If You Will Itemize This Year But Not Next Year, Accelerate Deduction Items Like Property Tax Payments

Hi Friendos,

I know I said I wasn’t going to send out any more newsletters this year…but I had to do this one! Today I have for you a possible tax maneuver for homeowners that illustrates a technique that could apply to anyone (typically higher-income people who live in higher-tax states), and also a cool tip for how to open cardboard boxes without damaging the things inside.

Possible tax-reducing maneuver: If you will itemize deductions on your federal tax return this year, but take the standard deduction next year, it is to your benefit to accelerate payment of any deductible items from calendar 2026 into 2025. Often it is financially beneficial to delay payments and hold on to your money for longer, but not in this case! If you are a homeowner and have already been assessed property taxes that are due in 2026, see if you can prepay those property taxes before year end. Then you can include your prepayment as a deduction on your 2025 federal tax return, along with the other property tax payments you made in 2025. You’d have to pay those taxes within the next year anyway, and this way, each dollar of extra itemized deduction shelters a dollar of income from federal income tax. Next year you’d only get the standard deduction anyway, so why not accelerate payment and take the extra savings? The IRS “counts” the deduction based on the date it was paid, not the time period to which it relates. You can only do this for assessed property taxes where you are already legally liable for paying that amount, so there is a limit to the size of this maneuver.

The same logic applies to charitable donations and medical expenses, if you will itemize this year but not next year. Yes, I recognize that most medical expenses are not planned, but you might have some discretion around the edges. If you have the cash on hand and can reasonably make payment in 2025, rather than in 2026, go ahead and do it – you’ll lower your tax bill.

Cardboard box opening tip: At a recent shift at my neighborhood food coop, I learned how to reliably open cardboard boxes without slicing the items inside. I can count this as helping you financially if you avoid damaging things you paid for? Take your box cutter or other box opening tool, and begin by cutting across the tape on each side. Then, you can carefully lift up the top flaps that comprise the top of the box, and only after lifting them up a bit, you can slice down the middle to finish opening the box. Voila, you won’t cut into whatever sits right underneath the top of the box!

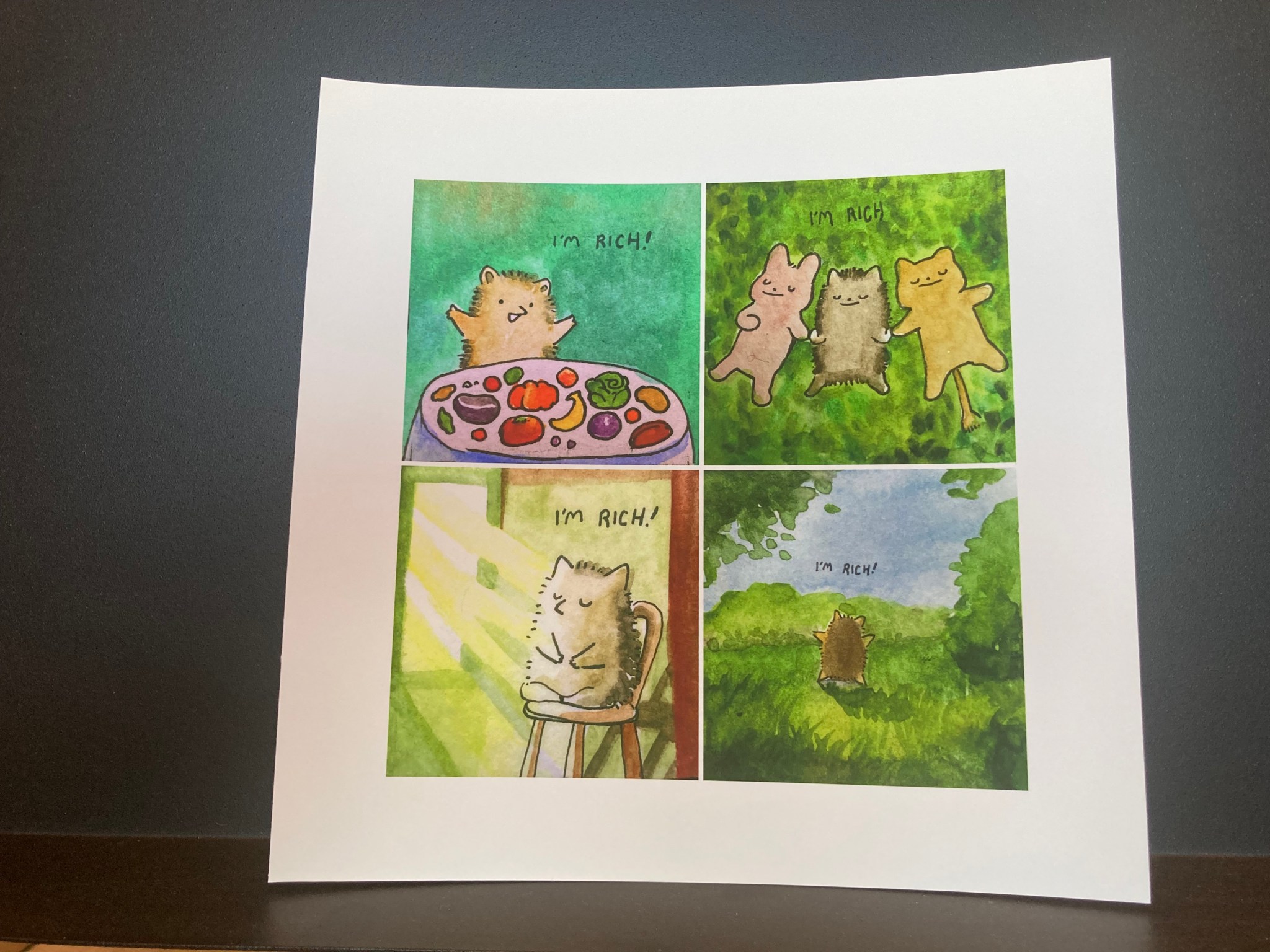

Year-end well wishes: For me, this time of year can be wonderful and complicated and hard, and also hopeful. I hope you have a lovely year-end and wonderful start to 2026. I’ll end with a picture of a print I bought a couple years ago, to hang by my desk as a reminder of some things that are key to living a good life.

-Stephanie