Hi Friendos,

A lot of writing and thinking about personal finance topics, including my own, focuses on mathematical and technical topics like the benefits of using tax-advantaged investing accounts and low-cost index funds. These are important, but so are emotional and behavioral factors.

I have had multiple times in my life when I intentionally made the “wrong” mathematical decision in favor of the better-for-me option.

Example #1: My husband’s student loans.

Early in my marriage, my husband still had part of one student loan outstanding. I had a savings account with more than enough cash to pay off the loans and earned a lower after-tax interest rate on the savings account than the interest rate on the loan. The math was clear! I suggested we take money from my savings account and pay the loans in full.

My husband was not comfortable with this idea at all, as he needed to pay the loans “out of” his paychecks. Considering that we shared housing and all household expenses, this seemed like a bit of a fiction to me because money is fungible and if part of his paycheck went to the loans that meant less went to our other expenses, so they were then paid “out of” my paychecks.

I knew the balance of the loan, its interest rate, and how much my husband paid on it every month. I estimated that we would pay less than $1,000 in interest by the time the loans were paid off. Given the strength of his feeling, it was obviously more important to our relationship to pay the interest than to make the mathematically “correct” financial decision. We could afford it and in every other regard we were on the same page about money decisions.

If you’re thinking, “so, you spent under a thousand bucks on interest, big deal!” then you’ll like this next story better, because it cost me six figures for sure and I still think it was the right approach for me.

Example #2: Big down payment on a home and mortgage prepayments.

The math here is simple: We made a big down payment when we bought a home and then made prepayments to further reduce the loan balance even though we could have earned much higher returns by investing that money. Even if I account for the difference in risk between risky market investments vs certain mortgage prepayments, I still think there’s an argument that we gave up some meaningful ground here. Further, we gave up the inflation hedge that is built into a 30-year mortgage, where inflation reduces the real value of the required monthly payments. I live in NYC where housing is expensive, so this decision cost a lot because a lot of dollars were involved!

I grew up in an emotionally chaotic atmosphere and my parents were very controlling. It’s not that I became a good saver as an adult because I was “smart” or “disciplined”, even though I would like to believe those things about myself. I became a good saver because it was an absolute emotional imperative that I not have personal relationships shaped by my need for another person to give me money.

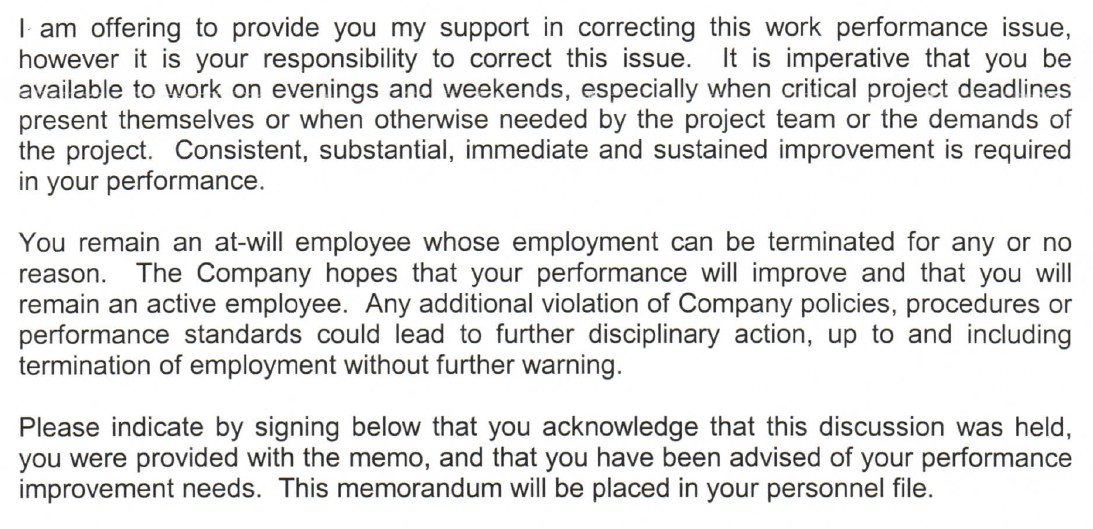

When I was about 3 years out of college, my team at work had a project that was maybe going to require some weekend work. I was mad because my boss had been sitting on things he could have looked at earlier and now us underlings would have to pay the price. I said I wasn’t available to work that weekend. The next week, my boss put a letter in my HR file that I had to sign:

It’s one thing to be aware of being an at-will employee, it’s really something else to sit in a room with your boss and the HR rep and be given a folder with that letter on the table in front of you. In the decades that followed, I never operated under the assumption that my job was secure, despite several promotions and twice leaving firms that later opted to hire me back.

I knew that if I lost my job, I might not make as much somewhere else. My home was my haven from the world, a place of safety. If I had to move out of a home because I could no longer afford it, that would be the opposite of safety. I always saved for retirement and invested those funds, but also made sure that if I had a big pay cut, my housing would still be secure.

Some people talk about personal finance as if the math is all that matters and people are just stupid if they can’t see that. We’re not stupid, we’re full human beings. Sometimes we do need to master our inner demons to make better decisions with money, but sometimes the best decisions are not mathematically optimal.

-Stephanie

p.s. If you are in open enrollment for employer-provided medical insurance or for insurance on an exchange, you might like the series I did last year:

- How FSAs and HSAs save you money, here.

- How much you can save by using an FSA, here.

- How much you can save by using an HSA, here.

- Bringing it all together to choose a medical insurance plan, here, with the spreadsheet I actually use every year.

p.p.s. If you have not voted early, do you have a specific plan for Tuesday? What time of day will you go? Will you vote your whole ballot? vote vote vote!

One reply on “The Boring Newsletter, 11/2/2024”

[…] I could not allocate even more time to pore over medical bills and fight with Blue Cross; I was an at-will employee who had to make sure I kept my job that provided the […]

LikeLike