Hi Friendos,

Today I have homeowner’s insurance on my mind. That’s because I recently did a comprehensive review of my condo building’s insurance after I became our Treasurer earlier this year. In a multi-family condo building like mine, the common elements of the building, like the roof, are covered by the condo’s commercial insurance, and the private elements, like kitchen cabinets, are covered by the unit owner’s insurance. My own policy provides “walls in” coverage that pays for damage to my drywall and everything inside the walls of my unit, while the condo policy covers everything else, like the plumbing inside the walls, the interior stairwell, the basement, and the exterior envelope of the building. The one exception is my water heater that sits in the basement – although it sits in a common area of the building, it belongs to me and my spouse, and therefore is covered by our homeowner’s policy.

This insurance review was pretty tedious but I am so happy to have gone through the process. Earlier this year, we had no flood coverage at all. Is that a good idea? Take a look at this a photo from a 2023 rainstorm taken less than half a mile from me:

Flooding was on my mind, as was possible root intrusion or other things that would damage our water and sewer service lines (in NYC, homeowners are responsible for those pipes that connect to the city main lines). I also wanted to ensure we had enough coverage for a full cleanup after any sewer backups into the basement. Public service announcement: there is no such thing as a “flushable” baby wipe. No, it really doesn’t matter what it says on the package.

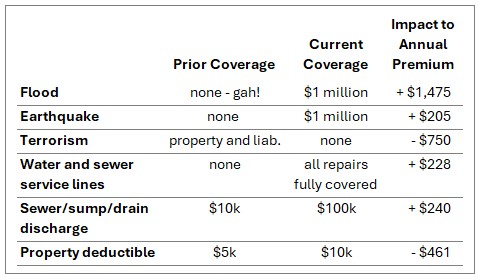

Here are the primary changes to my condo’s coverage:

I was not too worried that our building would be damaged by a terrorism event, and even less worried we would somehow have liability exposure from such an event, so we dropped that coverage. We added flood, earthquake, and sewer service line overage, increased coverage for sewer backups into the basement, and decided we could increase some of our deductibles. On net, we ended up slightly reducing our annual premiums, which was not the goal but was a nice byproduct of the process.

If it’s been a while since you reviewed your homeowner’s policy, or renter’s insurance policy, I suggest taking a look. Maybe you would like to add some coverage where you currently have gaps. Maybe you should increase your coverage limits if those have not kept up with inflation. And if you do need to increase coverage, you could perhaps also increase your deductibles to help offset the increase to premiums. But then… if you need to file a claim, be prepared to pay that deductible out of your fully funded emergency fund.

If you are enjoying wonderful weather this weekend, as I am, apologies for the thoughts of natural disasters and other unpleasant events. But also, please make sure you have the insurance you need!

-Stephanie