Hi Friendos,

Today’s topic is “hobby income” and how this differs from “business income” for tax purposes. If you earn money from a small side activity you might wonder if you have a “real” business where you need to keep records, report it on your taxes, and do other boring business things vs. if you can just have fun with it and skip all that tedious stuff.

You have to pay taxes on both hobby income and business income, but there are differences in tax treatment. So what is a hobby, according to the IRS, and what is a business? In many instances, your layperson intuition will be correct. The IRS provides key questions to consider:

- Is the activity conducted like a business?

- E.g., does the taxpayer maintain complete and accurate books and records?

- Does the taxpayer change their methods of operation to improve profitability?

- E.g., does the taxpayer advertise or promote the activity?

- What is the taxpayer’s expertise in the activity?

- Is the activity a main source of income for the taxpayer?

- Has the taxpayer made or expect to make a profit?

- Is the activity profitable in some years?

- Do any losses from the activity fall beyond the taxpayer’s control or are they normal in the startup phase of their type of business?

- Does the activity have elements of personal pleasure or recreation?

I’ll use a few scenarios to illustrate.

Scenario 1: You sell some hand knitted items at a card table you set up in the park on some weekends. You also knit many items that you don’t sell, like things you make for yourself, friends, and family. During the year you had sales of $250 and customers paid you in cash, and overall you spent $350 on yarn and a few new pairs of knitting needles.

- This is a hobby. You did not earn a profit this year and do not expect to ever earn a profit.

Scenario 2: Your friend also knits and has been selling things on Etsy for years. They are a super fast knitter and constantly turn out pieces, some that they sell on Etsy, some that they keep for themselves, and some they give to friends and family. They had Etsy sales of $1,250 and spent around $1,750 on supplies. They live in New Jersey and Etsy sent them a 1099-K tax form.

- Your friend also has a hobby. Receiving a tax form from Etsy does not change that your friend never expects to earn a profit from their knitting.

- If your friend wanted to turn this into a business, they could change up how many knitted pieces they give away and knit for themselves vs how many they sell on Etsy. They could also start keeping good business records, for example, having a separate checking account for their business, direct Etsy to deposit sale proceeds into that account, and using that account’s debit card to purchase supplies for their Etsy pieces. Having all the business cash flows go in and out of a separate checking account would assist in their record keeping and be consistent with conducting their Etsy knitting as a business.

Scenario 3: Your mom took a photography class and her teacher organized an art show at the end of the semester. Thrillingly, two of her photos sold for $550 each, a total of $1,100! She was so proud when she got the payment check from the art gallery. During the year she spent $500 on the class, $230 on extra time in the darkroom, and $120 on photo paper and other supplies for total expenditures of $850.

- Your mom has a hobby. She did not have the notion of selling photos in mind when she created the photographs and while she unexpectedly made more money from photography than she spent on it, she does not conduct her photography activities like a business.

Scenario 4: Your neighbor took a candle-making class and loved it. After learning how it all works, they decided the candle sellers at the local flea market were making a killing so they got their own booth and have been doing great business every Sunday, usually selling around $200 of candles each week. They ended the year with $9,300 of sales and spent $1,500 on flea market table fees and $3,000 for wax, wicks, and other supplies. They know these amounts because they track weekly sales and expenses in one of those “composition” notebooks with the black and white marble cover.

- This is a business. Your neighbor got into this with the idea of making money and indeed, was profitable from the beginning.

- While some people might consider a composition notebook an unsophisticated method for maintaining business records, it is in fact just as legitimate as keeping a spreadsheet on a computer or using costly bookkeeping software.

How are people in these scenarios taxed on the money they made? It will be different for your candle-making neighbor with business income vs you, your friend, and your mom with hobby income.

Difference #1 is whether expenses can be deducted.

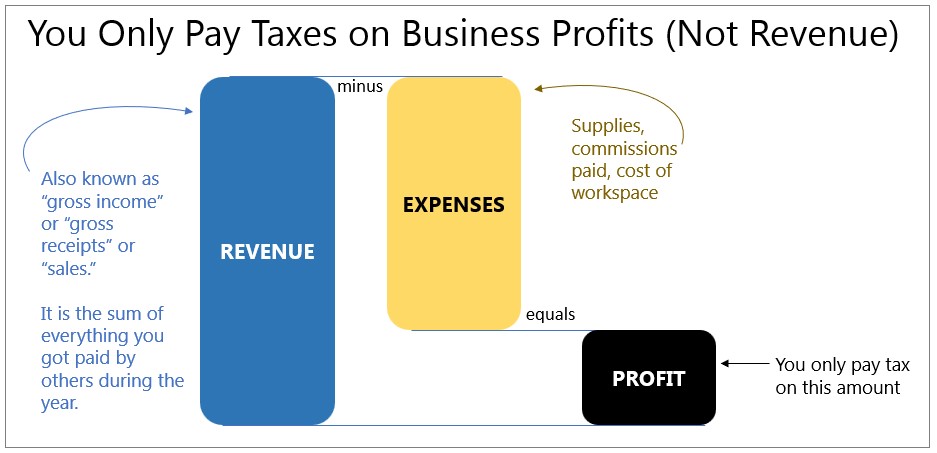

Difference #2 is whether losses can offset other taxable income. With a business, you can deduct expenses from your revenues, so you only owe tax on your profits. Like this:

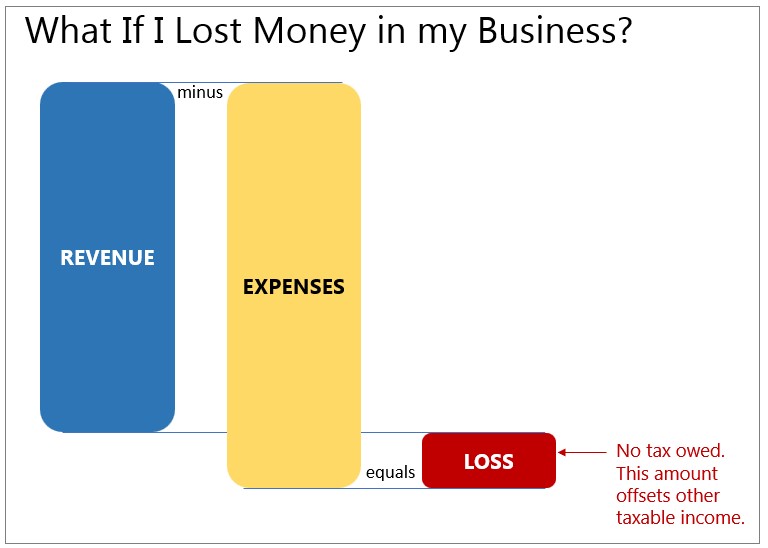

If your business loses money, such that you have negative profit, your losses can offset other income, like income from your main job. Like this:

All that reporting of business revenue, expenses, and profits or losses happens on Schedule C, Form 1040.

With a hobby, you must pay tax on your revenue – no subtracting off expenses except for “cost of goods sold.” That means if you are selling something like a knitted item, you could subtract the cost of the yarn used to create the item, but not costs like advertising or the cost of driving to a craft fair. See Pub 535, “You can determine gross income from any not-for-profit activity by subtracting the cost of goods sold from your gross receipts. However, if you determine gross income by subtracting cost of goods sold from gross receipts, you must do so consistently, and in a manner that follows generally accepted methods of accounting.”

“But,” you say, “that’s not fair! I could never have made those hobby sales without marketing my products!” I know it might seem unfair, but that’s what the tax law says. With a hobby, you are not allowed to deduct expenses other than cost of goods sold, so consider thinking of your after-tax hobby income as a small offset to expenses you would have spent on your hobby in any case. Hobby income is reported on Schedule 1, Form 1040, line 8.

Note: tax laws regarding hobby income changed in 2018, so be mindful of information you may see online and ensure it is up to date. In the past, people with hobby income could deduct expenses up to the amount of their revenues (as itemized deductions), but this is no longer true.

“Ok, but can’t I just report my hobby as a business anyway? I really want to deduct all of my expenses.” Congress doesn’t want people to pretend that everything in their life is a money-losing business which therefore should offset the income from their regular jobs. Or as the IRS put it, “just attempting to create and utilize losses to offset other unrelated income.” There are certain areas the IRS scrutinizes more closely in the event of an audit, including:

- acting

- art work

- auto racing

- boat racing

- bowling

- craft sales

- dog breeding

- drag racing

- fishing

- golfing

- gunsmithing

- horse breeding

- horse racing

- making movies and videotapes

- operating a bed and breakfast

- photography

- stamp collecting

- writing

Multiple years of little or no income and large losses are a red flag to an auditor, so think twice before declaring that your weekly golf outing is a money losing “business” so you can use a year’s worth of course fees to offset taxable income from your regular job!

There is an upside to tax treatment of a hobby…

Difference #3 is that business income is subject to self-employment tax while hobby income is not. If you have self-employment business income, you have to pay 15.3% self-employment tax on it (both the “employer” and “employee” portions of Social Security and Medicare tax), unless you fall below a small threshold ($400 in 2025, see Schedule SE, line 4c). Hobby income is not subject to self-employment tax.

With this in mind, we can consider the tax treatment of our earlier scenarios:

A few last points for your consideration:

- Both you and your mom have taxable hobby income even though she got a check from the art gallery while you got paid in cash (paper money) by your customers in the park. The form in which you get paid does not determine whether income is taxable.

- If your friend’s Etsy sales had been only $200, below the threshold at which Etsy would send a 1099 form, your friend could still have taxable income. Whether Etsy sends the 1099 form is separate from whether the income is taxable – the difference is whether the IRS already knows about the income (because Etsy told them about it) before you file your tax return.

- You might be interested in converting your hobby into a business so you could deduct all expenses, not just cost of goods sold. But if your expenses are low, you might prefer to keep things as a hobby. Avoiding self-employment tax for a hobby might outweigh the benefit of deducting expenses for a business.

If you sell items from your hobby or business for the holidays, I hope you are having a great year-end season!

-Stephanie