Hi Friendos,

Today I am continuing the discussion of tax-advantaged accounts to save for retirement, and how to pick the type of account that is best for you. Two weeks ago, I discussed weighing HSA vs 401k vs IRA and last week I discussed Roth vs traditional. Today’s installment is for you if you have self-employment income, either as your sole source of income or alongside W-2 or other sources of income.

Let’s say you are already rocking an IRA but want to put away more than the annual max ($7k in 2024). You could just save into a regular brokerage account, but it would be better to put funds for retirement into either a solo 401k or a SEP IRA to receive some tax benefits from deferred income tax payments (if you open a traditional-style account) or from no taxes on investment gains (if you open a Roth-style account).

Solo 401k or SEP IRA?

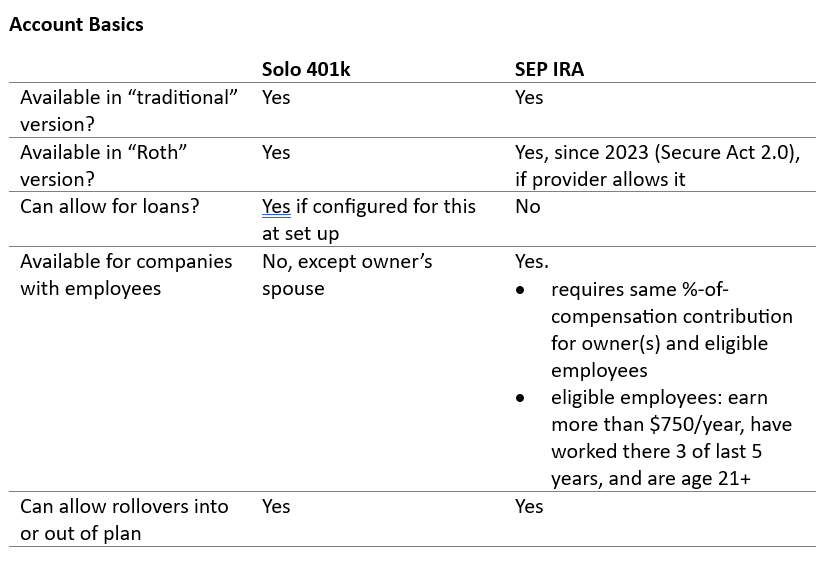

A solo 401k (aka individual 401k, one participant 401k, self-employed 401k) is only for a business owner, or a business owner and their spouse, with self-employment income.

A SEP IRA (SEP = simplified employee pension) can be for just a business owner (and their spouse) or for a business owner (and their spouse) and all employees of a company. There are other types of retirement plans available for a company with employees, but today I am only considering the scenario of someone who has their own business with no employees.

For most people, either type is a great option.

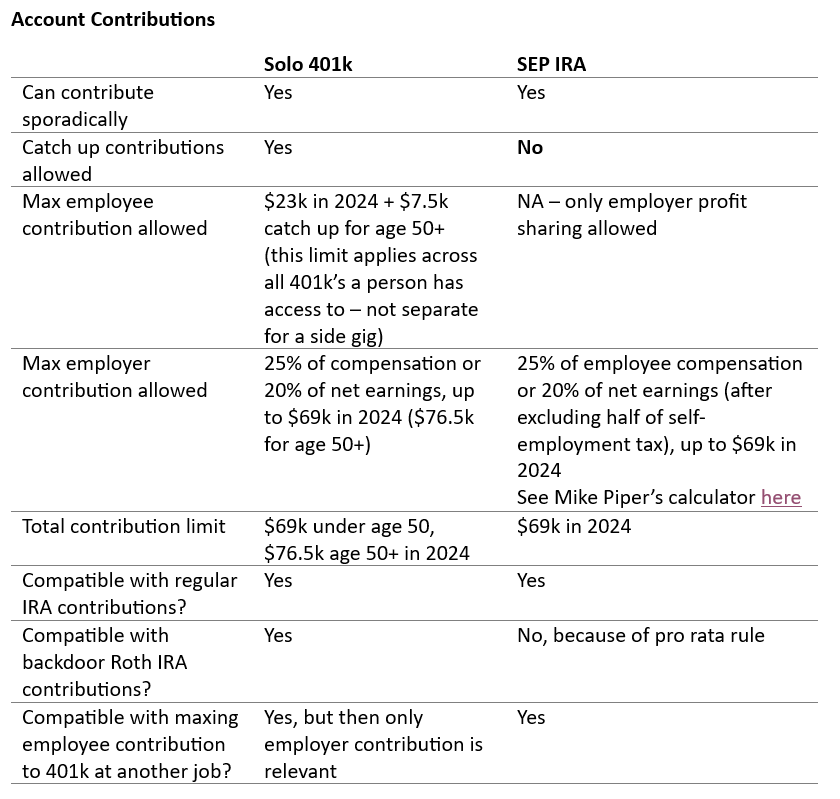

- If you will contribute more than 20% of your self-employment income, solo 401k is the way to go as it will let you tax-shelter additional income.

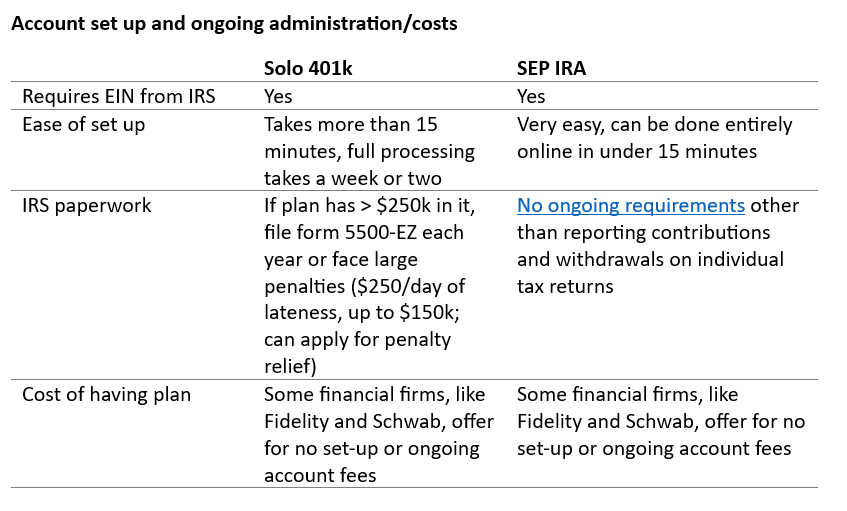

- Solo 401k a bit more involved to set up and has an extra form you may need to file with the IRS each year, but that hassle is definitely worth the benefit from getting to tax shelter more income.

- If you will not contribute more than 20% of your self-employment income, SEP IRA is your better choice for its simpler administrative requirements. SEP IRA’s have lower max contribution limits, but these don’t matter for most people because most people cannot afford to set aside that much for retirement.

And whichever type you pick, traditional will be better than Roth for most people, as I discussed last week.

Last week we looked at an example of a single person with no dependents, under age 50, who makes $100k of W-2 income and decided they will put $15k toward retirement this year. What if that was self-employment income instead of W-2?

If they went with a solo 401k, they could put in a maximum total of $41,587 ($23k as an employee contribution and $18.587k as an employer contribution). If they went with a SEP IRA, their maximum contribution would be $18.587k. Since they will only put aside $15k for retirement, either option works. If this person had access to an HSA, I would advise them to max out the HSA at $4,150, and then for the remaining $10,850 they’ll set aside, probably put it all in a SEP IRA for administrative simplicity. Could they put some of the $10,850 into an IRA instead? Sure, that’s equally good.

Below, I summarize some key features for solo 401k’s and SEP IRA’s.

-Stephanie