Hi Friendos,

Today I’m going to wrap up last week’s discussion of the Social Security “trust funds.”

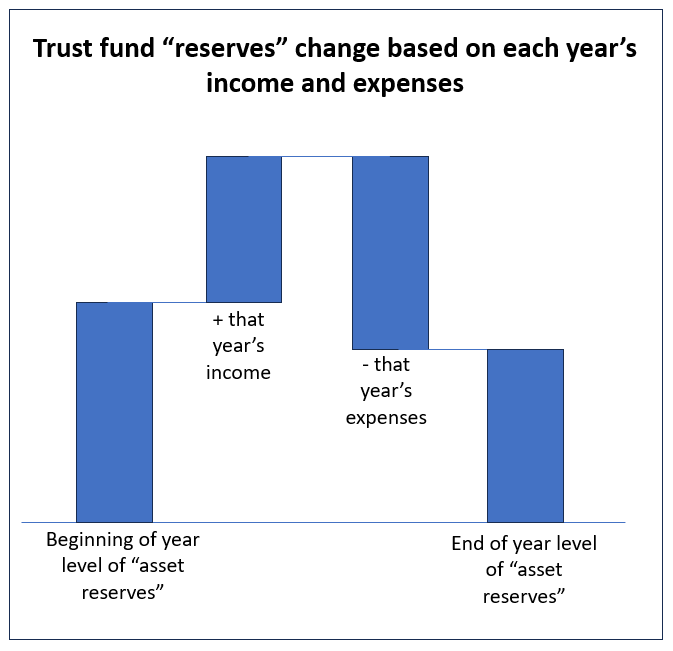

Last week we discussed how Social Security benefits are not paid for from general revenues of the federal government, but instead are paid for from so-called trust funds. The government accounting works like this: each year the level of “reserves” in each trust fund goes up by the amount of that year’s income and goes down by the amount of that year’s expenses. Like this:

In the picture above, expenses were more than that year’s income, so reserves were lower at the end of the year. In recent years that has typically been the pattern, and this is why people say Social Security is “running out of money” – because they assume/pretend that nothing about the pattern of income and expenses will change and eventually we will be “unable to pay benefits” because the trust fund will be “empty.”

Let’s explore this trust fund accounting a little more with an examination of 2017 data. In 2017, the OASI trust fund started with $2,801,349 million ($2.8 trillion) in reserves. It had income of $825,630 million and expenses of $806,669 million, for a net increase in reserves of $18,961 million (=$825,630 – $806,669).

That $825,630 million in income came from four sources: 86% from payroll taxes ($706,505 million), 4% from taxation of Social Security benefits ($35,877), a teeny way-less-than-1% from general fund transfers ($17), and 10% from interest earned on U.S. Treasury securities ($83,231).

- Payroll taxes: Wage income up to $168,600 (in 2024) is subject to Social Security tax of 6.2% paid by the employee, and a separate 6.2% paid by the employer. Income over $168,600 has no Social Security tax at all, or if you like, a 0% tax rate. Observation #1: this is a regressive tax where the overall tax rate is lower for people with higher income. Observation #2: payroll taxes aren’t “held in trust” for you while you are working and then paid out to you when you are retired, I don’t care what the 1952 film, “Your Social Security” says! It is a “pay as you go” system where current year payroll taxes are used to pay current year benefits.

- Taxation of Social Security benefits: When you receive benefits from the Social Security Administration, they may be taxed. I won’t discuss the details of that here, but it is generally based on your overall level of income.

- General fund transfers: Last week I said, “Typically the federal government pays for things with funds from ‘general revenues’…Congress… decided to pay for [Social Security] not from general revenues, but from a so-called ‘trust fund.’” Except, there are some small exceptions. (See Note A to the middle table here for details.) So, I guess we could make other exceptions too?

- Net interest: When the trust fund’s income exceeds its expenses in a given year, it invests the remaining funds into U.S. government bonds that earn interest. That’s right, we have the federal government buying bonds from the federal government, earning interest from the federal government…hmm… What if we just make sure bonds held by the trust funds equaled the amount needed to balance the accounts? Yes, that accounting trick would work!

Social Security’s “crisis” of funding is caused by Congress choosing to effectively handcuff itself to certain tax sources (like payroll taxes), unlike how it approaches funding for the rest of the government (like paying for the military). The payroll tax serves to limit Social Security benefits and the only “problem” with funding for Social Security is a simple choice by Congress to set up the law in this way. Congress wrote the funding laws and can change the funding laws, as it has done many, many times in the past.

The fabulous Death Panel podcast discussed claims that the Social Security trust funds are “going bankrupt” (episode 425, April 17, 2023). Co-host Beatrice Adler-Bolton said:

“Much of this panic really stems from the fact that our current discourse about funding for these programs is fundamentally flawed. Put simply, the entire way that we talk about Social Security and Medicare funding is wrong and this whole situation is really one of the quintessential examples of artificial scarcity in our political economy.”

My entire life there have been people who wanted to cut Social Security benefits and used this trust fund accounting myth as an argument to do so. Edwin L. Dale, Jr. worked as a financial journalist and government employee; he was an expert analyst of the federal budget. His opinion piece, “The Security of Social Security,” was published in the New York Times on January 14, 1973, and I want to end this newsletter with a long excerpt from it. I find it shocking how spot on every sentence remains today, 51 years later:

“To dispose of one tenaciously held myth first, there is nothing wrong with the ‘soundness’ of the system. No one’s benefits—present or future—are in jeopardy. If the day comes when the United States Government cannot pay its contractual obligations, a lot more people than the retired will feel that the world has come to an end. The Social Security ‘trust fund’ is a convenient financial accounting device, but in fact it is largely meaningless. The obligations to pensioners, like the interest payments on Government bonds, would be paid if the trust fund disappeared tomorrow. Social Security payments will stop only on the day that the U.S. Government stops paying its bills.

I recognize that it is very difficult to persuade some people of this fact. There are criers of doom who bombard us with figures seeking to demonstrate the ‘unsound’ condition of the trust fund, the Social Security system’s ‘unfunded liabilities’ and the like. But they overlook the fact that, in the real world, the Social Security benefit is a straightforward obligation of the United States Government, regardless of how it is financed. Some day, part of it may be financed by regular income taxes, as many now urge. But the benefit payment will remain an obligation. Perhaps the best analogy is compensation benefits for veterans with war‐connected disabilities. These are paid out of general revenues, and they are paid every year even if the budget is running huge deficits. If necessary, the Government will borrow the money to pay its obligations, as it now often does with no disaster for the economy.

…in the end, the ‘insurance’ is only the insurance that the U.S. Government pays its obligations, and that is pretty good insurance.”

-Stephanie

One reply on “The Boring Newsletter, 1/28/2024”

[…] 1/28/2024: This dug further into Social Security accounting and the manufactured, decades-long “crisis” politicians and their moneyed backers use to justify proposals for benefit cuts. I quoted at length from Edwin L. Dale, Jr’s outstanding piece, “The Security of Social Security,” which was published in January 1973 and remains shockingly fresh and relevant today. […]

LikeLike