Hi Friendos,

Today is our fourth installment discussing tax-advantaged medical accounts (HSAs and FSAs) where we’ll look at how these fit into the overall selection of a health insurance plan. I am always grateful to have insurance (really grateful) but I *hate* that choosing a plan is so complicated.

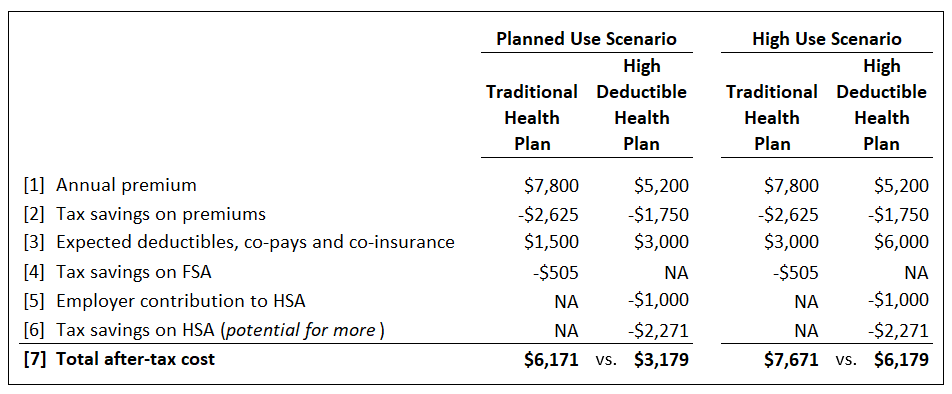

My approach is to consider the overall after-tax cost of each plan under consideration under (1) a “planned use” scenario and (2) a “high use” scenario. “Planned use” means doctor visits, scans, bloodwork, prescriptions, and everything else we know we’ll want during the year. “High use” covers anything extra that might come up.

When I say “the overall after-tax cost of each plan” I am thinking about:

- The amount I will have to pay if I choose that insurance plan: annual premiums,

- The amount I expect to pay for deductibles, co-pays, and any co-insurance,

- Tax savings from using an FSA or HSA account, and

- Any employer contribution to an HSA account.

Before diving into the numbers here, I’d like to share some thoughts from a reader. She is a seasoned FSA user who maxes her contribution every year. In thinking about your possible FSA contributions, consider her advice:

Ask yourself, “Is there something that you don’t do that you would if it didn’t cost so much out of pocket, if you knew you could get reimbursed for it, and you wouldn’t miss the money because you technically never saw it?”

Initially it really hurt when she reduced her paycheck for the FSA, but then she got used to it. Now she uses her FSA to pay for all sorts of health care, including some over-the-counter things for which she got prescriptions so they would qualify. The FSA acts as a mechanism for saving and paying for health care.

The first time you contribute to an FSA, she advises starting with last year’s medical expenses, but then also keep track of all the things you DON’T do for your health because you don’t think you can afford it. Next year, you could increase your FSA contribution to cover these as well (do verify they are “qualified” medical expenses). Also remember that at the end of the year, you can use remaining balances on little stuff like aspirin and bandages.

So let’s consider a “traditional” health plan + an FSA vs a “high deductible” health plan + an HSA. I think the numbers here are realistic for a person plus a spouse being covered through an employer health insurance plan; inputs can easily be changed for other set ups. We’ll follow the advice above and put 100% of our planned spending in the FSA with our traditional plan ($1,500), and, consistent with last week’s discussion, max the HSA contribution with our high-deductible plan ($7,750).

I’ll give you the overall numbers here, followed by a breakdown of each row in the table. I assumed a marginal tax rate of 34% (=22% federal + 4% state + 7.65% payroll):

The overall result is that the high deductible plan looks better under either scenario. Here’s a breakdown of each element, so you can decide if it differs in your own situation:

[1] Annual premium: The traditional health plan has annual premiums of $7,800 ($300 out of a paycheck every other week, 26 paychecks per year) vs. only $5,200 for the high deductible plan ($200 out of each paycheck). The premiums are the same in our “planned use” and “high use” scenarios because you pay the premiums regardless of usage. These #’s would be higher if the employer did not pay some of the premiums.

[2] Tax savings on premiums: If you have employer-provided health care and pay your part of the premiums via payroll deduction, you pay with “pre-tax” dollars; your tax savings equal your marginal tax rate multiplied by the amount of premiums ($7,800 * 33.65% = tax savings of $2,625). If you buy insurance on an exchange because you are self-employed and deduct premiums on your tax return (as an adjustment on Schedule 1 of Form 1040), you also pay with pre-tax dollars and have tax savings on premiums. If your job does not offer employer insurance so you buy it on an exchange with “after-tax” dollars, you have no tax savings on premiums.

[3] Expected deductibles, co-pays and co-insurance: Here, I assumed the traditional plan has lower expected deductibles, co-pays, and co-insurance. That’s usually the tradeoff with a traditional plan: you pay higher premiums up front, but then pay less at each doctor visit/treatment. For the “planned use” scenario, you can develop this number the way outlines above, by looking at last year’s doctor visits, prescriptions, lab tests, and other care. For the “high use” scenarios, you can assume the annual out of pocket maximum.

[4] Tax savings on FSA: Equal to the FSA contribution times the assumed marginal tax rate ($1,500 * 33.65% = $505). This would be $0 if your employer has no FSA or if there is one but you don’t contribute.

[5] Employer contribution to HSA: Assumed at $1,000 per year here. This would be $0 if your employer does not contribute.

[6] Tax savings on HSA: Equal to the HSA contribution times the assumed marginal tax rate. The contribution here is $6,650 (the annual max of $7,750 less the $1,000 put in by the employer here), multiplied by the marginal tax rate of 33.65% (= tax savings of $2,271). If you contribute directly (not via payroll deduction), the marginal tax rate should not include 7.65% for payroll taxes. If you live in California or New Jersey, the marginal tax rate should not include anything for state income taxes. In the table, I said there is “potential for more” tax savings. Last week we talked about how you can invest the money inside of an HSA account and let it grow, to ultimately pay for more qualified medical expenses. You will owe no taxes on your investment returns.

[7] Total after-tax cost: The sum of the items above.

There are a lot of variables to consider here (Dear Congress, please do better). I don’t do this analysis if things haven’t changed much from the year before, but force myself to do it when things have changed (e.g., new job, new medical situation). I hope this framework will help you navigate this year’s open enrollment.

-Stephanie

p.s. Navigating these issues can be frustrating. If you would like help with your own choices or have more questions after reading these articles, I would love to help with a coaching session. Just reply to this email and say generally what you’d like to discuss, and we’ll go from there.

One reply on “The Boring Newsletter, 10/29/2023 🩺”

[…] your own plan. It’s not fun but you’ll want to run some numbers to figure out your best option. This article I wrote lays out how I think about this analysis. This is also an opportunity to change FSA […]

LikeLike