An Eye Doctor Can Be In-Network AND Out-of-Network At the Same Time

Hi Friendos,

Next Saturday, Feb 14, I am hosting my free monthly Zoom at 11am ET / 8am PT; the meeting ID is 897 1710 3456 and you can join in the Zoom app or at https://www.zoom.com/. What could be more romantic?

Today I’m continuing the discussion about health care costs by drilling into the issue of “in-network” for eye doctors. Because of course eyes are not normal body parts so we have to have separate insurance for their required care? Ha!

There is medical insurance, there is vision insurance, and there is dental insurance. If you have all of them, that is a great thing! What is less great is that there are 3 distinct contractual relationships involved, 3 different premiums you must pay for the policies, and 3 sets of rules you’ll deal with for annual deductibles, co-payments, and co-insurance. Each policy has its own network of providers. Each policy has its own rules about what is and is not covered.

Last year at my annual eye exam the eye doctor used fundus photography to check for certain types of eye problems. This added $35 to my out-of-pocket cost, but saved me the trouble of having my eyes dilated and dealing with blurry vision for some hours after the appointment. This year, I wanted to have my eyes dilated because I’d read it was best practice to do that every other year or so, and my doctor agreed it was a good idea.

I had to make an entirely separate appointment just for the dilation, because the claim for my eye exam would be submitted to my vision insurance with Cigna, but the claim for the dilation and related exam would be submitted to my medical insurance…also…Cigna. It was treated as a specialist doctor’s appointment, so I had a $40 copay.

Lesson #1: some things that eye doctors do fall within vision insurance, some fall within medical insurance. The same is true for dentists and dental v medical insurance. Most ofwhat my eye doctor did fell within my vision policy, but the dilation fell within my medical policy.

Lesson #2 I learned from this KFF Health News article: your eye doctor can be in-network for vision insurance services, and out-of-network for medical insurance services, or vice versa, even when you have both policies with the SAME insurance company.

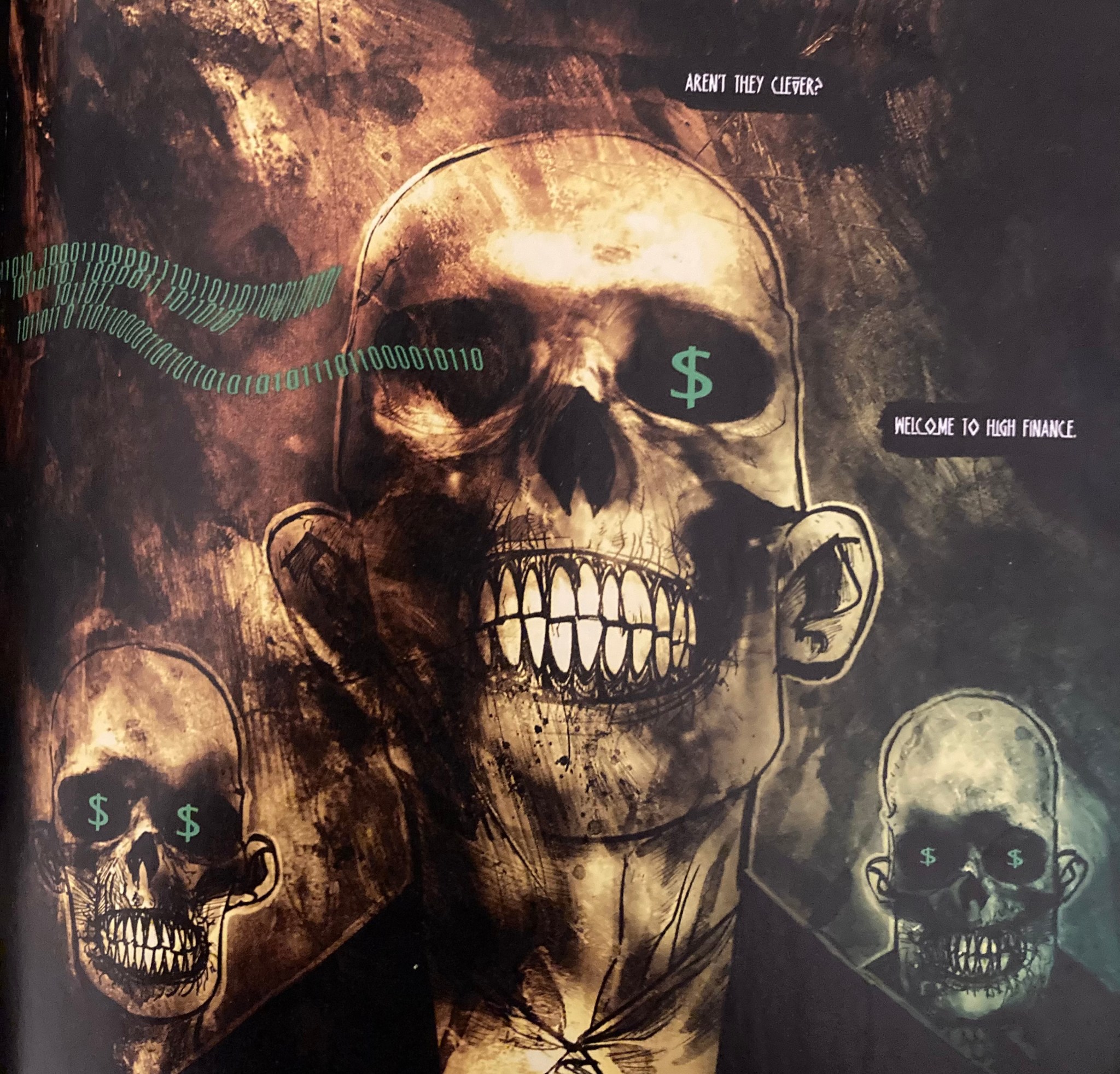

Oh, this makes no sense to you? Let UnitedHealthcare spokesperson Meg Sergel reassure you that she understands “how a customer could mistakenly think vision insurance would cover all care for the eyes. She said UnitedHealthcare recommends that before undergoing treatment, patients ask care providers whether they are in-network for specific services.” Got that? It’s not enough to verify that your provider is in-network. You need to verify that they are in-network for the specific services you need. Aren’t they clever? It reminds me of Occupy Comics from 2013:

-Stephanie