When you ask Cigna if your dentist is in-network and discover they hired George Orwell as a consultant

Hi Friendos,

As you know from prior newsletters, I’ve been learning a lot about health insurance this summer. Today I am writing about something that I’ve learned is not at all a new topic, but was new-to-me: in-network status for a medical provider or medical practice is not always a simple yes or no. Getting a handle on this before you get treatment can save you a lot of money.

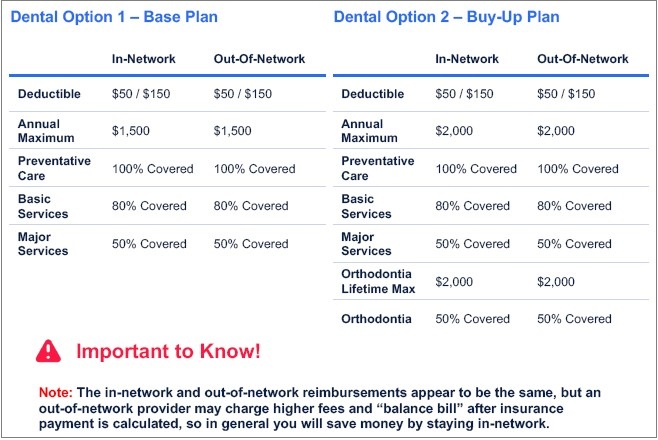

This year I’m on new dental plan and I’m still getting up to speed on all the details. I did notice this warning in the employer benefits packet, on the page summarizing dental insurance:

They are helpfully warning me that even though the same % of service costs are covered at all dentists, an out-of-network provider will charge more. That means, for example, for Basic Services, my portion will be 20% of a larger $ amount. That’s a helpful warning – I’ll make sure I stay in network.

I looked up my dental practice on Cigna’s website to check on their network status and found two dentists listed. I’m almost certain that more than two dentists work there, so that means only these two are in-network:

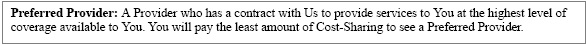

Over on the right side, I see that one dentist shows “Total – Lower benefit level may apply” and the other shows “Advantage – Higher benefit level.” Hunh. I call Cigna to get details and ask if this dental practice is a preferred provider under my policy. I asked about “preferred provider” status because that’s the actual language used in my policy documentation:

Cigna explains to me that it depends, because within a given dental practice, some dentists can be in‑network while others are out-of-network. Woah! What? I thought it was an all-or-nothing kind of situation for a group of providers that practice together.

After further discussion, I establish that where the Cigna website says “Advantage” to the right of someone’s name, that means “preferred provider” under my insurance policy. (So why doesn’t the website just say “preferred”?) Also, there are dentists with “Tier 2” rates. Or, as one Cigna rep described it, “in-network but not fully in-network.” (omg, when did Cigna hire George Orwell?) Tier 2 dentists are in-network but bill at different contracted rates than the Advantage dentists, and Tier 2 dentists are listed as “Total” on the Cigna website. The phrase “Tier 2” does not appear in my policy document, but I suppose it maps to “Participating Provider.” (Why is this a secret?) I have now learned that within a given dental practice, some in-network dentists can bill at lower rates than other in-network dentists for the exact same procedure code. My dentist’s office never informed me of this, it is not discussed on my explanation of benefits document, not discussed in the employer benefits packet…the only way to learn about it from reading documents is by reading the “Definitions” section of my policy document. It states: “You will pay higher Cost-Sharing to see a Participating Provider as compared to a Preferred Provider, but less than if you received Covered Services from Non-Participating Provider.” 😡

So, it looks like the dental practice I’ve been going to has one dentist who bills at Cigna’s contracted Advantage rates, one who bills at contracted Tier 2 rates, and other dentists that are out-of-network (not listed on Cigna’s website at all) where Cigna doesn’t know their rates because they have no negotiated contract with Cigna. Previously, I was happy to have an appointment with any of the dentists at this practice, but now I may need to be more careful.

Well, ok, at least the Cigna website is going to give me some helpful info to decide how big a deal this is, right? I can just click on “View procedures and cost information” next to a dentist’s name. Here’s what I got when I did that for each of the two listed dentists at the practice I’ve been going to:

What a fool I was to think it could be so easy. Cigna has signed contracts with each of these dentists that hammer out specific service costs, but for me, a patient looking at Cigna’s website, “Cost not available.” 😡

This is not just a dental insurance issue – recently my cousin went to a doctor’s office where he had an appointment with an in-network doctor. When he arrived for the appointment, the receptionist said that doctor was no longer available to see him, but a different doctor in the practice would see him instead. Ok. Then my cousin got a huge bill, because the doctor who saw him was out-of-network. 😡

From a cursory internet search, I see this issue of in-network status being complicated is not at all a new problem – here’s a 2015 article from NPR discussing how one women verified that a specific surgeon was in-network on her insurance, only to find out from a bill using out-of-network rates that this surgeon belonged to two different medical groups: one was in-network and the other was not. Network status can relate to both the location and the specific medical provider. 😡

The next time someone says that we need people to be smart healthcare consumers who are incentivized to price shop and help control costs, that we need people to have skin in the game…please, for my sake, tell them to go pound sand.

-Stephanie

2 replies on “The Boring Newsletter, 7/20/2025”

[…] Last week I wrote about learning that only one dentist in this practice is in-network for my current insurance, and since a different dentist did my routine exam last spring, that explains why I was billed much more than the in-network rate: $575 billed vs the in-network rate of $244 for a routine exam and cleaning. My insurance covered $475 of the amount billed and while my explanation of benefits (“EOB”) shows I owe $100. The dental practice never billed me for that $100. Hmm… […]

LikeLike

[…] Last month I also wrote about how dental insurance has in-network and out-of-network dentists, but not all in-network dentists are the same when it comes to pricing. This impacts how much of your annual coverage is used up with each dental visit. I also wrote about how out-of-network dentists may tell you “yes, we take your insurance,” and this also impacts the amount of your annual coverage limit that is eaten up with each dental visit. […]

LikeLike