Hi Friendos,

Today I am here to bring you: Five Common Myths About Taxes. These are the most common misconceptions I’ve encountered about the U.S. tax system. Got others? Please share them with me! I think we should have some required education on taxes in all high schools. People need to know this stuff!

Myth #1: When you file and pay taxes in April, that amount is the taxes you owed for the year.

- Truth: Preparing a tax return is a true-up process. We have a pay-as-you-go system (I discussed this in a prior newsletter). When you, or your tax preparer, “does your taxes,” you are figuring out two things: (1) the total amount of taxes you owe for the year, based on your income and other factors, and (2) how much of that total tax bill you’ve already paid during the year. The difference between those two is the payment or refund in April.

Myth #2: If you get a raise at your job, you end up worse off because of being bumped into a higher tax bracket.

- Truth: That is not how marginal tax brackets work. It is only the extra income you earn in the higher tax bracket that is taxed at that higher rate – all your other income will still be taxed at the lower rates of lower tax brackets (I walked through the math of tax brackets, step-by-step, in a prior newsletter). Now, the tax nerds among you might be sharp shooting me to point out strange edge case examples where one dollar of extra income truly does set someone back – yes, that is possible, but not so common and what someone has in mind when they’re worried about getting a raise and being worse off because of it.

Myth #3: Charitable donations and mortgage interest are tax deductible.

- Truth: Ok, this is not a total myth, but did I get your attention? Fewer than 10% of Americans get any tax benefit from these deductions, even if they did give to charity and even if they do pay interest on a home mortgage. That is because over 90% of people take the “standard deduction” and do not “itemize” their deductions (I wrote about this in a prior newsletter).

Myth #4: If I don’t file my taxes, eventually the IRS will message me (and yell at me and shame me).

- Truth: Quoting the IRS itself: “The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.” You MUST open your physical mail! If someone unexpectedly calls you and says they are from the IRS, that is almost certainly a scam and they are trying to steal from you, please hang up on them (what a jerk). Also, about someone messaging you to shame you (which is not going to happen), I’ll just say that the people who work at the IRS are just…people…doing their jobs.

Myth #5: If you don’t have any income there is no reason to file a tax return.

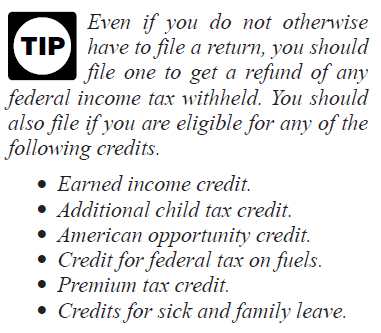

- Truth: I’ll quote the IRS on this one also (2023 instructions for Form 1040):

- It is entirely possible for someone to have little or no taxable income and receive a tax refund due to, for example, refundable tax credits. Such tax returns are generally very quick to prepare and likely qualify for a Free File program. If you are in that situation, I’d recommend preparing a return to ensure you identify and claim any money the IRS owes you.

Happy spring-forward weekend!

-Stephanie

One reply on “The Boring Newsletter, 3/9/2024”

[…] a prior newsletter, I said it is (effectively) a myth that charitable donations are tax-deductible (except for the […]

LikeLike