Your Dental Insurance Has an Annual Max: Get the Most Out of It

Hi Friendos,

This week I am here with two ideas to help you get the most out of dental insurance. Both involve understanding your annual coverage limit, assuming your policy has one.

In the last 10+ years, I’ve had dental insurance from Delta Dental and Cigna, two of the largest players in the space. I’ve been on employer-provided group plans this whole time, and always had an annual max on how much the policies would pay out, regardless of actual medical need.

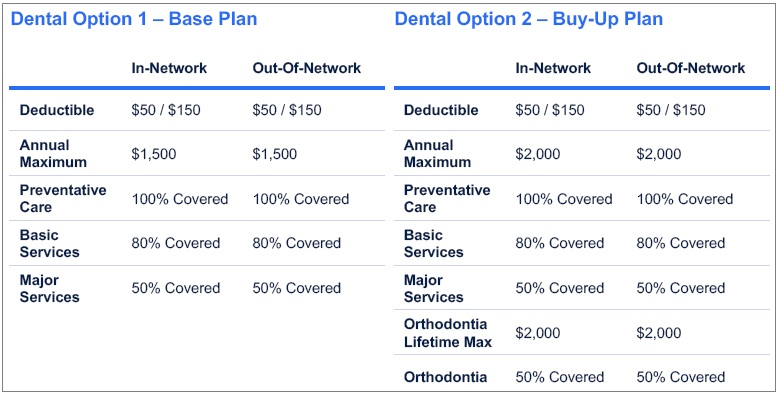

Last fall during open enrollment, we reviewed the benefits presentation from my spouse’s HR department. Here is how it summarizes the two available dental plans – we selected option 2 with the $2,000 annual max:

Each year, I can have up to $2,000 of “covered” dental work paid for by the policy and so can my husband. He is paying for this out of payroll deductions which will total $256.08 for the year. He would have paid $222 for the “base plan” that only offered $1,500 of coverage for each of us, so by paying an additional $34.08 of premiums, we each get up to $500 additional coverage. Looking back over the last 3 years, in 2 of them one or both of us hit the annual max coverage limit, so the buy-up plan was a no-brainer.

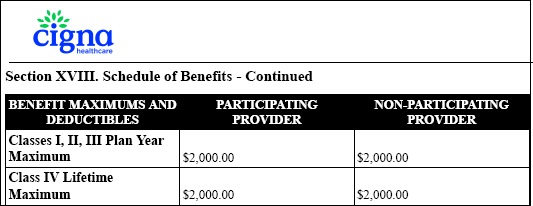

Here’s how our policy contract summarizes the $2,000 limit:

Hmm, ok, what are these Classes? An insurance policy is a contract and, as is customary for contracts, capitalized terms are defined and the contract will spell things out. The policy section on “Covered Services” explains in a couple pages that Class I includes your basic semi-annual check-up type of stuff and other diagnostic and preventative services. Class II is “Basic Restorations, Periodontics, Endodontics, Oral Surgery, and Prosthodontic Maintenance,” Class III is “Major Restorations, Dentures and Bridgework,” and Class IV is “Orthodontics.”

Since I’m not going to need orthodontics, I can see that all the dental services I’ll need, if they are covered, will fall under Class I, II, or III, and therefore I’ll have $2k to work with for the year. Now I’ve connected the annual max in the employer document to the actual policy document that governs things.

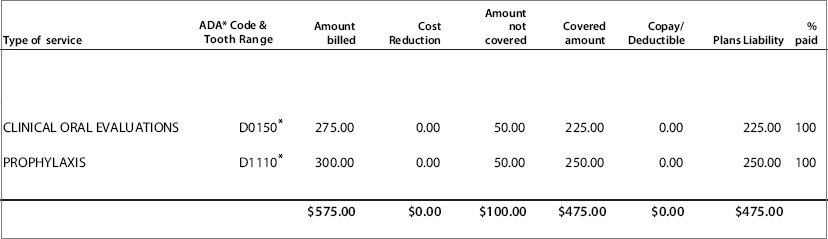

Each time I visit the dentist, including for regular cleanings, I am using a portion of this $2k. Some snips from the Explanation of Benefits for my last teeth cleaning make this clear:

I went to the dentist and got an exam from the dentist (clinical oral evaluation) and a teeth cleaning (prophylaxis). For those two things, the dentist billed $575. Cigna only covered $475 of it and paid the dentist that amount. Therefore, I have used up $475 of my $2,000 allowance for the year. If the dentist takes x-rays, that also gets charged against my $2,000. My last x-rays, in September 2024, used up $300 of my insurance coverage.

I like my dentist a lot. I think she’s a good dentist and I’ve recommended her practice to lots of people over the years. Over a decade ago, at an early morning appointment, she gave me the business over flossing and her stern words are what got me to start doing it every day – thank you! That said, every time I go there, the dental tech says “ok, now I’ll take x-rays” and every time I have to say that unless the dentist thinks it is medically necessary, I do not want x-rays unless it has been more than 2 years since my last ones. “Oh, it’s covered by insurance.” “I know, but I don’t want them so soon unless the dentist says it’s medically necessary.” Argh, I do not want to be in a fight with the technician.

The American Dental Association concluded, in a 2012 joint report with the FDA, that for adults without oral disease, “a radiographic examination consisting of posterior bitewings is recommended at intervals of 24 to 36 months.” (Higher frequency is recommended for people who are prone to cavities or have other risk factors.) For my personal dental situation, this means I can have my x-ray frequency at every 2-3 years without worry.

So, my first tip to maximize your annual dental coverage is: only get x-rays when you need them based on clinical evaluation. Unnecessary x-rays will eat up coverage you might need for other dental work. Don’t be afraid to ask your dentist: “Can you explain the medical reason for me to have x-rays at this time?” or “Is this frequency of x-rays consistent with ADA guidelines?”

My second tip is: adjust your semi-annual cleanings and exams so you have an exam in the last month of your plan year. This way, if you need follow up work and have already maxed your coverage for the year, you can wait just a couple weeks and do the follow up work within the next plan year.

Example: your plan year runs from January to December, so you decide to have your teeth cleaned in June and December. Let’s say you were unlucky enough to need some extra work done at your June appointment, so the June appointment used up $1,200 of coverage. Your December exam and cleaning will use another $400, leaving you only $400 before you hit your $2,000 annual max. If your December exam reveals 2 cavities you need filled, at a cost of $300 each, you could schedule an appointment for January so insurance will cover the full $600 (assuming it is medically ok to wait a few weeks). Or have them do one cavity in December and the other one in January. Fingers crossed that next year you’ll only need regular cleanings.

-Stephanie

p.s. Next Saturday, please drop in for “Tax Me Anything,” a free Zoom session I host on the second Saturday of every month, 11am-noon ET. The Zoom meeting ID is 897 1710 3456. Hope to see you there.

2 replies on “The Boring Newsletter, 7/6/2025 🦷 🪥”

[…] top of my second cleaning for the year would definitely put my over $2,000 annual max (discussed in this prior article) and I’ll have to pay out of pocket. I’ve done that before, in multiple years. If I’d only […]

LikeLike

[…] limit that caps the amount the insurance company will pay for in any given year (I wrote about that here), so if you can get your routine cleanings to use up less of your annual allotment, that leaves […]

LikeLike