Hi Friendos,

Today I am going to share a little tax “trick” that could help some people avoid an underpayment penalty if they did not make quarterly estimated payments on schedule. Maybe it will help you out.

The scenario: You received some income where taxes were not withheld, like self-employment income or interest income. You didn’t pay quarterly estimated taxes because you didn’t know you were supposed to do that or maybe you forgot. When you realized what happened and that you missed the deadline, you learned that you might be hit with a penalty for underpayment of taxes. That is a profoundly un-fun use of money.

The solution: If you have W-2 income or other income that is still coming your way later in that same calendar year, you can adjust the tax withholding to include the estimated tax payments you forgot to make. This will work!

Example: You received $20k of self-employment income in the first quarter of this year. You should have made a quarterly estimated payment to cover federal income tax and self-employment tax on that income.

- For self-employment taxes, that would be $2,826 (=$20k * 92.35% * 15.3%) if you want to pay the full amount owed (not merely the minimum required to avoid a penalty) so you don’t owe a huge amount you file your tax return next April.

- Your other source of income is $40k from your W-2 job and your filing status is Single, therefore your effective tax rate should be ~7.5% for the year. (I explain the calculation for effective tax rate in this earlier newsletter.) So you also should have sent in ~$1,500 for federal income taxes (=$20k * 7.5%), for a total quarterly estimated payment of ~$4,326.

But this was the first time you ever had self-employment income and you didn’t know about estimated tax payments. It especially stings because the whole reason you started doing self-employment work is because you used to have two W-2 jobs but lost one of them. Now you have all this extra tax stuff to deal with, you still aren’t making nearly as much as last year, and you’re facing a penalty for underpayment of taxes. UGH!

I can’t help that you need to pay the more than $4k in taxes related to your self-employment income, but this trick helps you avoid the underpayment penalty, which might be ~$275 in this scenario (this page has IRS interest rates, currently at 7% for individuals).

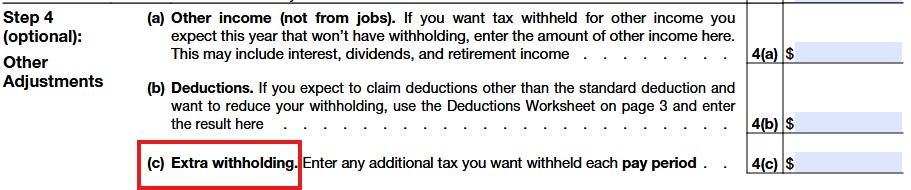

At your W-2 job, you submit a revised Form W-4 – just check out the section for Other Adjustments:

Let’s say your Great Tax Realization of 2025 happens in late September. You are paid twice a month and have 6 paychecks left this calendar year. You want to have $4,326 extra withheld by year end. $4,326 divided by 6 paychecks gives us $721 extra to withhold from each pay period. Your take-home pay will be quite small, but this would be the way to guarantee no penalty and that you won’t owe much at all come next April. Other options include only withholding enough extra such that you’ll owe under $1,000 next April or have paid at least 90% of what you’ll owe for 2025, thus avoiding the underpayment penalty and giving you a bit more time to save up for a tax payment next April. Or, you can just withhold whatever extra amount you can afford, thereby reducing the penalty you’ll owe – less is better!

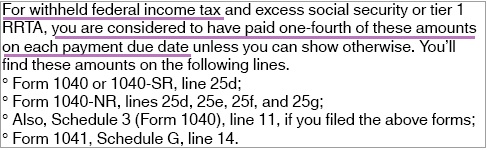

The reason this trick works is because the IRS treats any taxes paid via withholding as if they were paid evenly throughout the year – 1/4th paid by each estimated tax payment due date. The Instructions for Form 2210 (“Underpayment of Estimated Tax”) say so!

Even if your withholding was not done evenly throughout the year, that’s ok, the IRS will treat it as if it were for purposes of calculating an underpayment penalty.

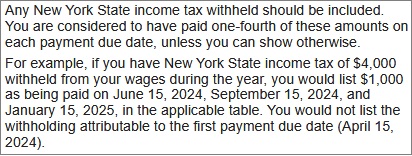

I think states follow this same approach, though I have not verified it for all the states that impose income taxes. New York state does uses this same approach, as it explains in the Instructions for its Form IT-2105.9 (“Underpayment of Estimated Tax”):

So, there you have it, my one weird trick for income taxes.

-Stephanie