Hi Friendos,

A lot of people would like to get a tax break for their home office or work from home space but don’t know how this works. The very short summary is:

- If you are a W-2 employee and the home space is used for work at your W-2 job, no deduction for you!

- If you (1) are self-employed and (2) use the space exclusively for self-employment work, and (3) the space is your primary work location, you can claim this deduction, which is worth $5/square foot (up to 300 square feet, $1,500) or more. It does not matter if you rent or own your home, the deduction is unrelated to who owns the real estate property.

I was curious how many people claim this deduction and what it’s worth to them, so I spent some time with IRS Publication 4801, “Statistics of Income, Individual Income Tax Returns, Line Item Estimates.”

In 2021 (most recent year with available data), 4.4 million tax returns claimed this deduction for business use of the home, out of 160.8 million tax returns filed (2.7%). Specifically, these were tax returns with self-employment income reported on Schedule C – sole proprietorships and single-person LLCs. This compares to 2.5% of returns claiming this deduction in 2019 (before the pandemic), and 2.1% in 2003 (earliest year with available data).

Some form of this deduction has been allowed since at least 1978, based on review of prior year Schedule C’s:

On average, the 2021 claimed deduction amount was $2,920. This means that on average, businesses could subtract (deduct) $2,920 from their top line gross income and shelter it from income taxes.

Who can claim this deduction?

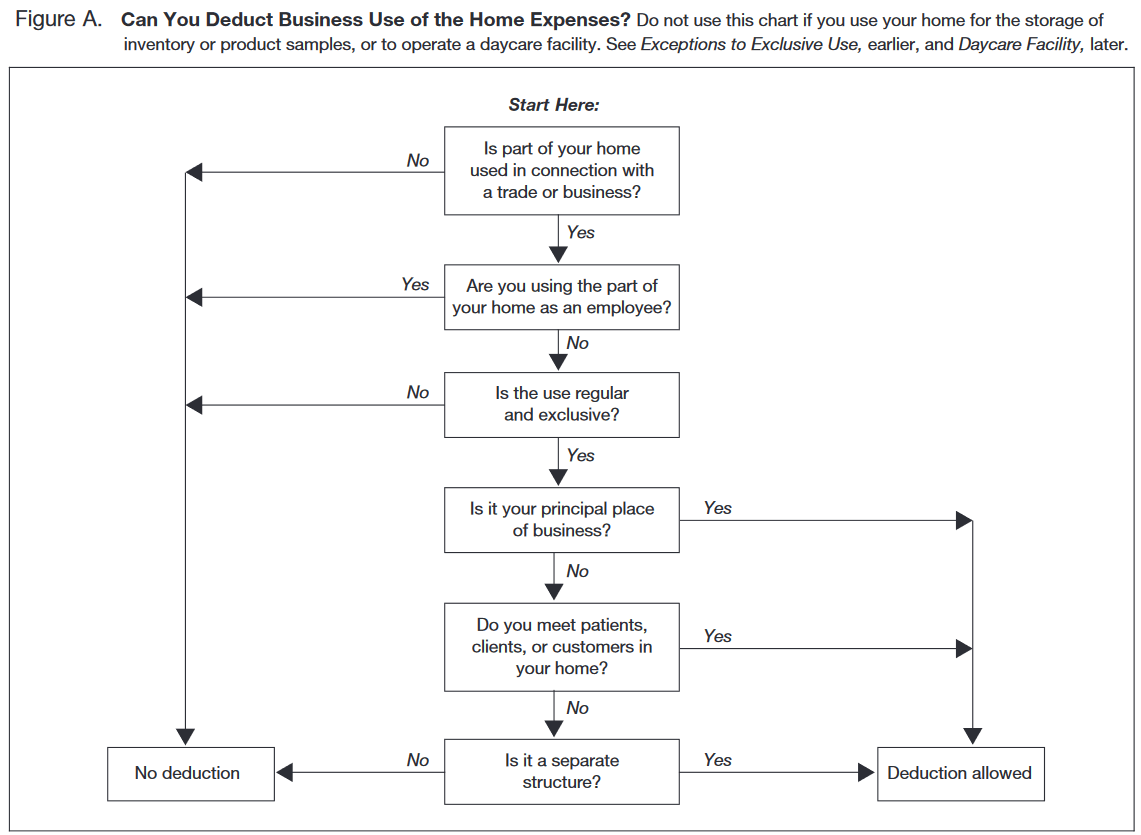

Our key reference source is IRS Publication 587, Business Use of Your Home. There is a nice flow chart we can walk through to see if someone can claim this deduction:

We start with the top question, “Is part of your home used in connection with a trade or business?” Hobbies do not get deductions (or generate income subject to self-employment taxes). A home office where you review financial reports and “carry out similar activities related to your own investments”? In Publication 587 the IRS specifically calls that out as not a trade or business.

Then we ask: are you using part of your home as an employee? If so, no deduction for you. Even if you are full time remote. W-2 employees don’t get a tax break for a workspace in their home. Your best bet here is to try and get your employer to reimburse you for as many business expenses as possible (which then become a deduction on their taxes), but that’ll be a separate deal unrelated to your personal income taxes.

So now we’re left with people who are either (a) fully self-employed or (b) have self-employment work they do in addition to work they do as a W-2 employee. Our next question is: is the use regular and exclusive?

Exclusive means you don’t use that part of the home for anything other than your self-employment work. If you have a desk where you sometimes pay personal bills and sometimes do self-employment work, no deduction for you. If you work off a laptop at your kitchen table, no deduction for you. If you create things in a part of your home where you also watch tv, no deduction for you. I do note there’s an exception for storage of inventory, see Pub 587 for details.

Overall, exclusive means the only activity in that area of your home is self-employment work. If you can only afford a small home where every space does double or triple duty, you are out of luck here. If you can afford a nice big house for your home-based employment, where you have enough space to use part of it exclusively for work, the federal government would like to give you a helping hand. Hmm…

Regular means…well here’s what the IRS says about that: “Incidental or occasional business use is not regular use. You must consider all facts and circumstances in determining whether your use is on a regular basis.” The Balance advises, “For example, if you use space as a home office where you go every month to pay bills, that’s regular use. But using it only once a year to prepare your tax return probably wouldn’t apply.”

Then we ask if the space in your home is your principal place of business. If you are a plumber/sales person/anyone who primarily works at client sites, but does administrative and managerial work in a home office, that home office is your principal place of business and you get the deduction. Forbes gives a nice example: “if you are a rideshare driver but do not have a work office and use your home office for ordering supplies, creating reports and other administrative tasks, you would qualify for the home office deduction.”

If it’s not your principal place of business, but you do meet customers in your home, you too can claim the deduction.

Lastly, if you regularly and exclusively use a separate structure at your home for your self-employment business, you can claim a deduction for that separate structure.

How do you determine the size of this deduction in dollars?

You use either the “simplified method” or “actual expenses.”

Under the simplified method you determine the square footage of your home work space and multiply by $5. You can only use up to 300 square feet for this calculation, even if your work space is larger. Under this method, if your work space is 100 square feet, your deduction is $500 (=100 * $5). If you use a 400 square foot area, your deduction is $1,500 (=300 * $5).

If you use actual expenses, you file Form 8829. Under this approach, you determine the percentage of your home’s square footage used exclusively for your business, and then allocate your total home expenses based on that. If your home office is 100 square feet and your entire home is 1,000 square feet, you allocate 10% of home expenses, like insurance, utilities, and repairs and maintenance to your business. In this example, if your electric bill averaged $100/month, $1,200 for the year, you’d allocate 10% of that, $120, to your business as part of the deduction.

The average amount claimed on Form 8829 in 2021, using the actual expenses approach, was $3,919, which is substantially more than the $1,500 max for the simplified method. That makes sense – people do the extra paperwork when it gets them some extra tax savings.

To my read of the data, when the simplified method was first introduced in 2013, only 1.1% of those claiming this deduction used it. That makes sense, it was new. In 2019, this was up to 20%, and by 2021, it had sharply increased to 44%! Simplification makes tax benefits more accessible to the people they are intended to reach.

This article was inspired by a question from a reader. She wondered if she could get a tax break for her home office for her W-2 job (sorry, no). If you have a tax question, please email to ask!

The Boring Newsletter is taking off the rest of March for a spring break. I hope the beginning of spring is wonderful for everyone, and perhaps that you get to enjoy some beautiful flowering trees.

-Stephanie