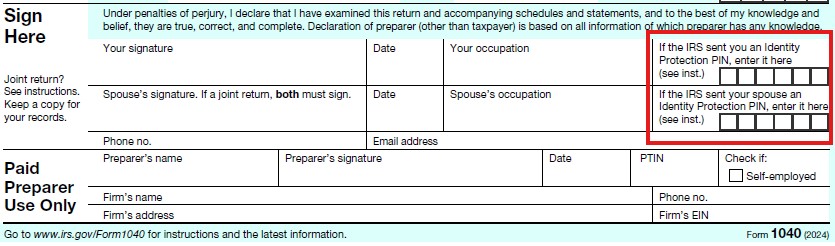

As the IRS explains, “An incorrect or missing IP PIN will result in the rejection of your e-filed return or a delay of your paper return until it can be verified.” You can see there’s a space on Form 1040 for IP PIN’s in the signature section at the end of the form:

Fine, I’ll do it. How do I get an IP PIN?

The first and most annoying step is to establish an online account with the IRS. This requires establishing an “ID.me” account and validating your identity. You’ll have to submit a picture of a government ID, like a driver’s license, and a selfie, or a live video chat with an ID.me agent. After you have your ID.me account established, then you can sign in / create your IRS account. It has multi-factor authentication, so have your cellphone by your side when you do this.

After establishing your IRS online account, you opt in to get an IP PIN. Follow the instructions the IRS provides online.

It’s annoying and has a lot of steps. My husband just did it a couple weeks ago, getting log in credentials for ID.me and everything else until he had an IP PIN in hand for 2025. I asked him, “Did it take more than 10 minutes.” “Yes.” “Did it take more than 20 minutes?” (No response, he was distracted by cooking.) “Would it be fair to say it took under half an hour?” “Yeah, that’s right, half an hour or less.” Since I already had my IRS account set up, it took me under 5 minutes to log in and find my 2025 IP PIN.

So there it is, an initial set up of half hour or less, followed by a few minutes a year, to avoid what would be untold hours of work if someone stole filed a fake tax return with your stolen identity.

-Stephanie

p.s. If you’ll use the IRS Direct File program to file your taxes for free, you’d need do to all this anyway, so why not get an IP PIN while you’re at it?

2 replies on “The Boring Newsletter, 1/25/2025”

[…] this service is undergoing maintenance right now, but will be available on Jan 6th. I wrote about IP PINs last year and how they help foil someone who wants to steal your tax refund. Yes, it takes a few […]

LikeLike

[…] I wrote last year: It’s a 6-digit number that is known only to you and to the IRS. Having an IP PIN is optional but […]

LikeLike