Hi Friendos,

Today’s topic is the real hourly wage. I first learned of this concept from the personal finance classic Your Money or Your Life, a book that was first published in 1992, but I first came across in 2010.

For jobs that pay by the hour, people think of their stated hourly wage (pre-tax) as what they “make.” As in, “I make $32 an hour.” For salaried jobs, people often translate their gross salary into an hourly wage by dividing it by however many hours they have to work per year. As in, “I make $85,000 per year and get 4 weeks paid time off, so that’s 48 working weeks times 40 hours a week is 1,920 and $85,000 divided by 1,920 is $92.39 per hour.”

The real hourly wage looks at your annual income and subtracts:

- The cost of transportation to and from work,

- The cost of clothing to wear specifically at work (costuming),

- The incremental cost to buy food away from home if you buy meals out while at work, and

- All other costs you would not incur but for the job.

The real hourly wage also considers your real number of hours worked during a year:

- Time spent preparing to go to work (costuming),

- Time spent commuting,

- Time spent on work emails, messages, and other work activities done outside of normal working hours, and

- Other time lost, such as needing to unwind after returning home from work due to energy drained by the workday.

This all-in calculation leads you to your real hourly wage, or, what you actually receive in exchange for each hour of your life you trade for money. And of course, you also will have to pay taxes on that.

“The cost of a thing is the amount of what I will call life which is required to be exchanged for it, immediately or in the long run.” -Henry David Thoreau, Walden

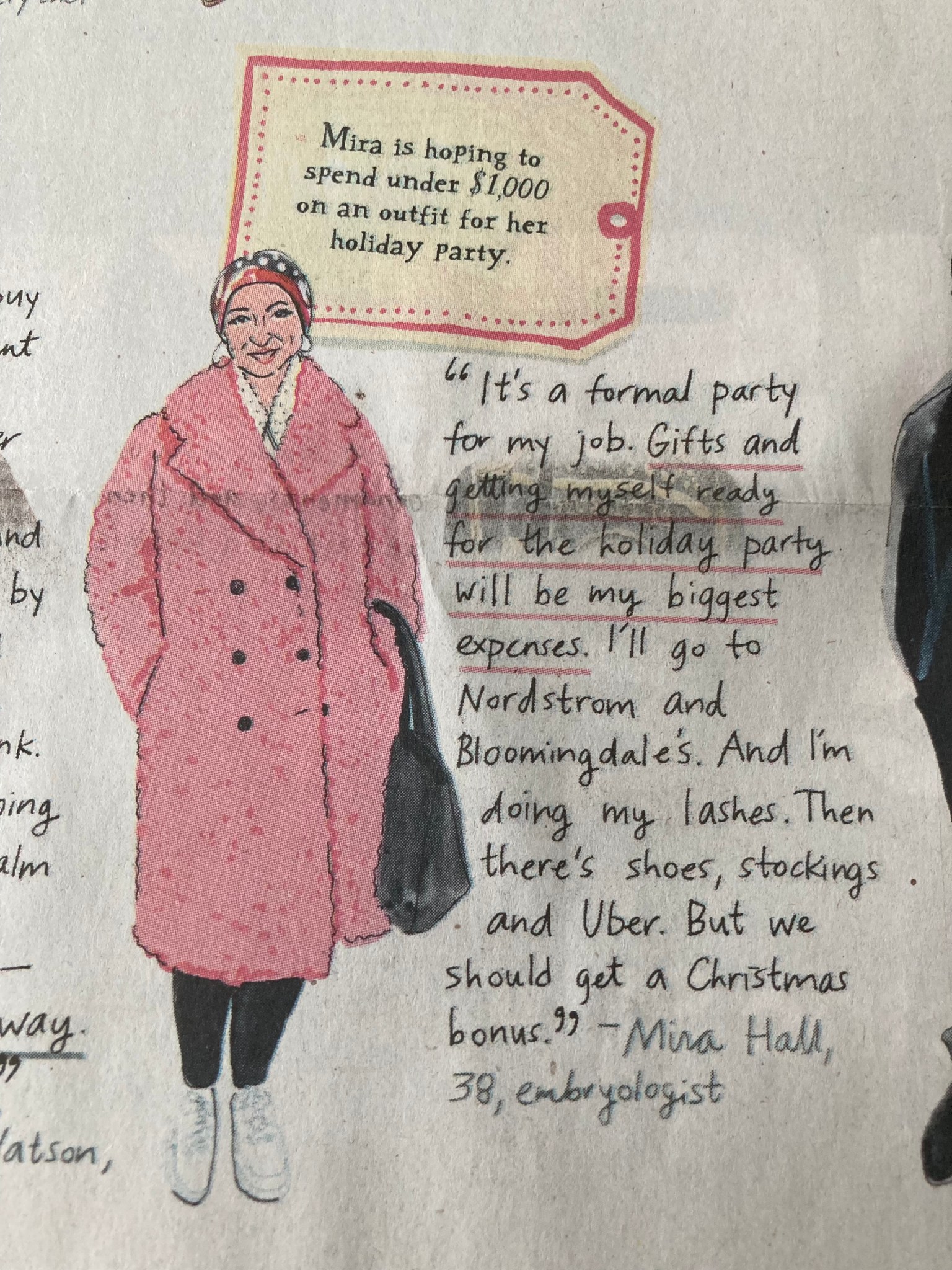

Below is a picture I took of an article about holiday spending (“17 People on the Street Tell Us What They Are Spending During the Holidays,” by Julia Rothman and Shaina Feinberg, December 17, 2023, New York Times):

Mira probably gets a lot of expressive and emotional benefits from the spending she does for the holiday party at her job. But no doubt this party is really eating into her real hourly wage. Mira is probably fine with that! Money is very complicated, as is clothing, and there is no way to avoid the norms of whatever cultures we live in.

“Normal is getting dressed in clothes that you buy for work, driving through traffic in a car that you are still paying for, in order to get to a job that you need so you can pay for the clothes, car and the house that you leave empty all day in order to afford to live in it.” -Ellen Goodman

For me, consideration of my true hourly wage did help me become more intentional about my spending, particularly on clothing and sad desk lunches eaten in front of my computer alone. It also helped me spend less in general as it gave me a deeper understanding of the exchange: “I will work X # of hours to buy this – is it worth that many hours of my life?” And of course, there is also the environmental impact of things we buy, which is almost never fully reflected in the sticker price.

I heard an interview with Vicki Robin, co-author of Your Money or Your Life, where she spoke about tracking one’s spending as a kind of meditation on money. I really appreciate her holistic way of thinking that has helped me so much in my own life.

-Stephanie