Hi Friendos,

March 29, 2025 was the 50th anniversary of the Earned Income Tax Credit (“EITC”). I doubt any of you reading this have ever qualified for or received this tax credit. Today I want to talk about some of the specific rules around the EITC that got me thinking about a smoldering talk by economist Joan Robinson in 1971.

In the 1960’s, economist Milton Friedman popularized the idea of a negative income tax, where low-income taxpayers would receive money from the federal government rather than paying. Richard Nixon’s “Family Assistance Plan” included a negative income tax and it became part of U.S. tax law in the form of the EITC in the Tax Reduction Act of 1975. Representatives on both sides of the aisle have supported various expansions of the EITC over the years, including those passed during the Reagan and Obama years. In dollars, the EITC is the most significant way we directly redistribute income in the U.S. today.

How big is the EITC? Overall annual spending on the EITC is $60 billion-ish. This is less than the ~$97 billion we currently spend on itemized income tax deductions for high-income taxpayers. For a different comparison, consider that the IRS says a single corporation, Microsoft, evaded $29 billion in taxes from 2004 to 2013. The judge opining on that lawsuit wrote, “the Court finds itself unable to escape the conclusion that a significant purpose, if not the sole purpose, of Microsoft’s transactions was to avoid or evade federal income tax.”

How much can an individual taxpayer receive from the EITC? On average, taxpayers receive less than $3,000. The amount you get depends on your level and types of income, parental status, marital status, and tax filing status. In 2024 the EITC tops out at $632 dollars if you have no “qualifying children” (not the same as having no children) and at $7,830 if you have three or more qualifying children. If you are not married and have no qualifying children, your credit is $0 if your adjusted gross income exceeds $18,550. If you are married and have three or more qualifying children, your credit is $0 if your income exceeds $66,800. Two qualifying kids or one instead of three? No credit if your income exceeds $62,688 (two kids) or $56,004 (one kid).

What proportion of taxpayers receive the EITC? During the 2001-2022 period, 15%-21% of tax returns received the EITC, but we also know that about 1 in 5 taxpayers who qualify for the credit do not claim or receive it. Why don’t they claim the credit? Have YOU ever reviewed the rules?

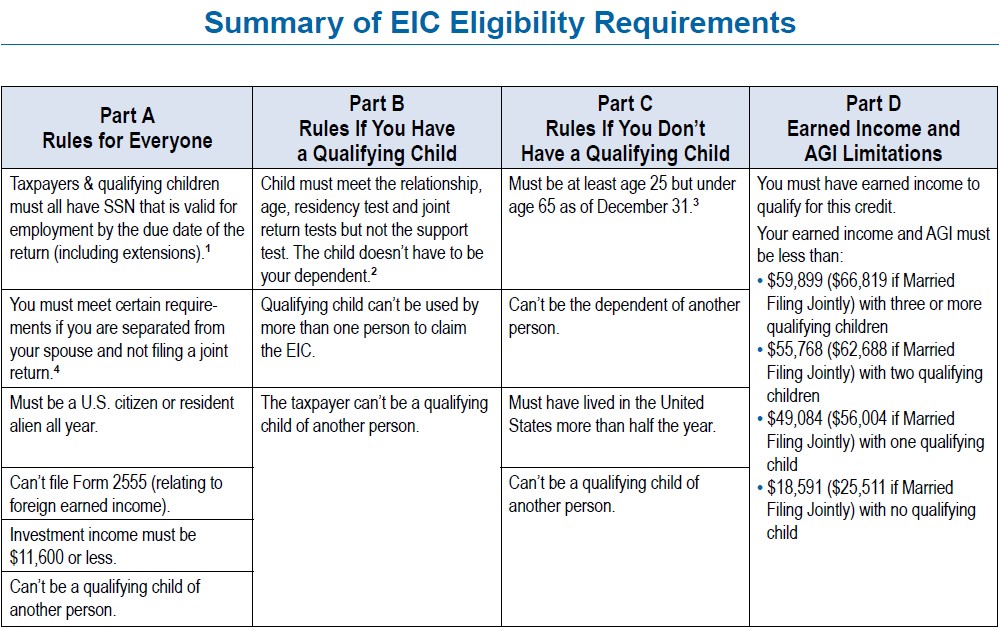

IRS Publication 4012, summarizes EITC eligibility requirements:

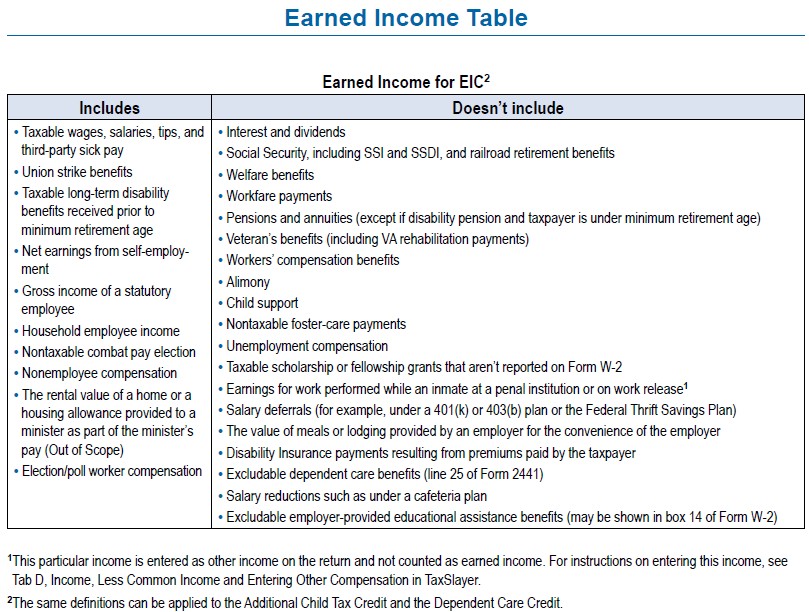

Does your income qualify? It’s simple just check the table:

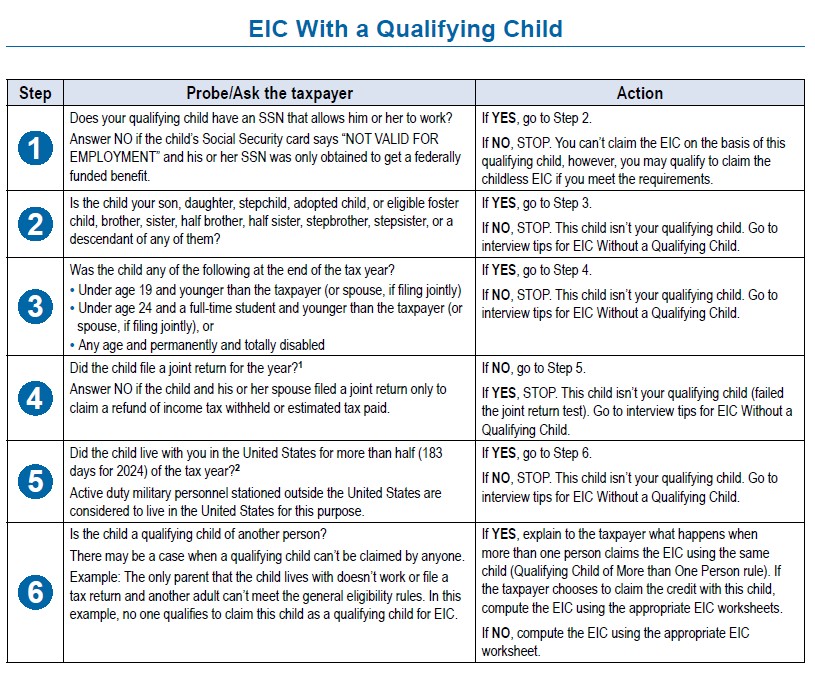

Does your child qualify? No problem, we just need to run through a 6-part questionnaire!

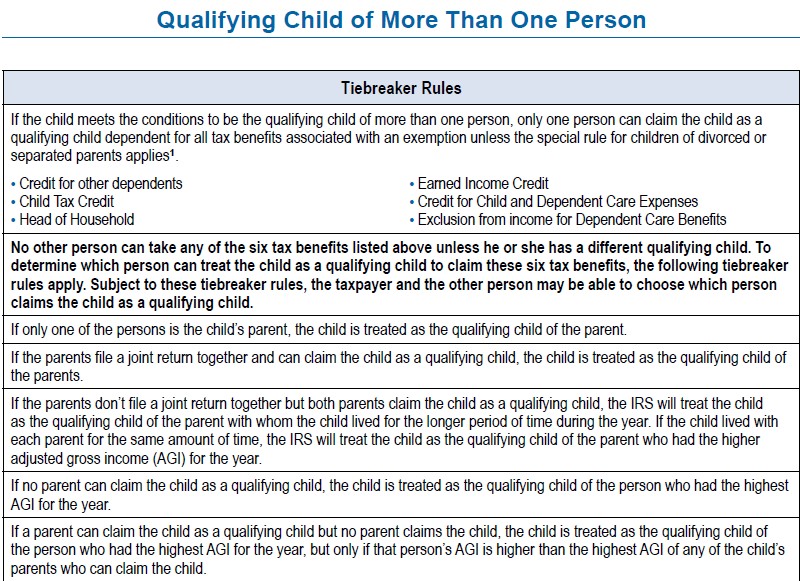

Take a look at number 5. What if a child lived with one or more adult? Oh, you should check out the tiebreaker rules!

If you are married but separated from your spouse, that has special considerations. Children adopted partway through the year have special considerations. Someone can be a parent and themselves be the qualifying child of another taxpayer. Oh, you or your spouse is in the U.S. on a visa? No problem, just use the decision tree to figure out if you are a Resident Alien for tax purposes! But don’t forget that “Nonresident students from Barbados and Jamaica, as well as trainees from Jamaica, may qualify for an election to be treated as a U.S. Resident for tax purposes under their tax treaty provisions with the U.S.”

Ok, so you ran the gauntlet of administrative burden and got your Earned Income Tax Credit! Woohoo, you paid negative income tax! Oh…no, that is only true if we pretend that Social Security and Medicare taxes don’t exist. And of course, low-income people die earlier than high-income people, so they don’t get as much federal support from those programs in their old age. Ok, ok, but it’s something, right?

We have a problem of EITC complexity because we distinguish between “deserving” and “undeserving” people. If you engage in paid work outside the home, you are more deserving. If you can certify your physical disabilities and you receive disability pay before age 65, you are more deserving. If your child lives with you, you are also more deserving. If you are between the ages of 25 and 65, you too are more deserving. If your income is from workers’ compensation because you were previously injured while working, you are less deserving. If your income is from nontaxable foster care payments, you are also less deserving.

What is government support for? Who is it for? Why? Who gets to decide?

In her 1971 “Distinguished Lecture” at the American Economic Association, Joan Robinson discussed “the famous marginal productivity theory” (emphasis added):

“In perfect competition…the real wage of each type of labor is believed to measure its marginal product to society. The salary of a professor of economics [measures] his contribution to society and the wage of [a] garbage collector measures his contribution. Of course, this is a very comforting doctrine for professors of economics, but I fear that once more the argument is circular. There is not any measure of marginal products except the wages themselves.

In short, we [economists] have not got a theory of distribution. We have nothing to say on the subject which above all others occupies the minds of the people whom economics is supposed to enlighten.

…Everyone can see that his relative earnings depend on the bargaining power of the group that he belongs to. The professors become quite nervous when they are discussing the earnings of the garbage collectors.”

Here in 2025, I don’t think economic orthodoxy can offer us any more than it could in 1971. The U.S. tax policy that I know, shaped by many economic thinkers, has features like the following:

- Subsidized retirement income for the wealthy, who can afford to save in tax-advantaged investing accounts, when they would have invested anyway.

- Preferential tax treatment for income from capital vs income from labor, even though we need both capital and labor.

- Some people get subsidized medical expenses (HSAs and FSAs) if their employer offers it, while others are out of luck.

- Subsidized housing for the rich (mortgage interest deduction), with larger subsidies for owning multiple homes and more expensive homes, when they would have purchased those homes anyway.

- Subsidized college and K-12 private school for the rich (529 accounts) when they would have paid for that schooling anyway.

There’s going to be a lot of tax talk this year, and surely some changes to tax code. I’m hoping for the best but expecting the worst. I’ll end with one more quote from Robinson’s 1971 talk that feels so fresh to me right now:

“A sure sign of a crisis is the prevalence of cranks. …The cranks and critics flourish because the orthodox economists have neglected the great problems that everyone else feels to be urgent and menacing.”

-Stephanie