Hi Friendos,

A recent episode of Gabe Dunn’s excellent Bad with Money podcast discussed money questions that people don’t even know they can ask, like:

- Can you (bank) remove that late fee from my account?

- Can you (bank) give me a lower interest rate (APR) on my credit card?

- Can I have an itemized copy of my medical bill? (revealing errors and charges that should be removed)

I wanted to share an example from my own life when asking a question paid off. So far this has saved us at least $920. If you have examples of your own, I hope you will share them with me directly or in the comments on my website so I might share them in a future newsletter!

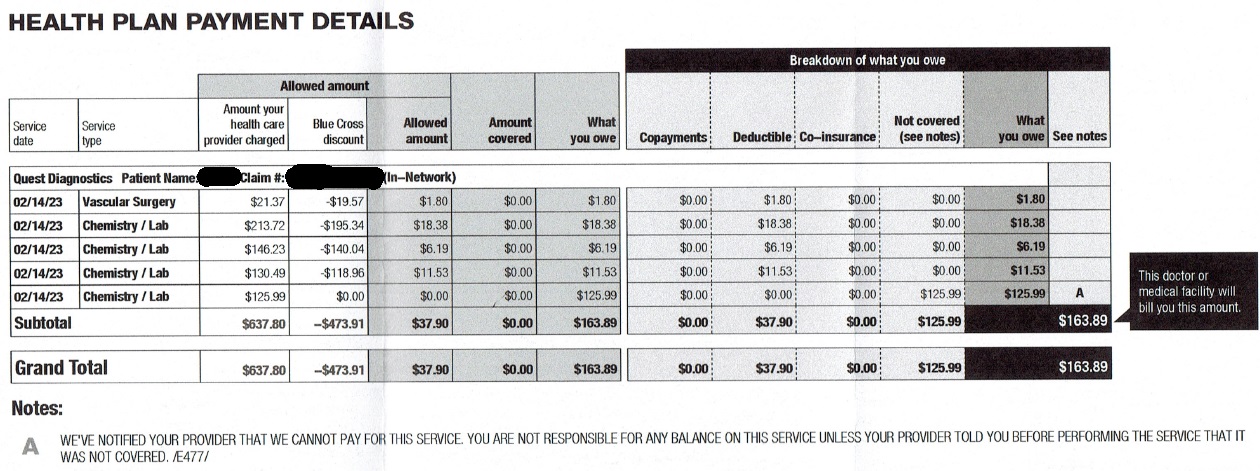

My partner has medullary thyroid cancer and, since his initial surgery some years ago, needs blood tests every few months to monitor for disease markers. We’ve had the same medical insurance (Blue Cross Blue Shield) for more than a decade and never had any problem with coverage of these blood tests. Then, starting in late 2022, insurance started claiming that one particular blood test was not covered. I had my partner call the insurance company to ask about it, because the explanation of benefits we received had a note that stated: “We’ve notified your provider that we cannot pay for this service. You are not responsible for any balance on this service unless your provider told you before performing the service that it was not covered.” Quest Diagnostics, which performed the blood test, never told him the test was not covered.

Every few months he’d call the insurance company and each time they “made an exception” and covered his blood test. After about a year, they said they couldn’t do that anymore. They told him this test was only approved for certain kinds of breast and gastrointestinal cancers and they sent the list of approved ICD-10 diagnosis codes, none of which applied to him.

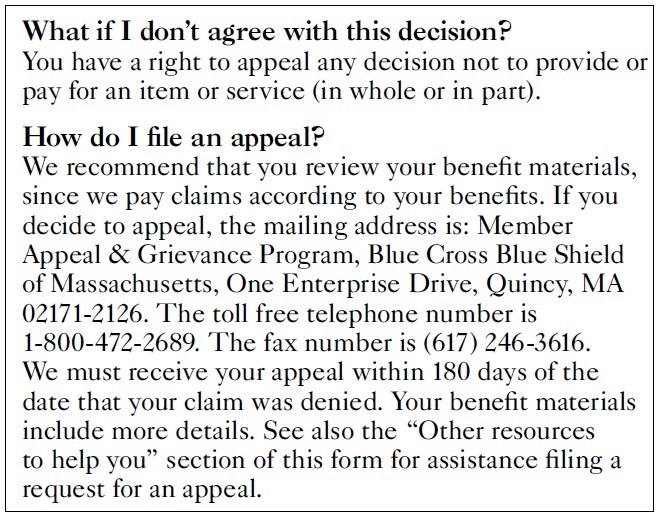

This made no sense to me, that one of two key blood tests for his type of cancer was suddenly disallowed. What the @#&!* is insurance for if it doesn’t cover monitoring of your freaking cancer?!? And $126 every quarter (increased to $139 in 2024) was something we could afford if we needed to, but a large enough amount that I was willing to try again. We tried working through the billing team at his endocrinologist’s office, getting a letter of medical necessity from the doctor and sending this into Blue Cross, sending it to Quest. Ultimately, this led nowhere and my partner worried it might hurt his relationship with his doctor if he was too much of a pest. In January 2024 I looked at an insurance statement again and, for the first time, noticed the boilerplate language about filing an appeal:

Yikes, would I have to fax something? I got the appeal form from the Blue Cross website and we filled it out. It was easy and we also included copies of the Blue Cross EOB (explanation of benefits) showing the denial, the bill from Quest Diagnostics, the letter from his doctor, and our explanation of why they should change their decision. Below, I provide some of the language we used that ultimately worked – you would want to tailor this to your own insurance denials of course:

“I have medullary thyroid cancer and my endocrinologist directs me to have certain bloodwork as a result, including this CEA test…CEA is a tumor marker and this test allows my doctor to monitor possible progression of my cancer. You should change your decision because this test is medically necessary given my cancer. Thank you for your consideration.”

A couple weeks after I sent this off in the mail (snail mail, after I scanned copies for our records) we got an acknowledgement letter from Blue Cross saying they received the appeal. About a week after that we got a letter saying: “We are approving your appeal to provide benefits for the carcinoembryonic antigen (CEA) laboratory test.” It worked! It worked! But…the letter also said “Although we are making an exception this time based on the individual circumstances in this instance, this one-time coverage determination does not apply to future services.” Well, I’d rather have $126 than not have $126, so…fine.

Given this initial success, we did additional appeals of Blue Cross denial of coverage for the same blood test in March 2024, May 2024, and August 2024. I varied the language a little bit each time:

- “…I am including a letter of medical necessity from my doctor. I have provided BCBS with this letter previously but not received a response. I still have cancer and this bloodwork is still medically necessary.”

- “…Unfortunately, I still have cancer…CEA is a tumor marker, not just in breast cancer but also in my rare medullary thyroid cancer. Thank you for your consideration.”

- “…I sure wish I didn’t have cancer and need this testing, but here we are. Thank you for your consideration.”

Some of our earlier phone calls failed because that was not the specific Blue Cross appeals process. Following the exact process was key to success.

One approval letter stated “Your appeal was approved because a Blue Cross Blue Shield…clinician reviewed all the information provided and applied individual consideration to approve your authorization.” The most recent letter stated, “Your appeal was approved because you met the medical necessity criteria (need) required for coverage based on the additional information provided with your appeal.” It is infuriating that I have to do this, but I will continue to appeal every single denial of coverage.

A Pro Publica reporter interviewed one oncologist whose practice employs people whose entire job consists of filing for prior authorizations and then appealing the insurance denials. She said that for an insurance company, “you know, death is cheaper than chemotherapy.” Things are especially bad for people on “Medicare Advantage” plans where more than 80% of appeals succeed. As discussed in a letter from 45 House members and 4 Senators, of both parties, to the Centers for Medicare and Medicaid Services (CMS), these so-called “Medicare Advantage” plans use AI tools to “erroneously deny care and contradict provider assessment findings.”

Our wealthy country could have a true single-payer system that would provide good health care to all of us, rather than mere health financing. Sadly, neither Presidential candidate favors such a system. In the meantime, all we can do is keep filling out that stupid paperwork and fighting for the coverage we deserve.

-Stephanie

p.s. Did you get your Real ID yet? If your driver’s license has a star on it (usually gold or black), you should be all set. Here’s what that looks like on my NY state license:

If you don’t have a Real ID, and would prefer not to carry a passport to fly domestically after May 7th of next year, go ahead and take care of that while there’s still plenty of time.

One reply on “The Boring Newsletter, 9/22/2024”

[…] you’ve been here for a while, you know that my husband has medullary thyroid cancer. Last year I wrote about our lab work adventures with Blue Cross Blue Shield of Massachusetts, our former […]

LikeLike