Don’t feed the trolls. Tell Congress: no tax prep bridge trolls!

Hi Friendos,

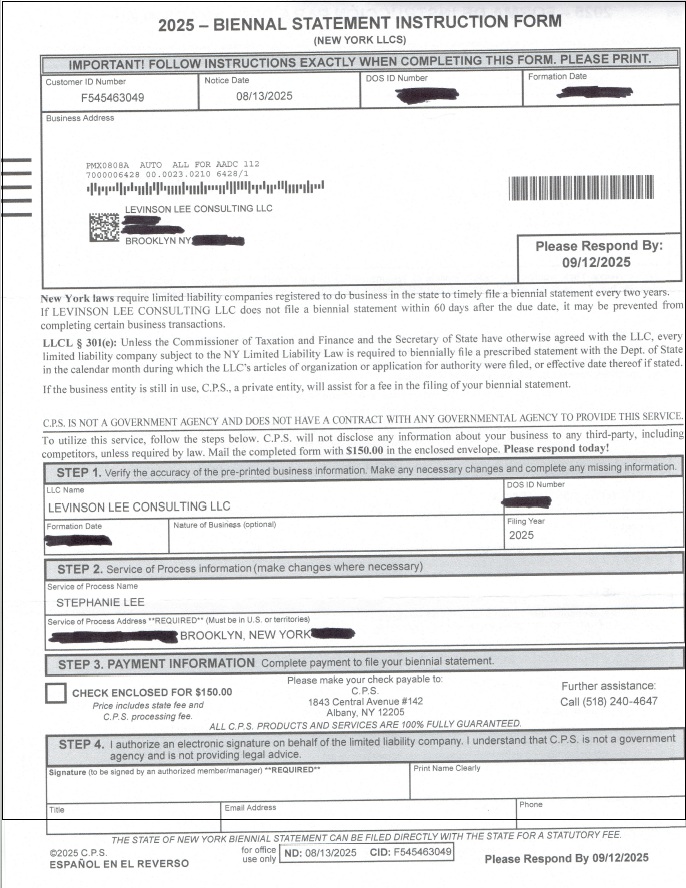

Last week my business received a letter (my official LLC name is Levinson Lee Consulting and my registered “doing business as” name is Frequently Taxed Questions). I opened the letter and thought, “oh yeah, that thing I have to file every other year with New York State.”

And then I saw it asked for payment of $150 and I thought “that can’t be right, it can’t be that expensive.” I checked my business files and saw that in 2023 I completed this filing online, directly with the NY Dept. of State, and the fee was $9. $9!

I looked at the letter more closely and then saw, right in the middle of the page, the letter says, “C.P.S. is not a government agency and does not have a contract with any governmental agency to provide this service.” OMG! They want me to pay them $150 instead of directly paying $9 to NY State…helluva service. This bridge troll created a letter designed to look exactly like government paperwork, down to the plain white return envelope that has an address in Albany, the New York state capital:

Apparently this scammer provides this “service” all over the country. And enough people must fall for it that it makes sense for them to spend money on all the mailings that go right into the trash.

It got me thinking about other bridge trolls that we encounter in personal finance and sometimes end up paying off so we can cross the bridge. Like the “admin fees” I had to pay to HealthEquity when I had my HSA with them. Sure, HealthEquity administered the account, which cost them a little bit, but not nearly as much as what they charged me. But my employer chose HealthEquity, not me, and if I wanted my employer to deposit $1,000 into my HSA each year (yes, I did want that money, I considered it part of my compensation along with my medical insurance and other fringe benefits), I had no choice but to have my account at HealthEquity and pay the troll.

I think huge swaths of the tax preparation industry are nothing more then bridge trolls. That software people buy each year to self-prepare their taxes? Troll tolls! H&R Block net profit margin? Over 14%! What I think it should be? Zero. Americans should not have to pay fees simply to pay their taxes. The tax system should be straightforward enough that we can administer it without undue burden on any taxpayer or government agency. This is what the IRS was aiming for with the Direct File program.

In June 2024, I wrote about the Direct File program:

After filing through Direct File, taxpayers could complete an optional survey. Of the more than 15,000 people who did, 90% said their experience was “Excellent” or “Above Average” and more than half said their filing experience was “much easier” than last year. The “Treasury Department estimates that Direct File users saved $5.6 million in tax preparation fees.”

Direct File served taxpayers in 12 states in 2024 (for filing of 2023 taxes), and expanded to 25 states in 2025 (for filing of 2024 taxes). I had been hoping that Direct File would continue to expand so even more of us could file for free this year, but the Trump administration went the other way, killing the program entirely.

IRS Commissioner Billy Long said “You’ve heard of Direct File, that’s gone,” Long said. “Big beautiful Billy wiped that out. I don’t care about Direct File. I care about direct audit.” Well, the BBB Act requires the IRS to report to Congress on free tax filing options for the public and you can provide input!

To participate, go to the IRS Free Online Tax Preparation Feedback Survey where participation is anonymous.

I did it from my phone and it took under 2 minutes. Would you like to be able to file your taxes directly with the IRS for free? Without sharing all your info with a private company? Yeah, me too. Do the survey! Of course I am not so naive to think the administration will actually listen to the public, but let’s at least not give them the survey data they want. Click here.

-Stephanie