Hi Friendos,

Today I am discussing tax gain harvesting, the less-famous buddy of tax loss harvesting that some people do with their investments. This technique only applies to regular brokerage accounts, not retirement accounts like a 401K or an IRA.

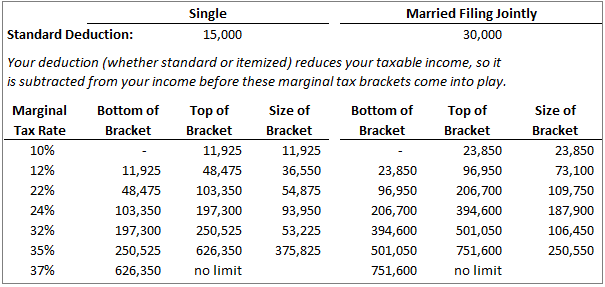

To understand and implement this technique, you must fully absorb how taxes on capital gains are calculated. Most people, if they are familiar with capital gains taxes at all, think they are taxed at a 15% rate. That’s correct…sometimes. Short-term capital gains, on investments held less than a year, are taxed as ordinary income, so at the same tax rate that a person pays on their W-2 income, Social Security benefits, distributions from traditional IRAs, or any other sources of “regular” income. In 2025, these brackets look like this:

How to read this chart? Meet Low-Paid Larry.

Example #1: Larry is single and earns $30k in gross salary at a W‑2 job. At the end of the year, his federally taxable income shown on his W-2 is only $25k because of payroll deductions for medical insurance and the like. He takes the standard deduction of $15k, so only has to pay federal income tax on $10k of income. All of his $10k in taxable income fits into the 10% bracket, so he pays $1,000 of federal income tax (on top of his Social Security and Medicare taxes, of course).

Larry has an investment that he bought in January for $1,000. Maybe he got the money from a friend, maybe he found it on the side of the road. Don’t be so suspicious! By December the investment was worth $1,500 – wow, a 50% gain! Larry decided to sell and use the gains to take his girlfriend to a Beyonce concert because his girlfriend is amazing and so is Beyonce. Larry has a $500 short-term capital gain, taxed as ordinary income, because he held the investment for under a year. Therefore, since Larry is in the 10% tax bracket, he should set aside 10% of that, $50, for federal income taxes and can spend up to $450 on the tickets.

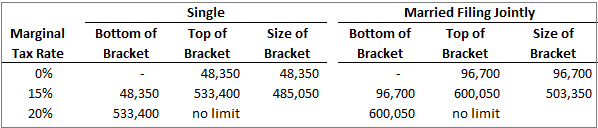

Example #2: What if Larry had owned that investment for more than a year? That would be a long-term capital gain and we have a separate set of tax brackets that apply. In 2025 they look like this:

To figure the tax on Low-Paid Larry’s long-term capital gain, we first take the $10k of income on which he has to pay federal income tax, and add to it the amount of long-term capital gains, $500. The resulting $10,500 falls entirely in the 0% bracket, so Larry owes no tax on his $500 of long-term capital gains. In fact, Larry could have up to $38,350 of long-term capital gains and owe no tax on them because they would all fit in the 0% bracket. If you are lower income, you can have long-term capital gains and owe no income tax at all!

Example #3: It turns out that Low-Paid Larry only has temporarily low income because he cut back his hours to help care for his niece while she is still a toddler – what a mensch. Larry didn’t want to brag, but he has an enviable brokerage account that he regularly invested into before the kid was born. Larry reads this newsletter and decides that for the next 2 years, while he’s still on childcare-duty and before he ups his working hours and earns more income, he will capital gains tax harvest while he’s still in that 0% bracket for long-term capital gains.

Each year, Larry calculates the difference between the top of the 0% bracket (it changes a bit each year with inflation) and his W-2 taxable income. He carefully selects appreciated investments that have capital gains of that amount and sells them, harvesting their gains and filling up that 0% bracket. Larry doesn’t want to actually take $ out of the market entirely though, so what he does is sell the appreciated investments and then the next day, buys them right back. There is no wash-sale rule for tax gains harvesting like there is for tax loss harvesting, if you were wondering about that. Larry has reset his cost basis to a higher level and when he does want to sell for good in the future, he’ll only owe tax on capital gains from this now-higher level. Amazing, Larry!

Maybe you’ll have years when you fall into the 0% bracket – take advantage of it and harvest your gains. Like investing into tax-advantaged retirement accounts, there will be a limit on how much you can do each year, so if you miss harvesting one year, you can’t get it back. I recommend checking for gains harvesting annually in early December. By that time of year, you’ll have a solid idea of that year’s ordinary income, including taxable dividends and interest paid year to date and potentially in December itself, but you won’t quite be swept up in year-end activities.

-Stephanie

2 replies on “The Boring Newsletter, 3/16/2025”

[…] be a couple of trades for tax loss harvesting (cousin of tax gain harvesting that I wrote about last month). In general, when you sell investments at a loss, you can offset that loss against realized gains […]

LikeLike

[…] tax gain harvesting and tax optimization with charitable […]

LikeLike