Hi Friendos,

Anton Chekhov said, “Only entropy is easy.”

That’s right. It’s easy for things to get messy and effortful to put them in order. It’s easy to have 4 different retirement accounts from 4 different jobs. Oh and you opened one account when you started working with a financial advisor, but kept some money in the old account. You opened one account to get some free shares of stock. You liked the looks of a roboadvisor offering, so you opened an account. If you are married and both engage in paid labor, double that number of accounts.

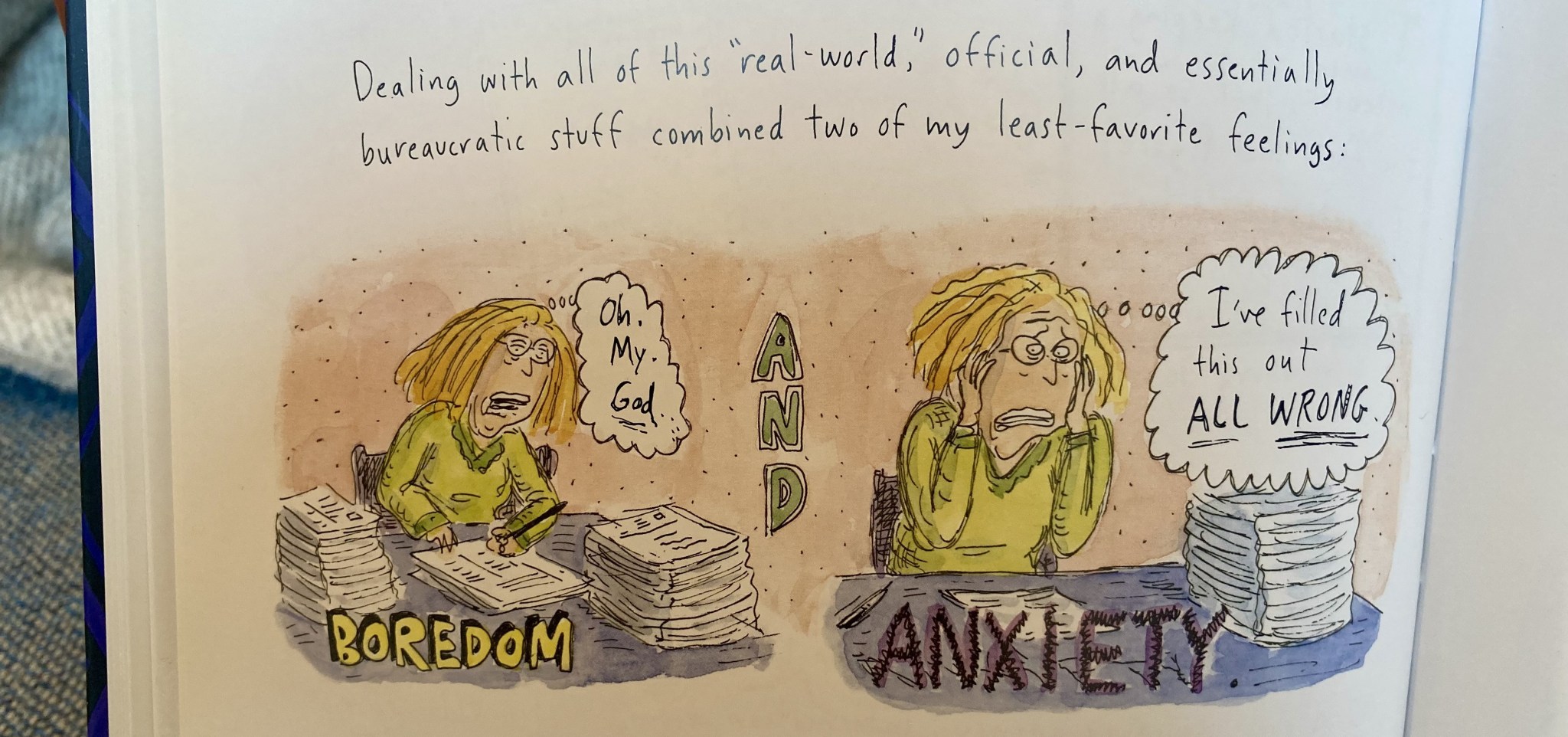

Consolidate your accounts, stupid! Ooooh, that’s not a super nice way to say that. I know that dealing with money stuff can bring up bad feelings. Roz Chast got it right in her brilliant memoir:

Ok so let me try again, a little bit nicer this time…

Don’t be the Head Curator of the Museum of Old Accounts! Museums are nice for visiting but are not for 24-7 living. Here are 5 reasons why streamlining accounts is worth the effort. #’s 1-4 are about taking care of yourself. #5 is about taking care of others:

- To get your asset allocation right: It’s harder to figure out your overall asset allocation when you have bits and bobs of things all over the place. Are you sure that the investment selections you made at a 9-years-ago job are appropriate for your current financial plan? (You have a written financial plan, right?)

- So you don’t lose yourself money: The more complex your financial picture, the more you will be tempted to make adjustments here and there. You will probably be less wealthy at a result.

- So you avoid junk fees: Your (small balance) account might get eaten away by fees. Fees you can avoid by moving your money elsewhere.

- So you avoid tax penalties: When you finally start to tackle things, you lose steam and decide it’s “easier” to just withdraw the money instead of doing a rollover, and you owe a 10% early withdrawal penalty. Or even worse, because you forget about that account, you don’t take required minimum distributions when you should and have to pay a 25% penalty for not doing that on schedule.

- Because you love your family: Your heirs will be overwhelmed by account complexity while they are still in mourning for you. Even if it feels “simple” to you right now, are you 100% sure it will feel that way to them in that moment? If you are sure, how do you know that? Did you ask them? People who are extremely capable and confident in one area of life are not like that across all areas of life. Personally, I have no problem dealing with financial institutions but can get overwhelmed dealing with the medical system (um, yes, that goes back to my childhood). Others might be just the opposite.

Your financial plan can include a statement like this: “Stephanie will consolidate accounts at financial institutions unless there is a current reason to maintain multiple accounts. She will consider account consolidation annually, when reviewing her asset allocation.”

Sometimes you can move assets from one account to another, so you don’t need to sell investments in order to consolidate accounts (typically the case at regular brokerage accounts). Sometimes you do have to sell something in order to move the money to a different account (like “proprietary” mutual funds held inside an employer retirement account). Sometimes you can do all the steps online, other times you need to get with people on the phone, and still other times there is snail mail involved. “Only entropy is easy.” Persevere! You can do it! I know you’ll feel awesome if you do.

-Stephanie

Subscribe to get The Boring Newsletter sent to your inbox each week: