Hi Friendos,

Today’s newsletter is about a pretty boring topic: helpful info available at your IRS.gov account. Will that continue to exist in the future? Ha ha, I have no clue! Oh no really…I’m fine. But for now…here it is…my favorite new part of the IRS website: the Transcripts page.

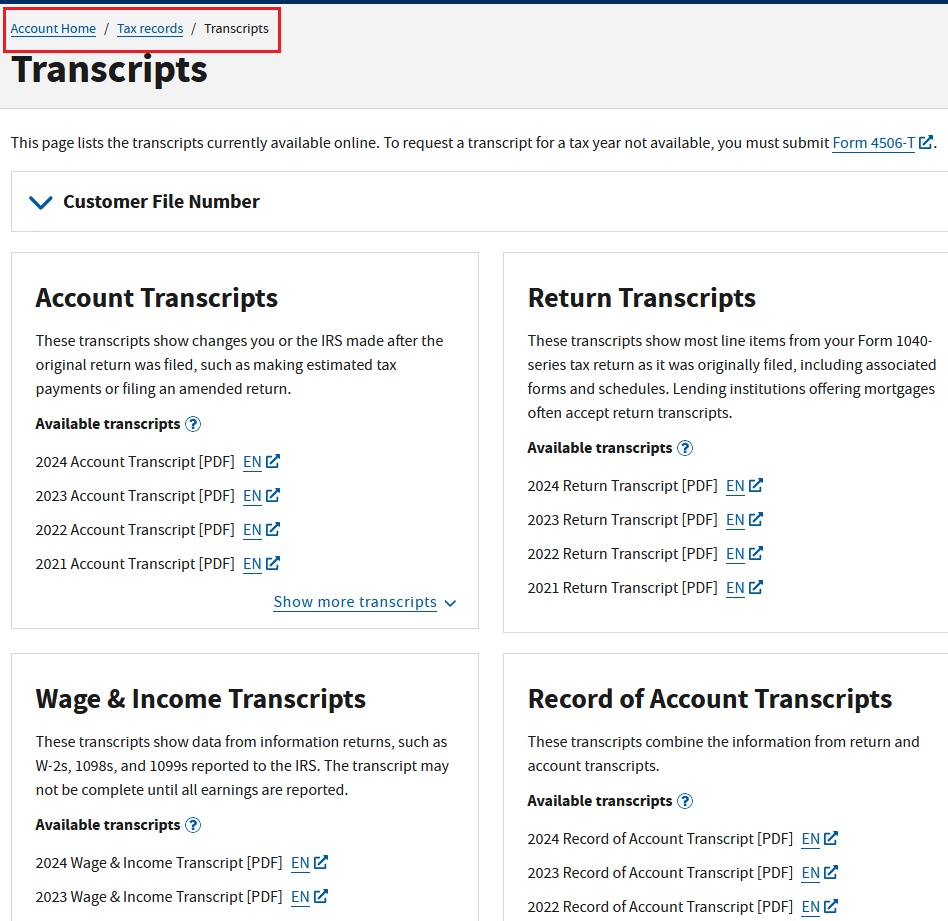

You can pull, at no cost:

- Wage and income transcripts – copies of forms provided to the IRS with your wages and income, like W-2s and 1099s,

- Tax return transcripts – like an electronic copy of your tax return,

- Account transcripts – has transactions and activity from after a tax return was filed, like estimated tax payments or filing an amended return, and

- Record of account transcripts – a combo of tax return transcripts and account transcripts, nice because it shows the full picture for each tax year.

There are other helpful parts of your IRS account you can check out too, like the “Payment Activity” section.

Here are some scenarios I have in mind:

- You are hiring a tax preparer (me? I am still accepting clients for this tax season!) and want to make sure they get copies of all the tax documents you received. You think you gathered everything, but are a little worried about missing something. For this tax season, by March 30th your wage and income transcript should reflect all the items the IRS has received. Note: for married taxpayers, each spouse needs to pull their own wage and income transcript as the info is compiled by Social Security number.

- You can’t remember if the estimate tax payment you made in January was last year’s Q4 payment, or this year’s Q1 payment. Your payment history will tell you what the IRS thinks, based on the tax year you selected when you made the payment.

- Your tax preparer asks for a copy of your tax return from last year, but you just can’t locate it. No problem, just pull a copy of your tax return transcript and send that over!

- You are applying for a loan and they want proof of your prior income – send over a tax return transcript.

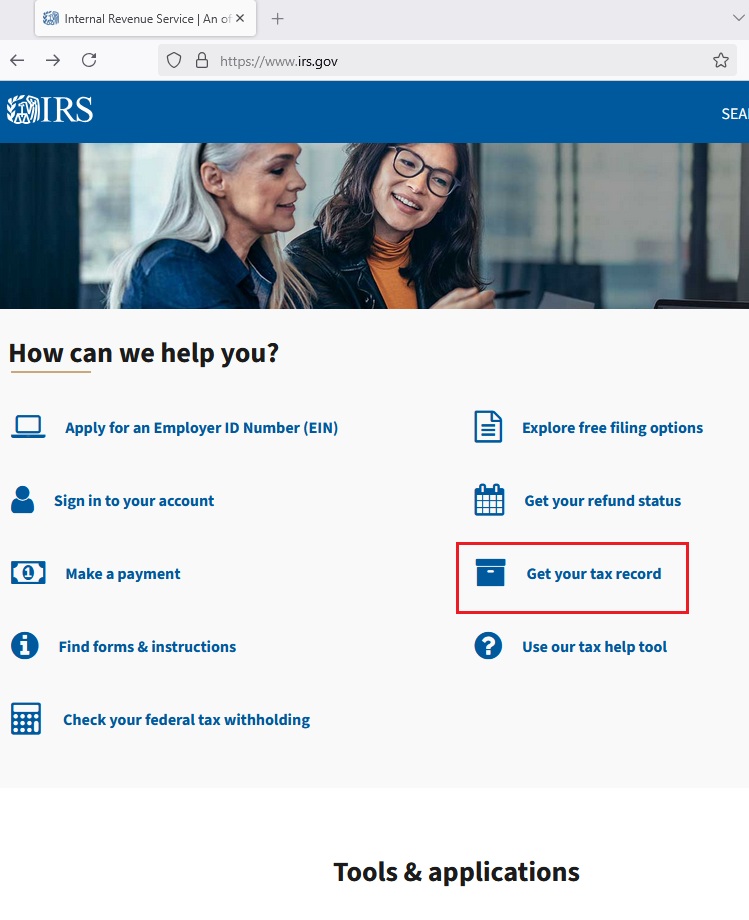

An IRS account is very helpful! Here’s what it looks like if you want to log in and pull one a transcript, starting at https://www.IRS.gov. You are presented with the following, and you want to get your tax record:

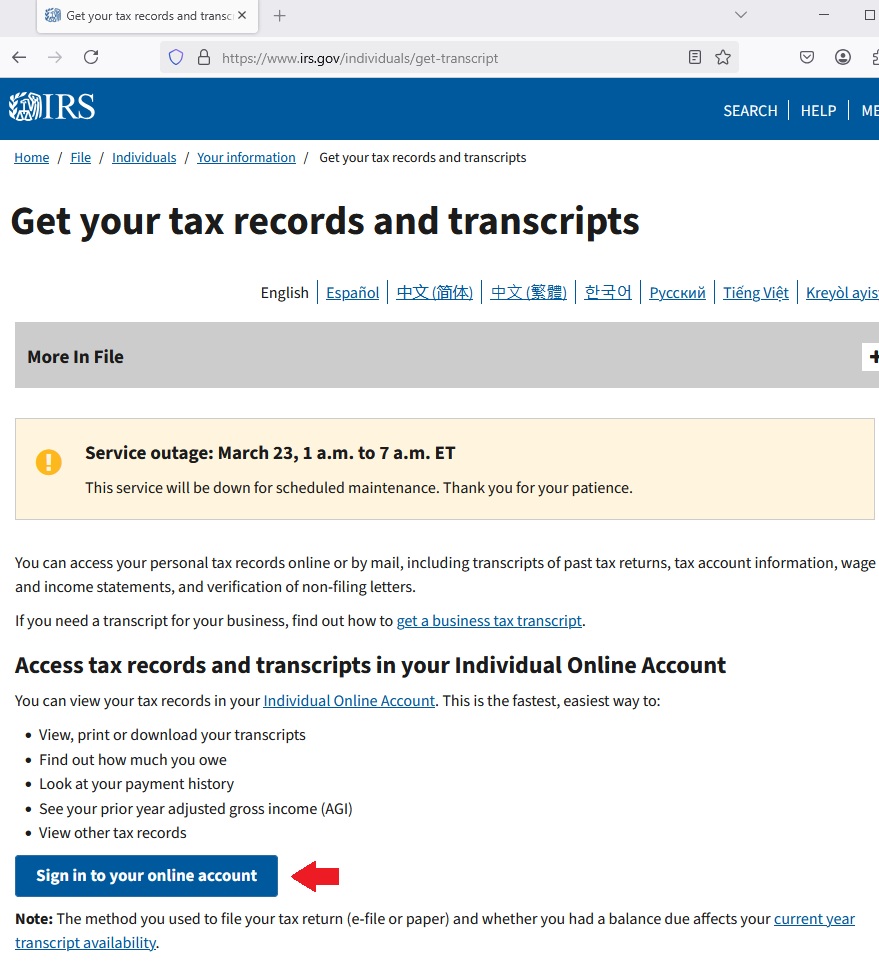

You click that and will be prompted to sign in:

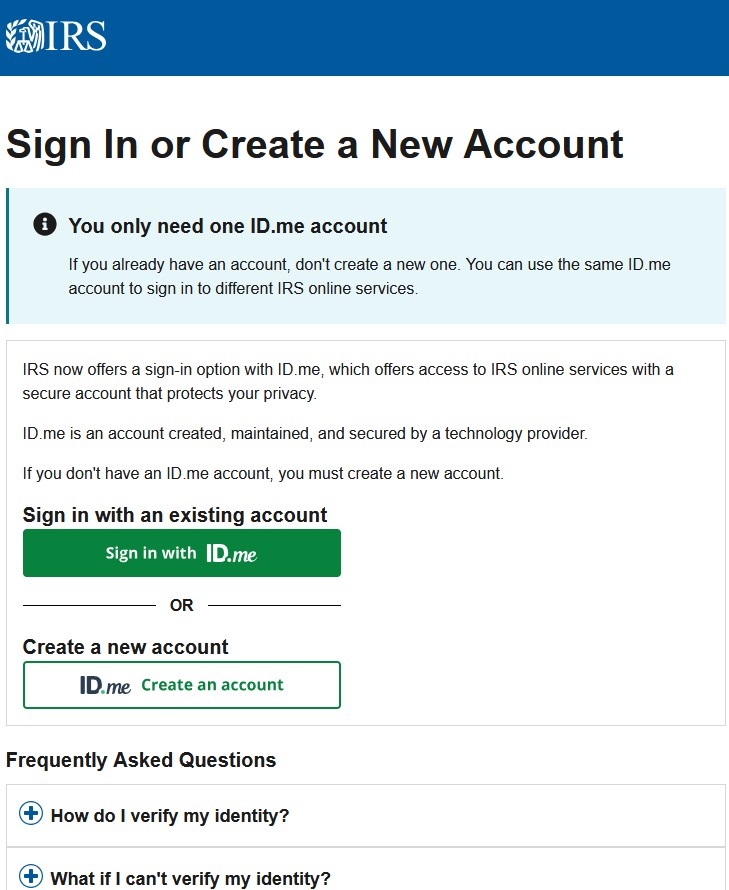

Now you use ID.me to sign in:

And after that, you’ll be at the page for transcripts!

Pretty easy. If you had never heard of this before, now you know.

-Stephanie