Hi Friendos,

I hope you are enjoying a wonderful holiday weekend.

Last week I wrote about an article co-authored by Alicia Munnell, “The Case for Using Subsidies for Retirement Plans to Fix Social Security.” Part of what the authors do is consider changes to the current rules around tax-advantaged retirement accounts, such as 401ks, and how these changes would impact tax collections. To do this analysis, they model savings and investments inside an account like a 401k vs inside a regular brokerage account.

Their calculations run smack into the issue of asset location: the account in which you locate (hold) an investment. (Not to be confused with asset allocation, the proportion of your portfolio held in different types of investments like stocks vs. bonds.) Let’s say someone wants to have 50% of their portfolio in equities and 50% in bonds. They have a Roth IRA and a regular brokerage account. Do they go 50/50 inside each account? Have all bonds in one account and all stocks in the other?

In real estate, it’s location, location, location. Investment location is not as crucial, but might impact your overall results by something like 0.05% to 0.3% a year. So in terms of financial wellness priorities, #’s 1 through 10 on the list are spend less than you make (this is by far the most important thing), then we’d consider how you need to have an emergency fund, invest your savings, use tax-advantaged investment accounts, have a reasonable asset allocation, have the right insurance coverage, have a will, avoid high taxes and fees on your investments, consider ways to increase your income….and then we’d get to asset location. I’d had clients ask me about asset location and my answer is: it doesn’t matter much and this is for the nerds who want to seriously fine tune things. If you want to know why I think so, read on!

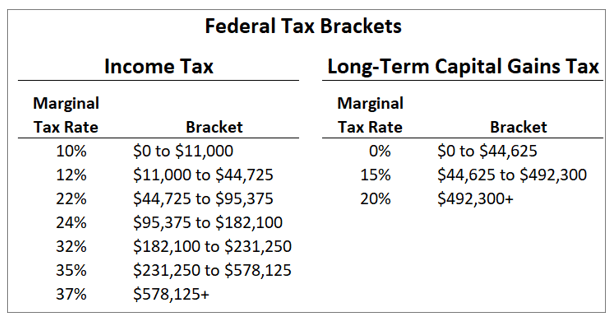

First consider the difference in tax rates for ordinary income vs capital gains (these are 2023 $ amounts):

For any given income level, capital gains are taxed at a lower rate than ordinary income. The article I discussed last week noted, “Equities outside of retirement plans are taxed more favorably than ordinary income under the federal income tax.” That is because of the lower tax rates on capital gains.

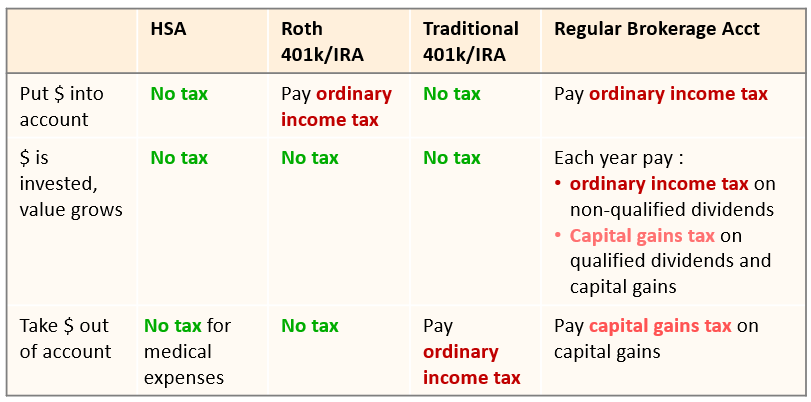

Now consider this summary of taxes for different types of investment accounts:

And consider that equities have higher returns than bonds (on average).

Back to our example person who has a Roth IRA and a regular brokerage account, and wants to own some stocks and some bonds. Perhaps the bonds will earn 5% real returns vs 9% for stocks.

- Consider tax rates: In the regular brokerage account, bonds will be taxed at higher ordinary income tax rates, while stocks at lower capital gains tax rates. Something has to be located in the regular account, something in the Roth, so let’s tax-shelter the thing subject to higher tax rates by putting it in the Roth. Conclusion: hold bonds in the Roth account and stocks in the regular account.

- Consider investment returns: Stocks have higher returns than bonds, so will grow to larger values. It’s better to pay tax on a smaller amount than on a larger amount, so let’s tax-shelter the thing that has higher returns by putting it in the Roth. Conclusion: hold stocks in the Roth account and bonds in the regular account.

Uh oh. Tax rates lead us to a different conclusion than investment returns. These two effects move in different directions, so it is an empirical question as to which one is larger. Put differently, for your taxable account you can choose to pay a low tax rate on a big gain (if you hold stocks in the regular account, pay capital gains tax rates) or you can choose to pay a high tax rate on a small gain (if you hold bonds in the regular account, pay ordinary income tax rates).

- Low cap gains tax rate * large investment returns (stocks), or

- High ordinary income tax rate * small investment returns (bonds).

The impact of investment returns is usually more important than the impact of tax rates. If you’d like to walk through some examples, there are some good ones here. But there are many other factors that can come into play:

- Different tax rates (brackets) can apply during working years vs retirement,

- Tax rates can change over time,

- You might have to pay fees on the investments that are available inside different accounts,

- You may need to rebalance your portfolio across different accounts and want to do so in a tax-efficient manner,

- And so on.

Personally, I don’t worry about asset location much. I hold most of my bonds in my traditional 401k account and am 100% stocks in my HSA. Asset location doesn’t make much difference in terms of $ in your pocket unless you have a really big investment portfolio or a lot of variation across tax efficiency of investments.

-Stephanie