Hi Friendos,

I hope everyone is having a lovely beginning-of-spring. I recently took a trip and was delighted to return and find that the chives I planted last year decided to come back!

I paid for the trip with money in my “travel fund” which is just my personal label for one of my high-yield savings accounts. I have four such accounts that are different applications of using a sinking fund in my personal finances.

The term “sinking fund” has its origin in the investment world, associated with sovereign debt (debt issued by countries), municipal debt (like borrowings by cities or states) and also corporate debt (issued by companies). But for a while now, people also have used this term to refer to accounts used by individual people to save for periodic expenses or large expenses. As a Time article describes it:

“A sinking fund is a savings account dedicated to a specific expense you know is coming. It’s different from a regular or emergency savings account, which exists to help pay for unexpected expenses like a new water heater if your current one breaks. With a sinking fund, you determine the amount you would need for a planned expenditure and set aside a certain amount each month specifically for that expense.”

I have four sinking funds and use each one slightly differently.

Sinking Fund #1: “The Property Tax Fund”

Some homeowners pay their property taxes via their mortgage bank. When I purchased my current condo, we chose to set things up where we pay our property taxes directly to the city. I know in advance the exact amount of my property taxes for the year, and I have to pay them quarterly, so one payment every three months.

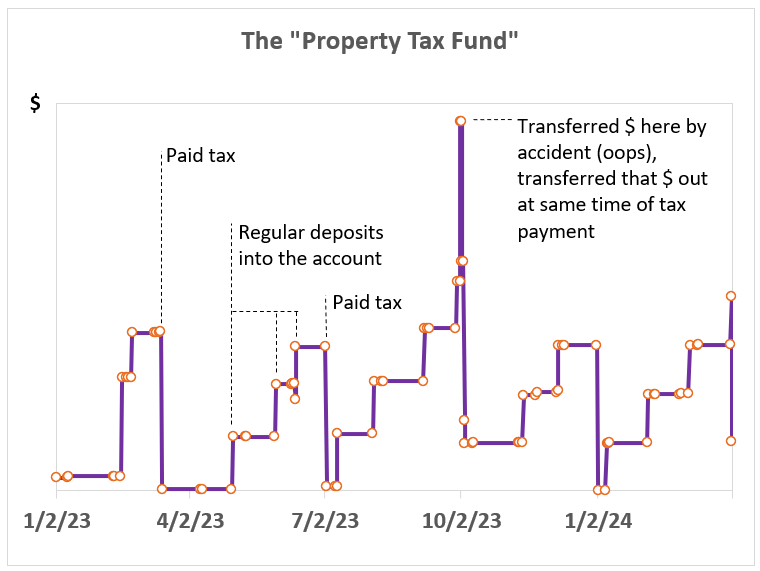

The thing is, I don’t really think in terms of three-month increments, I’m more monthly or annual in my thinking. Also, the property tax bill is pretty big relative to our monthly spending. So each month, I have a certain amount get transferred from our main checking account into our property tax account – one third of the quarterly bill is what I transfer. Then, every three months, our property tax bill is paid out of that account (the “property tax fund”). This chart shows the balance of the fund since the beginning of last year.

You can see the balance drops a lot each time we make a tax payment, and it bumps up each time we make one of our regular transfers into the account. This is my way of transforming our quarterly bill into a monthly bill, which is easier for me to work with, and I know there will always be enough in there to cover the bill when it comes due.

I don’t do this for every non-monthly bill – I pay a car insurance premium every six months, but our car is old and cheap so that bill is small enough to roll it in with other expenses in the month the payment is due.

Sinking Fund #2: Federal Income Taxes

This account holds money I use to pay quarterly estimated income taxes to the federal government. Some of the details are different, but overall it works in much the same way as my property tax fund.

Sinking Fund #3: “The Travel Fund”

This account is fairly new. I was discussing some spending with my spouse for something that was more important to me than to him, and he was frustrated that I was willing to spend a lot of money on this thing, but got pretty tight-fisted when it came to things like travel or entertainment. He was totally right and it was a wake-up call to try something different.

I thought about that conversation for a couple days. I’m always happy afterwards when we spend on fun things, my problem is on the front-end, when things seem “expensive.” I thought some kind of commitment device or precommitment might help. Enter: the Travel Fund.

We talked over what would be a good dollar amount for an annual travel budget. After we agreed, I divided by 12 to get a monthly amount. I opened a the Travel Fund account and since then have made monthly transfers into the account, where that money is now earmarked only for travel or other fun things.

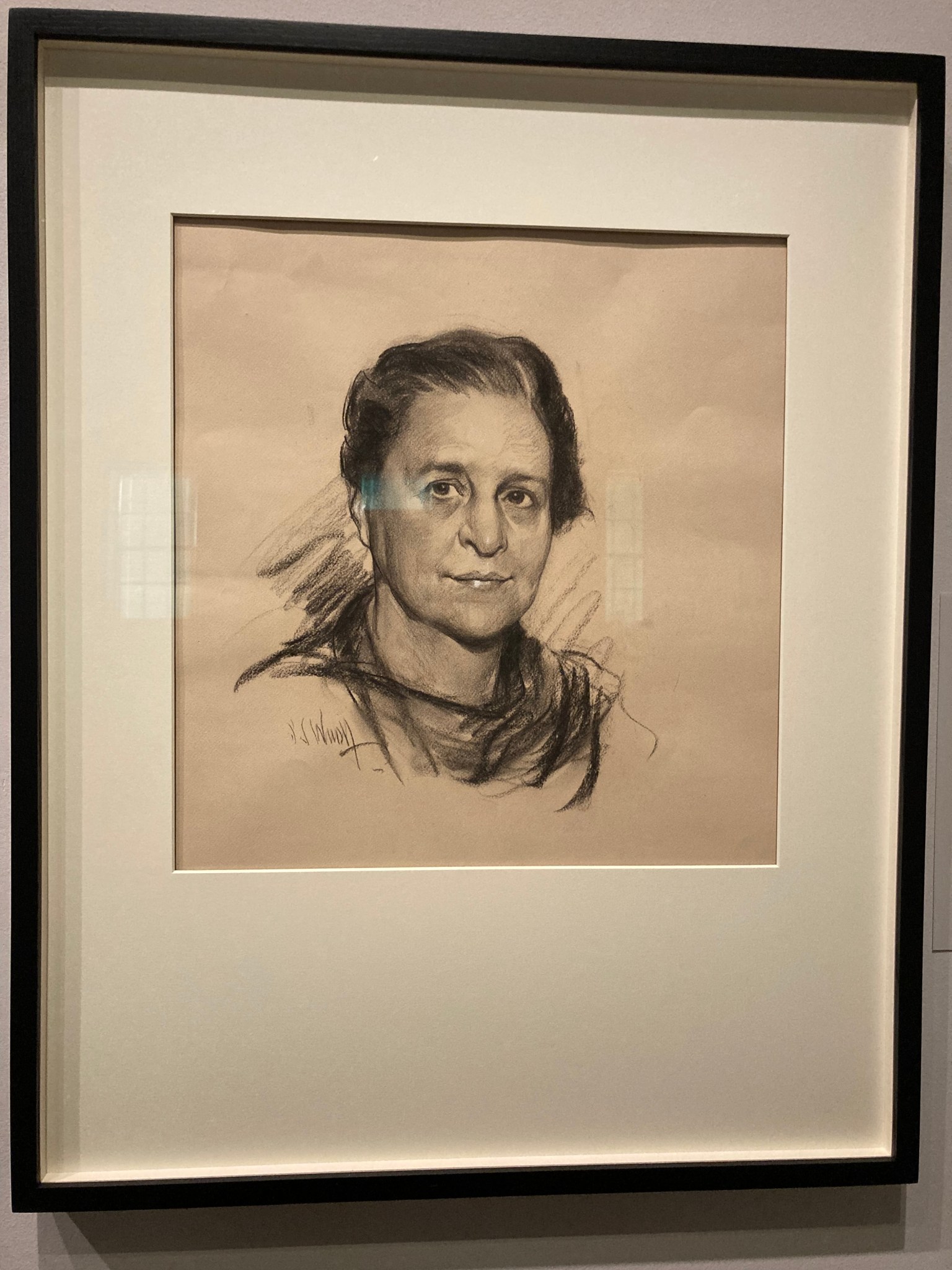

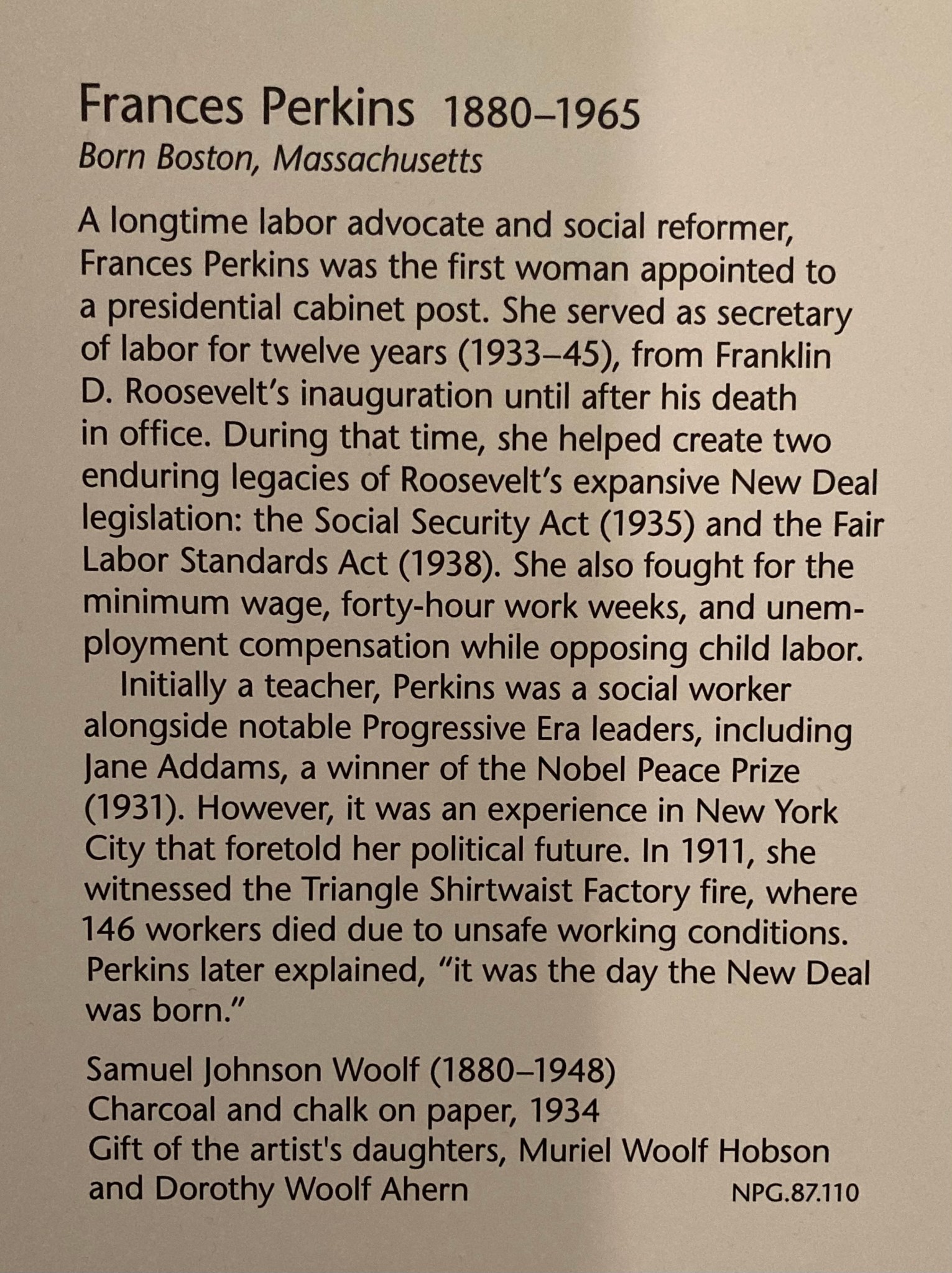

We had a wonderful trip! We went to Washington D.C., and one of my favorite places we visited was the National Portrait Gallery. One of the portraits was of Francis Perkins, Secretary of Labor from 1933-1945:

Sinking Fund #4: Next Goal

My last sinking fund is for whatever we are saving up for next. Currently, that is our 2024 allocation of I bonds. It could be used to hold money for an IRA contribution, as I prefer to save up the full amount for that year’s contribution and then put the $ to work all at once – it’s just administratively easier for me that way. It could also be used to hold money for a big expense – like when we moved apartments and were saving up for some furniture purchases. If we’re in between specific goals, I tend to direct extra money toward paying down our mortgage, but at other times, we’re saving up for something specific and having a separate account to hold funds for that goal helps me keep things straight.

-Stephanie

One reply on “The Boring Newsletter, 4/7/2024”

[…] discussion is about interest on saving accounts, and ties to the discussion two weeks ago about sinking funds. For some of you, this interest rate math may be easy peasy because you already understand it – […]

LikeLike