Hi Friendos,

I hope you had a nice Thanksgiving holiday if you celebrate. I am pleased to report that my apple pie turned out great, though the cranberry curd tart was hopelessly stuck to the pan (it still tasted great).

Today I’m expanding my prior discussion of auto insurance based on a reader suggestion to write about auto insurance for people who don’t own cars and insurance for rental cars more generally.

Before I turn to this scintillating insurance discussion, I am pleased to announce that I am offering traditional tax prep for the 2024 tax season (Jan-April 2025)! I am currently accepting simple tax returns for a limited number of individuals. Please see my Services page for more details and do email me if you would like to reserve a place on this year’s client list. Ok, back to insurance…

A Consumer Reports survey found that only 10% of people renting cars bought insurance from the rental company, and hypothesized the low rate was likely due to the high cost of the insurance but perhaps also due to high-pressure tactics from the rental agent causing a reflexive “No” from renters.

To be totally honest, I space out almost instantly when I am faced with blocks of tiny-print text on rental car paperwork. Especially if I’m at an airport, have waited in a long line (which is always?), didn’t use the bathroom back inside when I should have, and am tired because my flight was too early in the morning. When I was younger, I always bought the insurance from the rental company, even though I knew it was probably overpriced (it was). I only rented a car once every few years, the insurance was less pricey back then, and my travel budget could handle a somewhat higher car rental expense. I did a good job in other parts of my financial life and focused on “optimizing” my retirement saving and building up a down payment fund, my personal top two areas. I think it was ok to pay extra for the rental car insurance and not hassle to try and optimize everything.

If you have limited time and energy to spend on your financial life and don’t want to sweat an extra hundred or two on a car rental, that’s reasonable! On the other hand, if you rent cars a lot, your budget is tight, or you just want to better understand auto insurance, you can dial in on this topic.

First, we can distinguish between “rental car reimbursement coverage” that pays for a rental car while the car you own gets post-accident repairs and “rental car insurance” that pays for repairs to a rental car if you get in an accident while driving the rental car. Rental car reimbursement coverage is something to decide on when you buy insurance for the car you own. I don’t have it because I don’t need my car to get to work or for other life essentials, but lots of people do and should therefore get rental reimbursement coverage. Rental car insurance is today’s main topic.

As with insurance for a vehicle you own, there are different areas of insurance coverage to consider:

- Damage to the rental car (“collision coverage” and “comprehensive coverage”),

- If the rental car company would charge you for “loss of use” while the damaged rental car is being repaired, the logic being that they can’t profit from renting out the car during this time. Loss of use charges could be something like $85/day or $595/week,

- Damage to other people’s cars/property (“liability coverage” or “extended protection” or “supplemental liability insurance” or “third party liability”),

- If you and/or your passengers are hurt in an accident (“personal injury protection”),

- If someone else is hurt in an accident (also “liability coverage”),

- Your personal property that’s put in the rental car (“personal effects coverage”),

- Roadside assistance, to cover things like towing.

I know of 5 methods to obtain rental car insurance:

1. Buy it from the company that rents you the car. They charge a lot so it is worth looking into other options. A “collision damage waiver” covers damage to the rental car from a collision. A “loss damage waiver” covers damage to the rental car from other types of accidents (e.g., a tree falls on it while the car is parked) or if the rental car is stolen. “Liability coverage” handles harm to other people (e.g., someone needs medical treatment after an accident) or to other people’s property (you crashed through a glass storefront??? yikes).

2. Buy a stand-alone policy on your own. If you don’t own a car and rent cars frequently, do consider buying a stand-alone policy to cover rentals. You can do that! This type of non-owner car insurance, which might run you $200-$600/year depending on where you life and other factors (definitely shop around), also covers scenarios like if you borrow someone else’s car, use a car-sharing service, or use a company car for personal use. As with other types of auto insurance, you’ll want to understand what is and is not covered. For example, generally it won’t cover damage to the car if an accident was deemed to be your fault, and the insurance applies to you, the driver, not the vehicle you are driving (liability coverage for you, but not collision coverage for the car).

3. Buy it as part of a travel insurance policy. Travel insurance might include car rental collision coverage.

4. Buy it as part of insurance policies you already have. Most auto policies cover rental cars in the same way they cover your own car (same deductible applies, same coverage limits). The coverage might be different or not provided at all under certain circumstances:

- You are renting outside the U.S. and Canada.

- You are traveling for business.

- You are renting a luxury or exotic vehicle, an SUV, a truck with an open bed, an RV, a cargo van, or a moving truck.

- You will be off-roading or driving on gravel or dirt roads.

- Your policy may not cover rental company charges for loss of use.

Call your auto insurance company before a trip and make sure you understand your coverage for a rental car. Don’t be afraid to ask open-ended questions like “Is there anything I forgot to ask?” and you might get some additional helpful tips.

Also, consider whether circumstances around your rental car differ from those for the car you own. For example, my own car is not worth much at all and therefore I have minimal collision coverage. Any car I rent is surely a much more valuable vehicle, so I probably want more collision coverage for my rentals.

Homeowners’ insurance or renter’s insurance usually covers your personal effects if someone steals things out of your rental car (your usual deductible would apply). Your medical insurance can provide coverage if you are injured in an accident, so you may not need additional personal liability coverage.

5. Pay for the rental car with a credit card that provides rental coverage. A few key points here that I illustrate with a mailing I recently got for one of my own credit cards:

- You must pay for the rental with that credit card! That might sound obvious but if you hold multiple cards and are busy planning for a trip it would not be hard to overlook this.

- You have to decline the collision damage coverage from the car rental company. If you purchase that, the credit card coverage won’t apply.

- You’ll want to consider the coverage limits and possible restrictions. You should be able to get this info online or just call them up to ask. Make sure there is liability coverage if you plan to rely solely on credit card coverage! Also do verify coverage for things like: the country where you’ll be traveling, the type of vehicle you plan to rent, and the length of your rental (coverage might only be for up to a certain # of days).

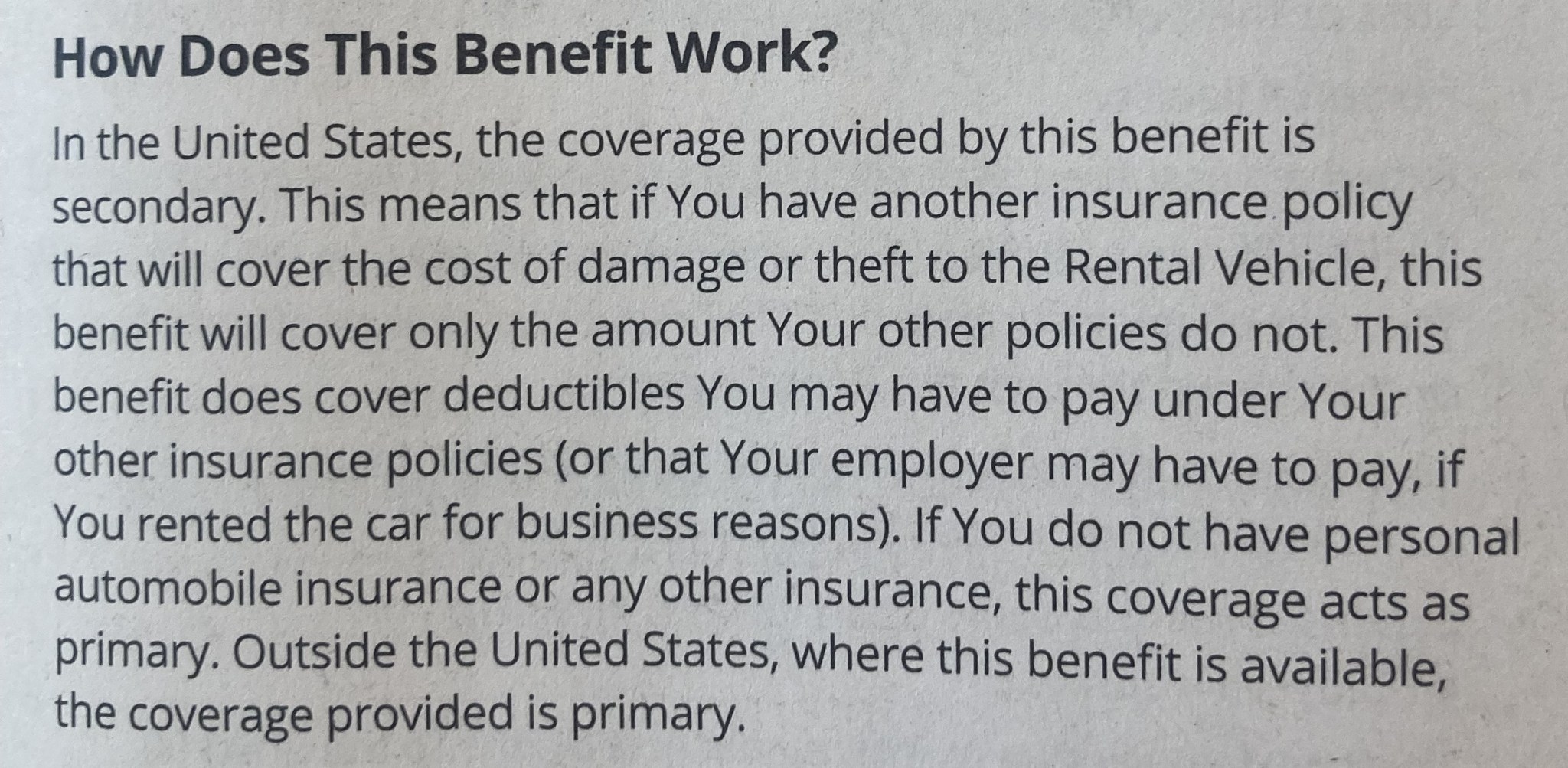

- Credit card coverage may be “secondary” meaning it kicks in after you’ve utilized other insurance you have, such as from a policy on a car that you own.

- The coverage provided by any particular credit card can change over time, so do recheck the terms for your card to ensure they are as you expect.

To really dial in on this, you need to consider each type of coverage you want to have and how you’ll obtain it. You might rely on one source to cover possible medical expenses from an injury and another source for possible property damage. And I hope you never need to use this insurance because you don’t have any accidents!

Safe travels this winter,

-Stephanie