Currently, I offer the following services for US clients:

- Learn how to do your own taxes,

- Traditional tax preparation where I prepare and file your tax return for you (selected states not available),

- Tax return review where you prepare your return and I am a second set of eyes,

- Understand your employer retirement plan, individual retirement account, HSA, and/or FSA,

- Make a get-out-of-debt plan, and

- Custom coaching sessions (*most popular option historically).

Read more about each of these below.

I also work with organizations! Presentations, workshops, and “office hours” can all help your people. Could your employees benefit from a better understanding of fringe benefits (e.g., why is it helpful to save into a 401(k), why is an HSA an awesome benefit)? I can help explain that from an independent perspective.

I welcome and want to work with diverse clients of every type and have a strict “no judgment” policy regarding personal finance.

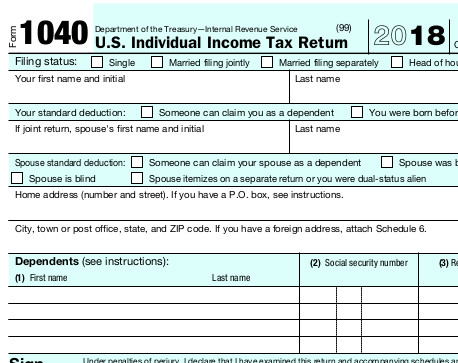

1. Learn how to do your own taxes.

Have you ever wondered why you owe more income taxes in some years but get a refund in others? Wondered why the amount of taxable income shown on your W-2 is different from how much you actually make? Do you think you could do your own taxes if someone just showed you how?

I’ve spent several tax seasons as a volunteer, and have prepared hundreds of tax returns for low income people. I’ve often thought my clients had a solid understanding of their own tax situation and could do their own taxes if someone just taught them the software, provided a big picture framework for how taxes work, and helped them feel confident in what they already knew. For me, understanding and optimizing my own taxes was the beginning of my journey to financial security and building wealth, as I touched on in this article.

I aim to charge a rate similar or less than what you’d pay someone else to do taxes for you. The difference being, at the end of a tax session with me, your taxes will be complete, you should be able to do them yourself next year using tax prep software, and you walk away with a general understanding for how income taxes work. We’ll talk about concepts like marginal tax brackets, how numbers on your tax paperwork flow into your actual tax return, and tax withholding vs tax liability. A session usually takes about two hours (three is about the longest I’ve done). If you are eligible for a free file option, great, otherwise, you would also purchase tax software such as TurboTax. Cost: flat rate of $375 for your 2025 tax return. Bundle this with an hour of custom coaching for only $475, a discount of $80!

I describe the items you need for a tax learning session here.

2. Traditional tax preparation

I also offer traditional tax prep! As this is my second season offering this service, I am still only accepting fairly simple tax returns to be filed by April 15th, 2026. You will need to be comfortable scanning or photographing tax documents to provide to me via a secure portal. Cost: flat rate of $450. Bundle this with an hour of custom coaching for only $550, a discount of $80!

If you would like to reserve a place on my client list for preparation of your 2025 tax return, please email me and I will provide details on payment of a $50 deposit to reserve your place.

Unfortunately, this year I will still not be able to help file state tax returns for California, Connecticut, Maryland, Nevada, Ohio, or Oregon. The regulatory requirements in those areas add a level of complexity my business may tackle in future years. If you live in one of these states, consider option #1 above!

I will not take on any type of tax return unless I am confident I can provide the highest level of quality, so unfortunately I am not taking on certain types of clients at this time: military or militia income, rental real estate, corporate returns, trusts, estates, agricultural businesses, ex-pats, K-1 partnership income, extensions to file.

I am not affiliated with any provider of refund anticipation loans or checks.

I describe the process of working together on tax preparation here.

3. Tax Return Review

This is a new product offering as of January 2026! For a flat rate of $150, you will send me your completed (draft) tax return and tax documents (W-2, 1099, etc) and I will review your return and provide feedback. This is for clients who are comfortable self-preparing their returns and navigating the tax software, but want potential feedback like:

- You told me you got a small refund last year, and wondered why you owe a lot this year. This year, you owe on federal taxes because (1) you had some investment income (dividends received) where no taxes were withheld, and (2) last year you made larger estimated quarterly tax payments than you made this year.

- I noticed that you are using an HSA account, would you like to learn how to use this as a retirement account in disguise?

- I see that you withdrew money from a Roth IRA, but this is showing up as taxable income on your tax return. If this a simply withdrawal of your original contribution, that is not taxable and you should make the following adjustments to your tax return…

You can do what you want with the feedback and the file your return yourself.

4. Understand your employer retirement plan.

Do you feel unsure about which investment options to pick because you don’t understand what the options are? Do you want to better understand where your money will be going, so you can save and invest with confidence? Do you understand why an employer match is free money, a 100% return on your investment, and part of your compensation?

I am a big fan of automating my saving and investing– having it come out of my paycheck every two weeks makes it easy and it means I actually do it. For something so simple and, honestly, so boring, I think it’s remarkable how much wealth you can build paycheck by paycheck, year after year. Figuring out how to approach a 401k or 403b plan can be overwhelming, like I usually feel when I have to think about health insurance options. But if you have a retirement plan at your job, it really is worth your time to learn how to fully take advantage of it.

I charge an hourly rate and recommend starting with a one-hour session (it’s hard to take in information for much longer, and an hour might be all you need). Topics could include: What is an index fund and how does it work? How will investing in the retirement plan impact my take-home pay? How much does this cost and why do fees matter? What does [this thing] on my quarterly statement mean? How do I decide between the traditional 401k and the Roth 401k? If you have questions in mind, that’s where we’ll start. If you don’t have a starting point in mind, that’s ok too. You should leave the session feeling confident about how to best utilize the plan at your current job, and equipped to make good choices at future jobs. Rate: $180 for a private one-hour session (1-2 people), $230 for a one-hour group session (3-5 people).

5. Make a get-out-of-debt plan.

You want to get out of debt but aren’t sure where to start. What is the right order for paying off various debts? The internet says to use the debt snowball or the debt avalanche but what are those? How much can I put toward debt each month? We can work on all of this together! Rate: $180/hour. I also take pro-bono and sliding scale clients every year, so do not hesitate to ask if I could take you on pro-bono at no charge to you.

6. Custom coaching session.

This could be private or for a group (1-2 people, $180/hour, $230/hr for 3-5 people). We could talk about creating a written financial plan, employer benefits (HSAs, FSAs, group insurance policies), life insurance (like term life), or things like merging finances (or not) with a partner. Just get in touch with your interest. We can work out the topics to discuss and, if applicable, you can send materials in advance to help us get the most out of our time together. I also work with clients on a sliding scale when that is appropriate for their budgets! Make me an offer 🙂

Here are some examples of topics past clients have wanted to discuss:

- How do I prioritize where to put savings?

- I feel disorganized in my finances. Can you help?

- I have a bunch of different accounts, some opened years ago, but I’m not sure how to best use them all. Can you advise?

- Do I need to have a brokerage account now that I got a job paying more?

- I have a lot of savings but am not sure if I’m taking advantage of ways to minimize my taxes.

- I have a savings plan that I’d like someone else to review and discuss.

- I am leaving my W-2 job and going to be an independent contractor. What should I keep in mind for my taxes and investments?

- My 403B has some of the same investments as my IRA. Is that ok?

For Organizations

We can design a program that will best match your needs. For example, a 2-hour workshop could cover: why investing in a 401(k) is beneficial, what is an HSA (and/or FSA) and why are they a good thing, how self-employment taxes work (if lots of your people do side work), and tips on recession preparation/financial preparedness.

Lots of workplaces offer a nice set of benefits but the uptake rate is not what it could be if employees better understood the benefit of their benefits.

I can also offer paid “office hours” to meet one-on-one with your people, and they can drive the discussion agenda with whatever is of most concern to them.

For most services I charge organizations a $400/hour rate.

Ready? E-mail me with your interest!

Let me know what you have in mind and, if you have possible days/times in mind, share that too!

stephanie@frequentlytaxedquestions.com