Hi Friendos,

Last month I started a discussion about Social Security retirement benefits. I’ll continue on this theme for a few weeks, exploring different aspects of the program, including why claims that it is “running out of money” are wrong.

I suggested that it’s a good idea to establish an account with the Social Security Administration, regardless of your age, so you can periodically check the earnings record they have on file for you.

Why bother with yet another account, yet another thing to check on? Because your earnings history is the input into a formula that will determine the Social Security retirement benefits you receive in the future. If they undercount your earnings now, you’ll get less money in the future. Get your money!

In order to qualify for any retirement benefit at all, you need 40 “credits.” In 2024, you need $1,730 of earnings on which you paid Social Security taxes in order to earn one credit. You can earn up to 4 credits per year, so to earn 40 credits you need to have worked in 10 different calendar years.

If you qualify for a retirement benefit, the SSA (Social Security Administration) uses a formula to determine your “Primary Insurance Amount.” This is the dollar amount you receive each month if you claim Social Security at “full retirement age,” which is between age 66 and 67 (the exact age depends on the year you were born). If you claim early, like at age 62, you get less. If you delay claiming, like until age 70, you get more. But the starting point is your Primary Insurance Amount.

The formula considers 35 years of earnings – specifically, the 35 years in which you earned the most. Like this:

If you haven’t worked for 35 years, the formula considers average earnings from the years you have worked and fills in $0 for the rest. If the SSA (Social Security Administration) is missing data for some of the years you worked, you would much rather correct things so the formula considers your actual earnings amount instead of averaging in $0 for those years.

Here is how the formula works:

- For each year that a person worked, take their earnings that were subject to Social Security tax and apply an inflation factor. This puts each year of the earnings history into “today’s dollars.”

- Identify the 35 years with the highest amounts in today’s dollars. If they worked more than 35 years, the lower earning years are not part of the calculation. If they worked fewer than 35 years, include $0’s until there are 35 numbers to consider.

- Add up those 35 numbers and then divide the result by 420 to arrive at an average monthly amount (12 months per year times 35 = 420). This gives you the “Average Indexed Monthly Earnings” or “AIME.” (You can explore this calculation in detail on the SSA website here.)

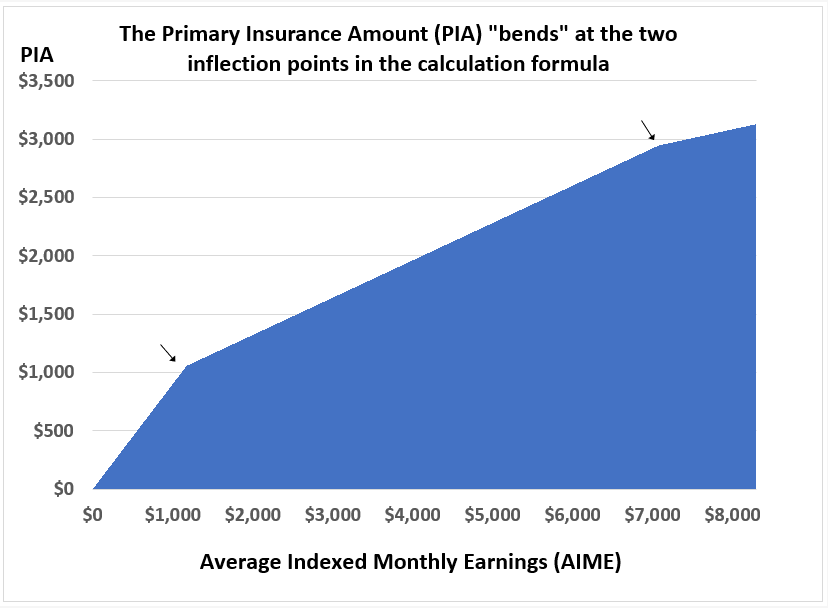

- Now the formula breaks AIME into three parts and multiplies each part by a specified percentage. These three amounts are then added together to arrive at the “Primary Insurance Amount” or “PIA.” The formula is indexed to inflation every year; the 2024 formula does it like this:

- 90 percent of the first $1,174 of AIME;

- plus 32 percent of any amount over $1,174 up to $7,078;

- plus 15 percent of any amount over $7,078.

Here is how one paper describes this: “A person’s Social Security benefit, or primary insurance amount (PIA), is 90 percent of the lowest portion of lifetime earnings, plus 32 percent of the middle portion of lifetime earnings, plus 15 percent of the highest portion of lifetime earnings.”

As you earn more, and your 35-year-average-earnings goes up, your Social Security benefit does not go up on a $ for $ basis. Instead, it goes up by 90 cents for each extra dollar of average earnings until you reach an initial threshold, then it goes up by 32 cents until the next threshold, then by 15 cents until you reach a ceiling. There is a ceiling because people only pay Social Security tax on earnings up to a certain amount ($168,600 in 2024), and the formula only considers earnings subject to Social Security tax.

This chart shows this less than 1-for-1 relationship for AIME up to $8,000:

This formula that determines your baseline Social Security retirement benefit has a couple implications:

- If someone wants to increase their Social Security retirement benefit, they can do so by earning more in any given year and/or by working for at least 35 years. Working more when AIME (average indexed monthly earnings) is below that first so-called “bend point” has a larger impact than working after that point.

- The formula does not “reward” higher earners with as much Social Security benefit (the line is less steep to the right of the bend points). Does this mean Social Security redistributes money to lower earners? No. People who earn more money live longer and receive Social Security for more years. When this and other factors are taken into account, economists find the system is regressive (distributing from lower income people to higher income people). Social Security taxes are also regressive. We could collectively decide to change this.

-Stephanie

One reply on “The Boring Newsletter, 1/13/2024”

[…] 1/13/2024: I discussed how you need 40 “credits” to qualify for retirement benefits and how those benefits are determined by a formula that looks at your specific earnings history. […]

LikeLike