Hi Friendos,

Today we’ll continue our discussion of Social Security. We’ve talked about how you can establish an online account with the SSA (Social Security Administration) to review your earnings history, and last week we did a very high-level walk through of how monthly retirement benefits are calculated (the $ size of your future Social Security monthly check).

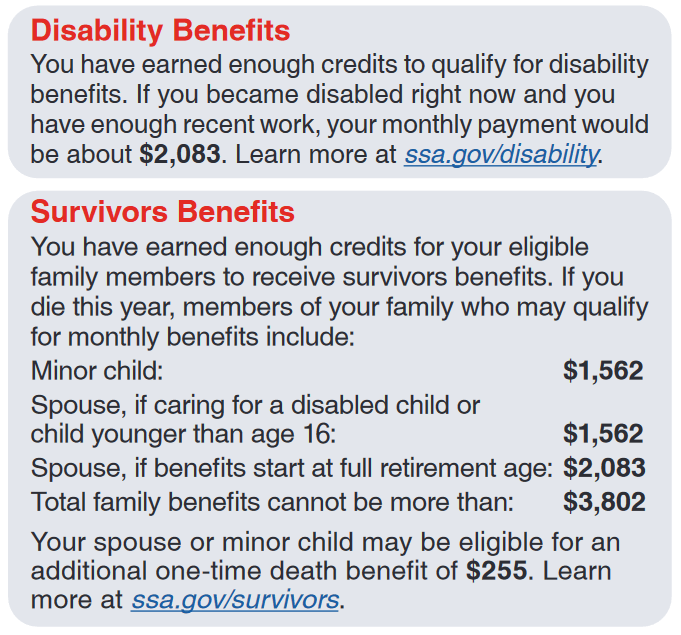

Before we tackle the fiction of our government’s accounting for Social Security, we need to touch on some other aspects of the program. The Social Security Administration doesn’t just send out monthly checks to older people. Take a look at your own Social Security statement (you’ve checked it on SSA.gov, right?) and on the first page, lower left, you’ll see something like this:

For those meeting all the required conditions, Social Security provides different types of benefits:

- “Retired worker and auxiliary beneficiaries” (retired workers, spouses and former spouses of retired workers, and certain children of retired workers)

- “Survivor beneficiaries” (spouses, certain children, and dependent parents of deceased workers)

- “Disabled worker and auxiliary beneficiaries” (disabled workers and their spouses and children)

In 2022, the first two categories (retired workers, their beneficiaries, and their survivors) received $1.09 trillion in benefits (83.3% of this to retired workers) and the third category (disabled workers and their beneficiaries) received $143 million (94.8% of this to retired workers). These benefits hinge on someone being a worker.

Congress created all of these benefits and all are obligations of the U.S. Government. Everyone who receives benefits gets a check from the U.S. Treasury. Typically the federal government pays for things with funds from “general revenues” (the federal income taxes you pay are part of these revenues). If Congress approves spending but there aren’t enough general revenues to pay for it all, the U.S. Treasury issues bonds (borrows) to cover the gap. When Congress created these different Social Security benefits, it decided to pay for them not from general revenues, but from a so-called “trust fund.”

More specifically, there is the OASI Trust Fund (the Old-Age and Survivors Insurance Trust Fund) and the DI Trust Fund (the Disability Insurance Trust Fund). The $1.09 trillion paid in 2022 to retired workers, their beneficiaries, and their survivors “came from” the OASI Trust Fund, while the $143 million paid to disabled workers, their spouses, and their children “came from” the DI Trust Fund.

Calling these “trust funds” was a specific political choice to shape the way Americans think about Social Security. Understanding their accounting is key to understanding why the manufactured panic about Social Security “running out of money” is unserious hokum, produced and reproduced for decades out of ignorance or a desire to cut benefits (aka, soak the poor and middle class). We’ll get into this accounting next week.

-Stephanie

p.s. One of the more fun parts of SSA.gov is the section on baby names. You can explore popular baby names by state and territory and also by decade (also, by birth sex – it is fully gendered). Development of all the current data was inspired by Actuarial Note number 139, “Name Distributions in the Social Security Area,” by Michael W. Shackleford, written in 1997.

One reply on “The Boring Newsletter, 1/21/2024”

[…] 1/21/2024: I discussed other types of benefits paid by the SSA, namely, disability benefits and survivor benefits, and provided my views that the naming of the “trust fund” that pays SSA benefits was a specific political choice and that the notion those “trust funds” are “running out of money” is unserious hokum! […]

LikeLike