It is not the LLC structure itself that can offer tax savings, it is electing tax treatment as an S-Corp

Hi Friendos,

Last week I wrote about my top advice for people starting out with self-employment income. I claimed that most do not need to worry about forming an LLC, which takes some administrative doing and costs money to establish and maintain. For example, California requires LLCs to pay an annual franchise tax that is at least $800/year.

An LLC provides asset protection from creditors and lawsuits. The LLC structure itself does not confer any tax benefits.

But…what about articles like “6 Ways Your LLC Can Reduce Your Taxes,” “5 Tax Advantages of an LLC,” and “LLC Tax Benefits”? Some of the benefits these types of articles cite are available to a sole proprietorship, like deducting business expenses or avoiding the “double taxation” of businesses structured as C-Corps (where corporate profits are taxed at the corporate level and then, after they are distributed to owners, taxed again as part of individual income).

I think articles like these are trying to take advantage of people’s confusion about the weird intersection of law and tax that is the LLC, and people can end up overpaying for professional services they don’t need. To be clear: LLC is a legal structure, not a tax status. An LLC is what the IRS calls a “disregarded entity” meaning that from the IRS point of view, it is like the entity does not exist, so the business profits flow through to the owner or owners as income.

- For a single-member LLC, taxes default to being the same as a sole proprietorship. The business does not file its own tax return and there is no separate taxation of business profits – they flow through to the owner as personal income.

- For a multi-member LLC, taxes default to being the same as a partnership. Here, the business does not file its own tax return, but there is no separate taxation of business profits – they flow through to the owners as personal income.

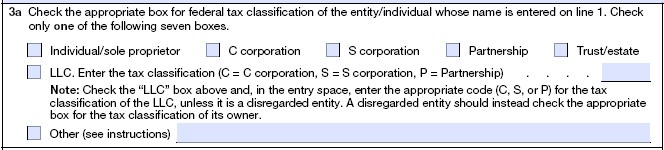

If you are self-employed and do contract work for a business, they probably had you fill out Form W-9. Question 3a on that form is really confusing unless you get this distinction between legal structure and tax status:

If you check the LLC box on the form, you also have to fill in tax status for C-Corp, S-Corp, or Partnership, or, if the tax status is sole proprietor, you don’t bother checking the LLC box at all, you just check the box for sole proprietor. An LLC is a legal entity that can take on different types of taxation.

Usually when someone says an LLC has tax benefits, they are referring to when an LLC chooses to be taxed like an S-Corp. With an S-Corp, the owner can set up their pay in two pieces: salary and profit distribution. Their salary will be subject to federal income tax, Social Security tax, and Medicare tax, while profit distributions are only subject to federal income tax. The big tax benefit of an LLC electing taxation as an S-Corp is avoiding payroll taxes.

Ok, so you might think cool cool cool, I’ll pay myself a $1 salary and take the rest as profits. Come on, I said “avoiding” taxes, not “evading” taxes! The salary must be reasonable and “reasonable” is based on the industry of that business.

Let’s say that if the owner of the LLC worked for someone else, with identical job duties, they would earn $80k/year. Working for themselves, they cannot take only a $10k/year salary and evade payroll taxes (Social Security tax, Medicare tax) on the other $70k of business profits.

Most people starting out with self-employment income don’t make enough in taxable profits to justify the expense of setting up corporate payroll and meeting the other requirements to establish an LLC and elect S-Corp taxation. But, over time, they make get there. A decent rule of thumb is that if you have $50k in profits or less, don’t bother. If you have $70k in profits, you’re getting to where it might make sense. If you have $90k+ in profits, it’s probably worth looking into.

-Stephanie