Get the Reference Number. There is Always a Reference Number.

Hi Friendos,

Today’s newsletter is about getting an insurance company to reprocess your claim when they did it wrong the first time. I have 3 examples from my own life to share where I was 3 out of 3 on getting this done. I learned all about this from the outstanding podcast “Arm and a Leg” which is all about practicing financial self-defense against medical insurance companies. I’ve been writing about medical insurance a lot recently because I love sharing what I’ve learned and I don’t see other personal finance writing get into the kind of detail you need so you can fight and win your own battles. One erroneous medical bill can easily wipe out multiple years of interest from your high-yield savings account – pay the most attention to the biggest dollar items!

Example #1: Cigna told me I would owe $0 out of pocket, my first EOB said I owed $85.23. They reprocessed the claim and my second EOB said I owed $0. Last October I had this procedure done to my wrist involving (1) an ultrasound and fine needle aspiration and (2) a steroid shot. Before I had it done, I called Cigna to find out if it required preauthorization and if I would owe a copay at the appointment. I took notes during the call and I wrote down the date of my call (10/24), and time of day. My notes also say:

- The rep put me on hold while calling the doctor’s office to obtain the procedure code.

- He spoke to doctor’s office and confirmed the info and gathered the CPT codes. “After checking, there is no need for them to send prior authorization so you’re good to schedule for next week”

- My question about benefit coverage: falls under x-ray and independent lab or independent facility, is covered 100%. No copay, deductible, or coinsurance.

- Reference # for this call: 8368. I got the reference number – there is always a reference number but you have to ask for it.

About a week later, I got an EOB (explanation of benefits) showing I owed $85.23. Why?

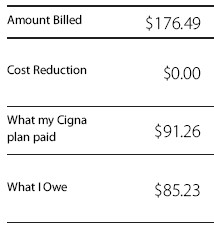

The initial EOB I received:

I called Cigna again, prior call reference # in hand, and this rep explained that when Cigna previously called my doctor’s office, my doctor only gave 1 of the 2 billing codes involved, where the second code was apparently not fully covered. But! This representative said he could send the case for review, they would listen to the discussion I had with the first Cigna rep, and honor whatever that rep told me about claim processing.

And they did! Just over two weeks later, I got the EOB for the reprocessed claim and it said I owed $0. They could easily look up my prior call when I gave them the reference number. If needed, so could an industry regulator.

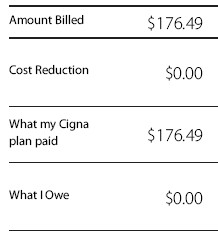

Reprocessed EOB:

Worth it? It was to me. I make these phone calls when I have other computer-based chores to do while I’m on hold with Cigna, so it’s not much of a lift.

Example #2: Cigna told me I would owe $0, my first EOB said I owed $124. They said they would reprocess the claim and my second EOB should say that I owe $0.

I went for a scan and beforehand, I called Cigna to find out what my coverage and out-of-pocket cost would be. They said $0. I got the EOB and it said Cigna didn’t cover this at all and I owed the full cost of $124. What! The cash price was only $110, so if this really wasn’t covered, I could have just paid the $110. Breathe…I called Cigna and it turns out their subcontractor, EviCore (Evil Core), had processed the claim incorrectly. They will reprocess it and my revised EOB should show I owe $0.

Example #3: I corrected my dentist’s error to avoid prematurely eating up coverage under my dental policy.

I went for a regular teeth cleaning and agreed to typical x-rays to aid the exam. The dentist submitted a claim to the insurance company that said he’d taken “full mouth x-rays,” but that seemed fishy to me because they didn’t take that many x-rays. I had the office email me a copy of the images and did an online search to learn what “full mouth x-rays” entails. Full mouth shows the entirety of each tooth in your mouth, usually a dozen images or so, but my 6 x-rays didn’t show the roots of most teeth and for some teeth, the tips were cut off in the images.

My dentist had upcoded the claim. This is where a provider submits an inflated claim to an insurance company so they can get paid more than they are really owed by billing for services they did not actually provide. In this case, the dentist submitted an $85 claim for full mouth x-rays he did not take, rather than being paid $41 for the less extensive bitewing x-rays that he did take.

Upcoding is MASSIVE in U.S. healthcare, including for Medicare. Another name for it is insurance fraud. UnitedHealth apparently has a whole team of employees devoted to the practice.

My dental policy only covers “full mouth x-rays” once every 36 months, so I only wanted to use up that coverage when I actually had the service provided. I’m glad to have the coverage available, but with this one it honestly just felt great to stick it to an unscrupulous provider who had previously bullied me over payment.

Tips for when you talk to representatives at your insurance company:

- Be friendly. Representatives can choose to be more vs less helpful to you and they take a lot of crap from people all day long. You want them to be your advocate.

- Clarify as needed: “Let me make sure I understand what you’re saying…”

- Take a deep breath. If needed, slow the conversation down. You can acknowledge they need to take other calls, but you are just trying to understand this complicated and expensive thing.

- Always take notes: (1) the date you called, (2) the phone number you called, (3) the name of the person you spoke with, and (4) the reference number for the call. There is always a reference number.

-Stephanie