Hi Friendos,

You’ve seen lots of discussion about people with subscriptions to streaming services they don’t use. Yesterday I saw a headline about people’s newsletter subscriptions getting out of hand, focused specifically on Substack. I just started using Substack for this newsletter! I was legally required to read the article. The reporter interviewed dozens of people:

“It can be difficult to keep track of how many newsletters they’ve signed up for and how much they’re paying for them.”

“[M]any said they did not know exactly how many newsletters they were paying for or even how to check, save some tedious bank statement forensics.” (emphasis added)

Every time I see things like this, I (very ungenerously) think, seriously? Since when is reviewing a handful of your own account statements a “tedious” “forensic” analysis? But…people use, and often pay for, services and apps to manage their services and apps. Financial writers discuss and rank these services and I’m sure those articles are very popular. How did we get here?

I thought about the specific steps involved for someone to review their paid subscriptions. I imagined someone younger than me whose primary tool is their smartphone. They might start by opening the app for their checking account. Their account balance would be clearly displayed, but the screen showing transactions probably has a lot going on (mine does). The info might be abbreviated from what is shown on the formal monthly statement. It might be in reverse chronological order, which for me is harder to review since that is the opposite of how I think about my spending over a period of time. There might be line wraps that make it hard to scan down the page…barrier after barrier standing between a person and their transaction data. The smartphone app is optimal for a few things (hello mobile check deposit) but not so supportive of this type of transaction review. And if someone has to struggle through multiple apps to review multiple accounts, I can see why they might appreciate an outside subscription review service, even though that puts yet another layer between them and their own transaction data.

I don’t struggle with out-of-control subscriptions and perhaps I owe credit to my old-school system for account management. If I wanted to review my subscriptions, I’d fire up my laptop and open the monthly statement pdfs for the joint checking account that I have with my spouse, my solo checking account, and the 4 credit cards that I currently use (I rotate through cards for travel rewards). All 6 monthly statements would be fast to open because when I get an email saying I have a new account statement available, my practice is to log into the website, save the statement to my laptop, and then review it. Each of my accounts has a folder on my laptop and files are named so they sort in chronological order (example: “Joint Checking Stmt – 2025.04.27.pdf”).

In April 2025, my checking account and credit card statements had 11 pages listing transactions. I think firing up the laptop, opening 6 pdfs, and reading 11 pages to identify subscription payments would take less than half an hour. Maybe 45 minutes if I had a bathroom break and then also a coffee break.

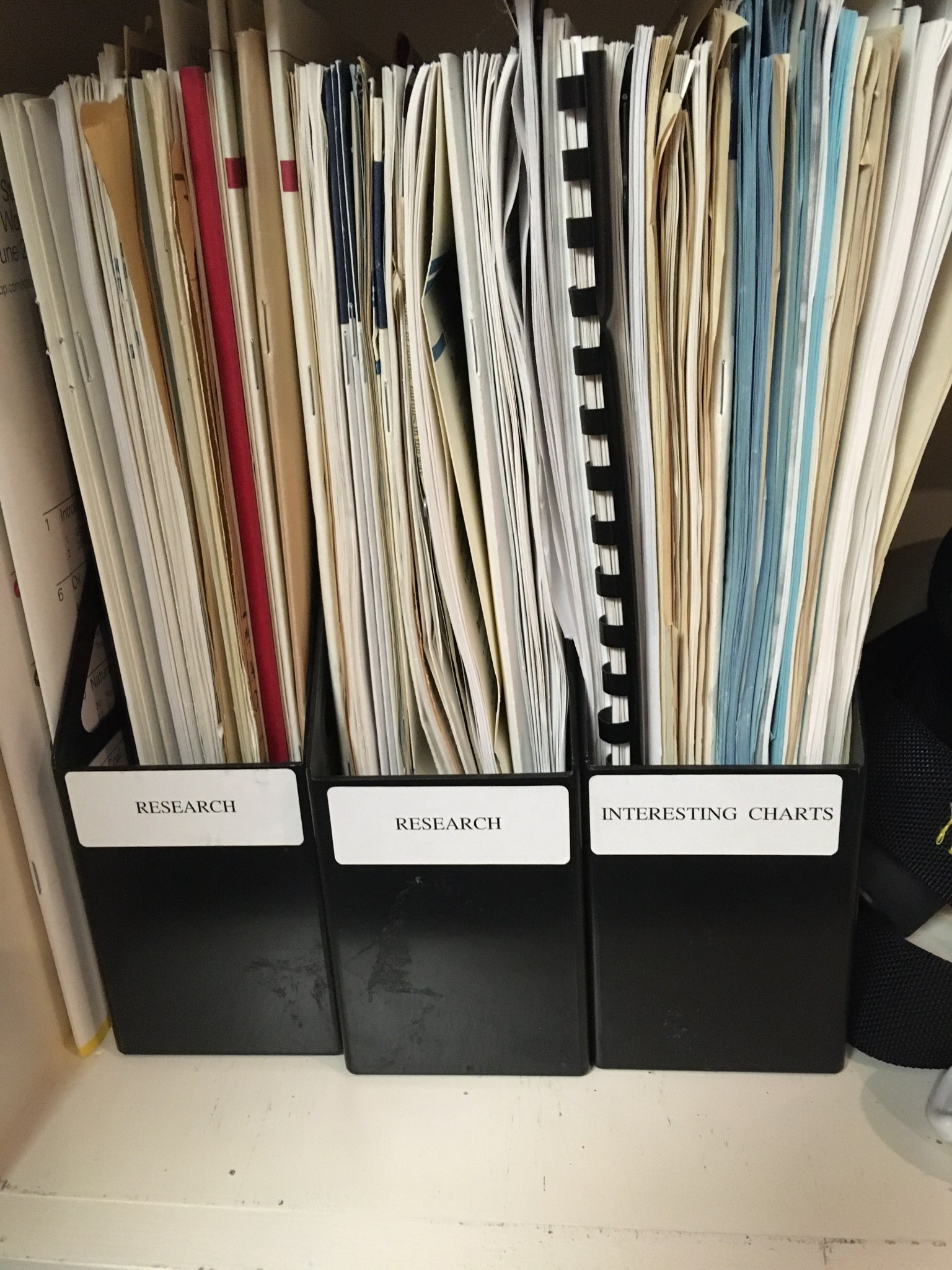

This is the same system I’ve used for many years, established in my early adulthood, before smartphones existed. In fact, my first filing system had hanging paper folders with plastic tabs to hold labels, just like my dad used for his paper files. He was a macroeconomist and had files for each of his personal financial accounts and also for various topics within his macroeconomic research.

He also had the equivalent of a filing system junk drawer!

So naturally when I started out on my own as an adult, I organized my own paper filing system. Throughout the early 2000’s, when each of my various accounts introduced online bill pay and paperless statements, it was an easy transition from paper files in my desk drawer to electronic files on my computer. One-to-one, paper file folder became electronic file folder.

Smartphone apps complement account websites but do not replace them. Access to account websites is essential these days, but a smartphone is not required for expert money management. Similarly, ads for firms like Public critique “clunky, outdated platform[s]” for investing when in fact a smart retail investor will only occasionally need to interact with their investment account website. Slick websites and investing apps encourage unhelpful behaviors like excessive trading and trading at the wrong times. Nobody advertises boring.

Thinking about people who struggle to review their own transaction histories, I wonder if I am lucky that my own habits were formed before smartphones. I started out by receiving a monthly account statement in the mail and having it already printed, right there in my hands, encouraged me to look at each page. When paperless statements came along, I was already in the habit of looking over each transaction. This prompts helpful thoughts like, “I am not using that subscription any more, I should cancel it,” or “I paid for that medical expense out of pocket, I should submit for FSA reimbursement.”

Sometimes new tech is not as helpful as old tech.

-Stephanie

p.s. Have you seen the “Solid Gold” exhibit at the Brooklyn Museum? It’s only $17 with NYC Culture Pass and on display until July 6th. I saw it in February and have thought of it many times since. What else in the world is sacred and profane, special and ubiquitous, classy and crass, ancient and modern? This exhibit is epic! On the way there, you could listen to my all-time favorite episode of “Planet Money” (from November 2010!) that examines the entire periodic table of elements and explains why only gold can be “gold.”