Hi Friendos,

Happy new year! I hope you had a nice holiday season. Because it is January, I am updating my family finances binder, including working through its checklist, and developing my savings/investing plan for the year. Don’t all rush to invite me to your parties!

I am also thinking about how tax season will start in a few weeks. I get so mad that our tax system is so complicated we all have to either pay a professional or purchase tax software from private, profit-motivated companies in order to correctly fulfill our obligation to pay taxes. So I was thrilled to learn that this year the IRS has a pilot program that will allow some of us to prepare and file our federal tax return for free using a web-based, IRS-developed online tool called “Direct File.”

The pilot program is open to people who live in 12 states (listed below) and only have certain types of income/tax credits/deductions that will appear on their tax return. These are the 12 states:

- Arizona

- California

- Florida

- Massachusetts

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington state

- Wyoming

The program is only open to people with income from W-2 wages, Social Security, railroad retirement income, unemployment, and/or interest income under $1,500. If you have other types of income, like from self-employment, you can’t participate. Similarly, participants can only have a few types of credits (earned income tax credit, child tax credit, and/or credit for other dependents) and a few types of deductions (standard, student loan interest, and/or educator expenses). If you have other types of credits or deductions, you can’t participate.

You can read more about the program here and here.

Although I live in one of the 12 pilot states, I can’t participate because I had self-employment income in 2023. Otherwise, I would try it out!

Whether or not this Direct File pilot program is for you, do remember to see if you can file your taxes for free: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free.

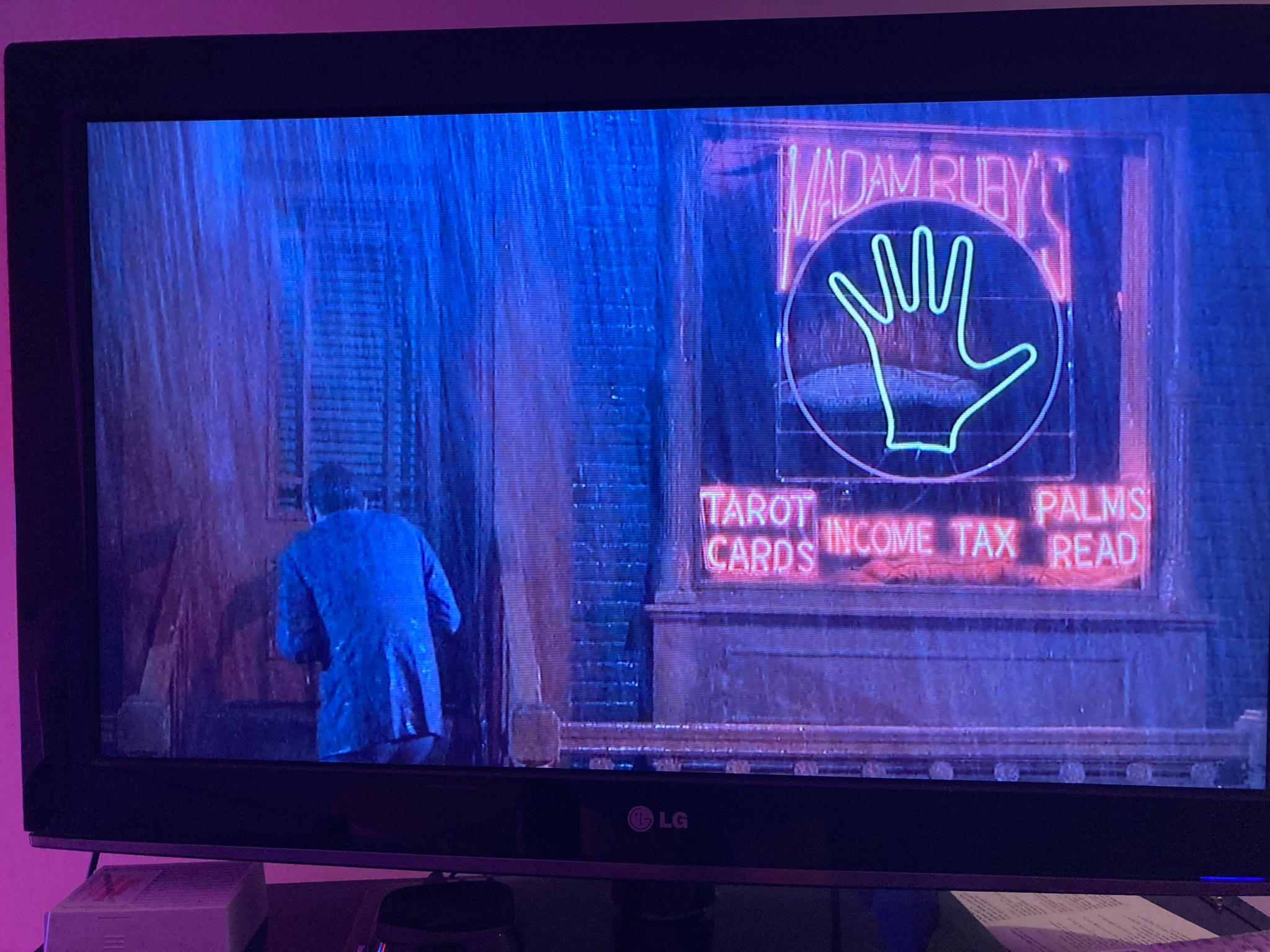

I recommend filing your taxes as soon as you have all your paperwork in hand (by mid-February for many people). If you’re getting a refund, you can get it as soon as possible. If you owe, you can file the return right away and schedule the payment to take place later on (any time before April 15th). Preparing a return early in the season gets you helpful information sooner rather than later such as if you should adjust your tax withholding, make different quarterly estimated payments, or need to save up for a tax payment. And you won’t need Madame Ruby!

-Stephanie