Hi Friendos,

Today’s newsletter is all about IRA contributions. Back when I was in business school (20 years ago!) I gave a presentation to the Women in Business club called “Who is Roth and What is He Doing with My IRA?” I looked it over recently and was surprised at how few updates it would need to be current for 2025. Tax laws change every year but the basic architecture usually stays the same.

IRA stands for Individual Retirement Account. It’s a type of tax-advantaged account where you can hold investments. Here are some situations when you might want to open an IRA and invest money inside it:

- Your W-2 job has no retirement plan like a 401k, or it has one but you can’t enroll until you’ve worked there for a year. You still want to save for retirement and get some sweet tax breaks like a rich person. Contribute to an IRA!

- You are self-employed, don’t have a solo 401k, and don’t want to set one up. Contribute to an IRA!

- You are a super-saver and want to save more for retirement than can “fit” in your 401k. Contribute to an IRA!

- You and your spouse are a pair of super-savers; you have a 401k/403b/457 at your job that you can save into, but your spouse does not. Based on your combined gross income of $180k and your target saving rate of 15%, you want to save $27k into retirement (=$180k * 15%). You can put $23.5k into your 401k (max allowed for 2025) but need to put the other $3.5k somewhere else. Contribute to an IRA!

As you may know, IRAs come in two flavors: traditional and Roth. Traditional IRAs have been around since 1974, Roth IRAs since 1997. Financial media tend focus solely on whether a Roth IRA is a better choice than a traditional IRA, forgetting to discuss why both traditional and Roth IRAs are more wealth-building than a regular brokerage account for retirement saving. Fin tech firms never put that in their ads!

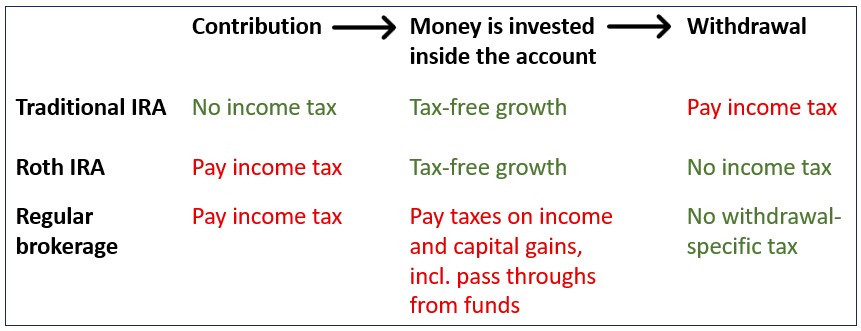

The primary tax advantage an IRA has over a regular brokerage account is that once the money is inside it, investments grow tax-free. In a regular brokerage account, you have to pay taxes on dividends and realized capital gains each year, including those that pass through to you from mutual funds and ETFs (even if you don’t sell shares of your fund, the fund can have realized capital gains on its holdings which are taxable). With a traditional IRA, you put pre-tax money into the account. With a regular brokerage account or a Roth IRA, you put after-tax money into the account. Here is how I think about all this:

Studying this chart, you can see that whichever type of account you choose, you’ll have to pay tax on your income, it’s just a question of now (at the time of contribution) vs later (at the time of withdrawal). But that middle column shows you that both types of IRA beat a regular brokerage account because they avoid “tax drag” on your investment returns. If you are saving for retirement, an IRA is better than a regular account!

Last year I wrote about why I think a traditional IRA is a better option for most people than a Roth IRA and I explained the mechanics of how someone puts “pre-tax dollars” into a traditional IRA. But! Not everyone is allowed to claim a tax deduction for a traditional IRA contribution. If your income is “too high” you get only a partial deduction or no deduction at all, in which case Roth is the way to go.

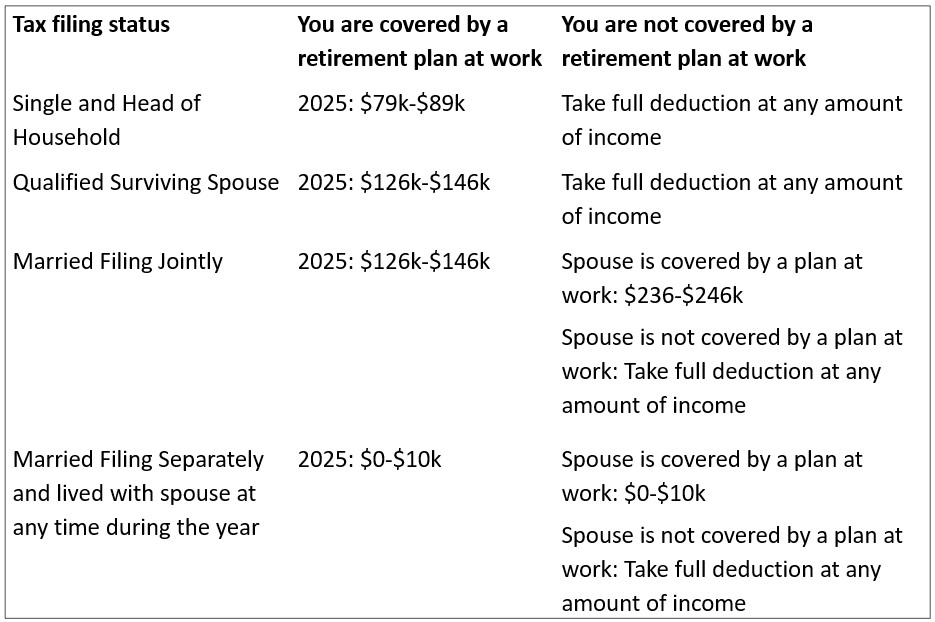

Here are the 2025 phase-out ranges for a traditional IRA tax deduction (adjusted annually by the IRS for inflation):

This means that if you are single and your income is $80k (higher than the $79k start of the phase out range), you don’t get to deduct 100% of your traditional IRA contribution. If you are single and your income is $90k, you don’t get to deduct any of your traditional contribution.

But remember! “Income” in this context is not the same as your gross salary. Federally taxable income is usually less than gross salary due to pre-tax payroll deductions like those for medical insurance, 401k contributions, and FSA/HSA contributions. Specifically, “income” here means Adjusted Gross Income (Form 1040, line 11) with certain deductions added back:

- Student loan interest deduction (Form 1040, Schedule 1, line 21)

- Excludable savings bond interest (Form 8815, line 14)

- Employer-provided adoption benefits excluded from income (Form 8839, line 28)

- Foreign earned income or housing excluded from income (Form 2555, line 45)

- Foreign housing deduction (Form 2555, line 50)

If you want to make a traditional IRA contribution but your income is too high for the deduction, then you can go with a Roth IRA contribution instead.

Roth IRA contributions have their own income limitation, but that only prevents higher earners from making a direct contribution (through the “front door”). Anyone can use a two-step process called a “back door Roth IRA” to get around this rule. I’ll write about that next week.

IRA contributions are a great way for everyone to save for retirement, regardless of income, self-employed vs W-2 job, tax filing status, or marital status. People often worry that they are choosing the “wrong” type of IRA. Please stop worrying! There are many unknowns that could end up causing Roth (or traditional) to beat traditional (or Roth) with hindsight – any retirement saving is a great decision.

If you are reading this, I am pretty sure you’ve felt some insecurity around your finances. As Astra Taylor wrote, “insecurity affects people on every rung of the economic ladder, even if its harshest edge is predictably reserved for those at the bottom.” We all can use some tools to help bolster our financial security. If you can scrape together some extra money to save for retirement, consider the stalwart IRA.

-Stephanie

2 replies on “The Boring Newsletter, 5/31/2025”

[…] now on to the “backdoor Roth.” Last week I discussed IRA contributions, and how they come in traditional and Roth flavors. But, I said, […]

LikeLike

[…] Set money aside for your future self, like by having a fully funded emergency fund and putting money into an IRA and investing it in low-cost, diversified index funds. I wrote about emergency funds here and about IRA’s (individual retirement accounts) here. […]

LikeLike