Hi Friendos,

Today I will continue the discussion about types of tax-advantaged investment accounts, like 401k’s and IRAs, and how to decide which type of account you should put your money in. At some point, nearly everyone saving for retirement will grapple with whether to put money into a Roth account or a traditional account.

Where I’m going with this discussion is: traditional 401k and traditional IRAs are better for nearly everyone except for very high-income people. I don’t think it is honest or accurate to say that Roth accounts exist to give people incentives to save for retirement. I think they exist to allow high-income people to avoid paying taxes. Let’s see if I can bring you around to my thinking.

Briefly, how do taxes work for traditional v Roth?

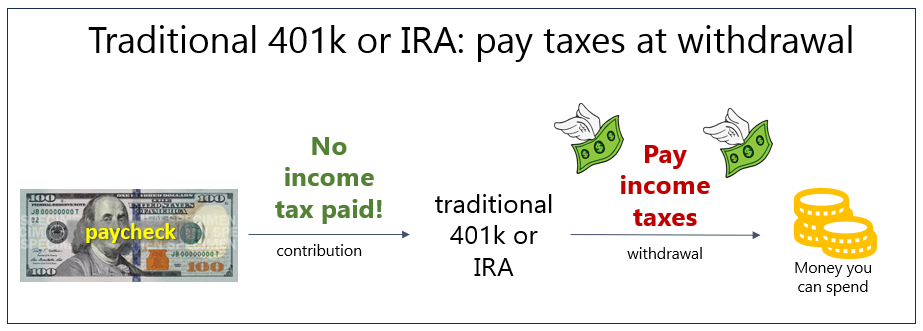

The first thing to get straight here is that you can have a 401k that is “traditional” or you can have a 401k that is “Roth” (same for 403b’s). You can have a traditional IRA or you can have a Roth IRA. More specifically, if you have a 401k at your job, it can be configured such that you could make all traditional contributions, all Roth contributions, or some of each. When you contribute income to a traditional account, you pay no tax on that income in the year of the contribution, no tax on investment gains while the money sits in the account, but do pay tax on withdrawals whenever you take the money out. Like this:

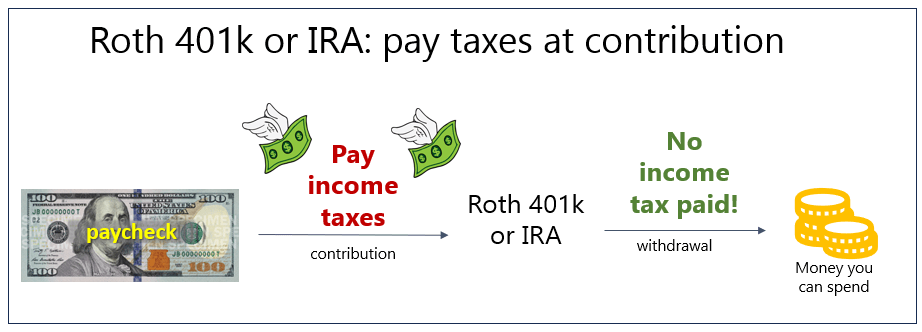

When you contribute income to a Roth account, you do pay tax on contributions when you put the money in, but no tax on investment gains while the money sits in the account and no tax on withdrawals when you take the money out. Like this:

I grouped together 401k and IRA in each of these pictures, but the mechanics are a little different for each of them.

Mechanically, how do I not pay taxes on a traditional 401k or traditional IRA contribution?

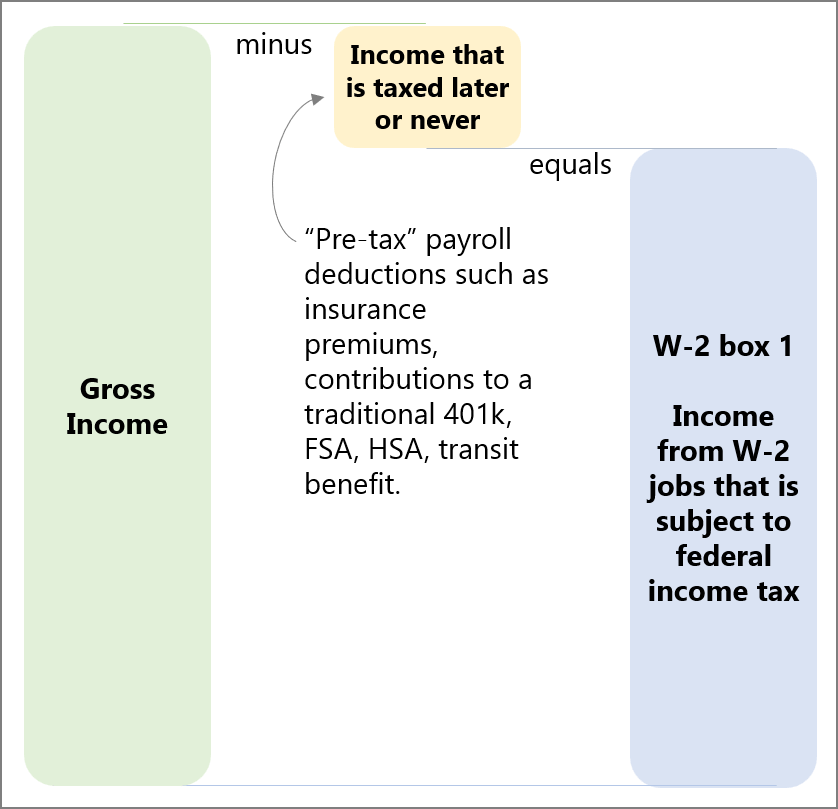

If you contribute to a 401k at your job, your contributions (the way you put money into the 401k) take place via payroll deductions. If you make traditional contributions, you will decrease your amount of taxable income on each paycheck and on your W-2 for that year. In the picture below, your traditional 401k contributions are part of that middle yellow bubble and therefore not part of your W-2 taxable income:

If you contribute to a Roth IRA, those contributions are not part of that middle yellow bubble, and are part of your W-2 taxable income.

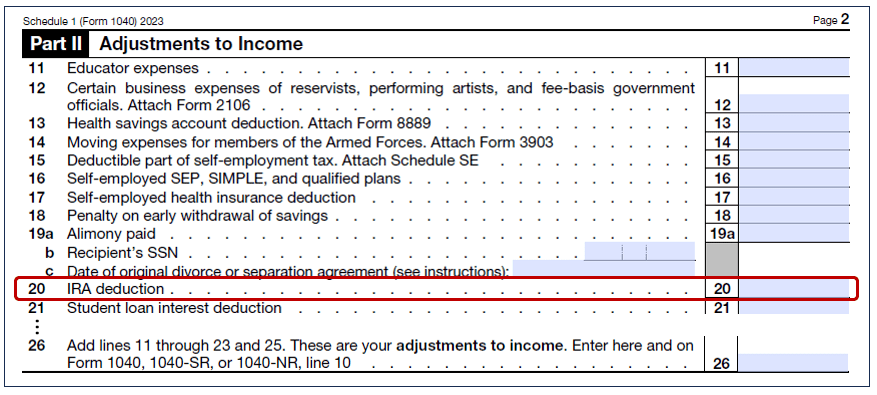

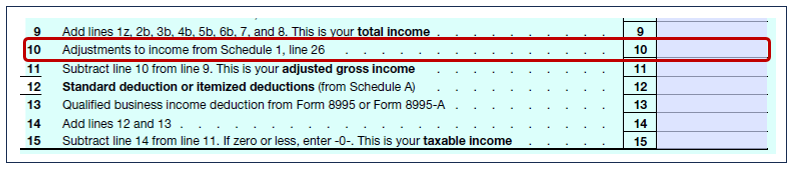

When you contribute to a traditional IRA, you do that on your own – it doesn’t involve your employer – sending money directly to the financial institution where you have the IRA account. You might be thinking: if I send money from my checking account, that is money I paid taxes on because I have taxes withheld from every paycheck. But! When you report that traditional IRA contribution on your tax return (Form 1040), you effectively get back any taxes paid on those funds. First you report the contribution on Form 1040, Schedule 1 as an adjustment to income:

Then the adjustment to income helps reduce your taxable income on Form 1040 itself:

If you contribute to a Roth IRA, there is no income adjustment on your tax return.

With the traditional 401k contribution, you benefit from the tax avoidance right away because your employer will withhold less in taxes from each paycheck. With the traditional IRA contribution, you experience the benefit from tax avoidance when you file your tax return, when you end up receiving a larger tax refund or owning less in additional tax payments due to the IRA contribution.

Everyone says: If I’m in a lower tax bracket now than in retirement, Roth is better. If I’m in a higher tax bracket now, traditional is better. If my tax bracket will be the same, traditional and Roth are equally good.

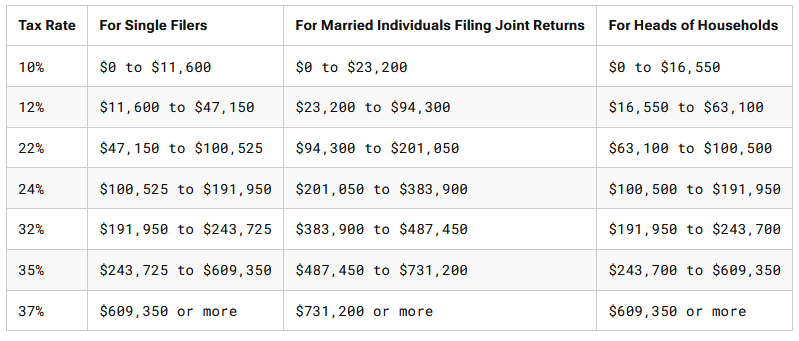

Understanding this claim requires understanding tax brackets. Here we pull them from Tax Foundation:

Let’s say you are single, have gross income of $100k (your only source of income), and take the standard deduction of $14,600. Your taxable income is $85.4k. $11.6 is taxed at 10%, the next $35.55 at 12%, and the remaining $38.25 at 22%.

If you decide to save 15% of your gross pay into a Roth 401k, your taxes don’t change. If you decide to save 15% ($15k) into a traditional 401k, your taxable income drops from $85.4k to $70.4k. You still have $11.6k taxes at 10%, you still have $35.55 at 12%, but now only $23.25 taxed at 22%. Their effective federal income tax rate is 10.54%, but every $ into the traditional 401k avoids 22 cents of taxes. The top marginal tax rate is what matters for contributions.

In retirement, assume our person wants to enjoy the same standard of living as while they were working and let’s say they aren’t yet receiving Social Security so will rely entirely on the traditional 401k for income. If they have income of $100k/year, they’ll be in the 22% top marginal bracket, so aren’t they in the same bracket now as in retirement? No. They don’t need $100k in (taxable) income to maintain their lifestyle.

Currently, this person has after-tax income of only $67k. Above, we penciled out total federal taxes of $10,541. They have to pay $7.65k (7.65%) in Social Security and Medicare (payroll) taxes. Let’s say this person lives in a state with no state income taxes. Then they have $100k of gross income, $15k going into a traditional 401k, $10.541k to federal income taxes, $7.65k to payroll taxes, and after-tax income of $66.81k.

Let’s assume no inflation by the time our person retires to keep things super simple (our tax brackets keep the same $ boundaries; if we did all the math assuming inflation, the results will be the same, it would just be a lot more math). The first $14.6k they pull out from the 401k is tax-free thanks to the standard deduction. The next $11.6 is subject to the 10% bracket, so they’ll get $10.44k of spending money from that withdrawal. The next $35.5k is subject to the 12% bracket, so they’ll get $31.24 spending money from that withdrawal. Finally, they can withdraw $13.5 subject to the 22% bracket and get $10.53k from that withdrawal. In total, they can withdraw $75.44k to get $66.81k of spending money, paying an effective federal income tax rate of 11.2% and at a top marginal tax rate of 22%.

This person avoided a 22% tax rate on their traditional 401k contributions in exchange for paying an 11.2% tax rate on withdrawals, a clear win even though they stayed in the same marginal tax bracket.

For Roth to be better, our person would need an effective tax rate in retirement that exceeds their marginal tax bracket while working. They would need a serious increase in income over the years to achieve that (true for a doctor who goes from resident to attending). Now, my example is super simple, and most retirees have income (like from Social Security) that fills at least some of their lower brackets, so things are not as severely skewed against Roth as what I laid out, but the math still favors traditional for almost everyone. Here are some other discussions on this topic that I find compelling:

- The Finance Buff: “The Case Against Roth 401(k): Still True After All These Years”

- The White Coat Investor: “Should You Make Roth or Traditional 401(k) Contributions?”

- r/personal finance: “Why you should (almost) never contribute to a Roth 401k”

Who does benefit from Roth?

- Someone who is so high income they are in the top one or two tax brackets now and will stay there the rest of their life,

- Someone who won’t be spending from that Roth account (they have so much income elsewhere) and wants to leave it to their heirs,

- Someone who has already maxed their traditional 401k, so now they want to contribute through the “back door” to a Roth IRA (they can’t go through the front door as their income is too high for that),

- Someone who has already maxed their traditional 401k and done a backdoor Roth IRA and wants to tax-shelter even more money in a “mega backdoor Roth.”

What is the policy argument for Roth? If it didn’t exist, the people who benefit from Roth accounts would still save plenty for retirement anyway, they’d just do it in regular brokerage accounts and pay more taxes along the way.

-Stephanie

One reply on “The Boring Newsletter, 5/5/2024”

[…] Last year I wrote about why I think a traditional IRA is a better option for most people than a Roth IRA and I explained the mechanics of how someone puts “pre-tax dollars” into a traditional IRA. But! Not everyone is allowed to claim a tax deduction for a traditional IRA contribution. If your income is “too high” you get only a partial deduction or no deduction at all, in which case Roth is the way to go. […]

LikeLike