Hi Friendos,

In September I wrote about my family finances binder. The “Social Security” tab has my and my spouse’s most recent statements from the Social Security Administration (“SSA”). Social Security is an incredibly popular program among Americans of all political leanings and helps millions live above our official poverty line.

You will get Social Security: According to the SSA, “surprisingly high percentages of young workers consistently expect that they will not receive [any] future Social Security benefits” even though “nearly all workers [~96%] will eventually receive Social Security benefits.”

It will probably be more $ than you think: The SSA also found that some workers “substantially underestimate their future Social Security benefits relative to projections from the Social Security actuaries.” Translation: people underestimate how much money they’ll get from this program.

In the coming weeks I will write more about how Social Security works. Social Security benefits are financially significant for individuals, so it makes sense to spend a little time understanding how it will impact you. Your knowledge is also politically significant: politicians who want to cut benefits want Americans to be uninformed about this valuable program: lack of knowledge makes it easier to reduce benefits.

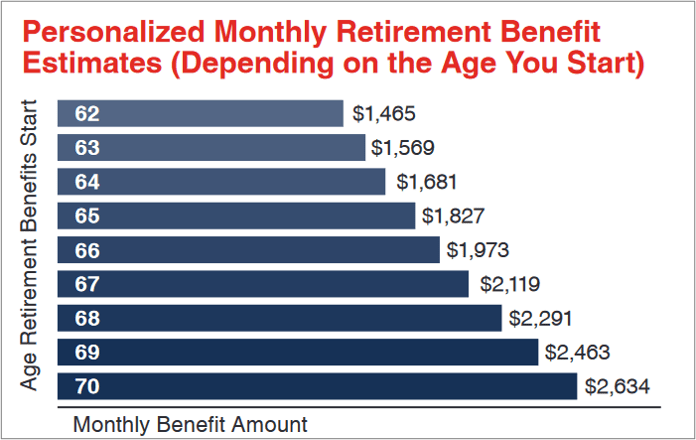

If you have never seen your personalized Social Security statement, I encourage you to take a look at it today. Go to SSA.gov and review your “record of earnings.” The first page will have a chart like the one below, showing how much you’ll get each month depending on when you choose to start receiving benefits. You get a lot more each month if you claim at an older age. On the other hand, not everyone makes it to age 70:

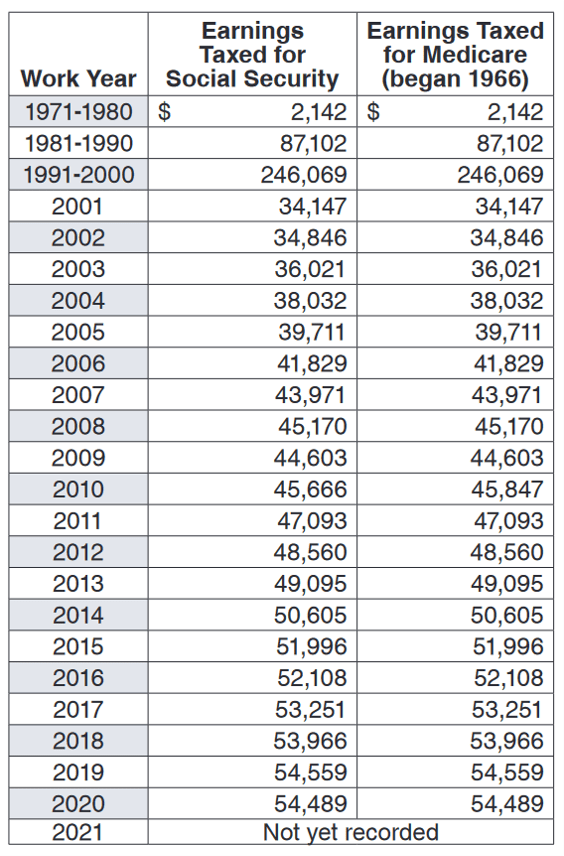

The second page of your statement will have a table like the one below, with a year-by-year listing of income on which you paid Social Security and Medicare taxes (payroll taxes). If you have a longer work history, some earlier years will be grouped together in one row:

It’s a good idea to verify the accuracy of those amounts against your own records (like your prior tax returns, W-2’s, year-end paystubs, things like that). If you spot any errors in your earnings record, you can contact the SSA to fix it. This is much more difficult if the error is more than 3 years and 3.5 months old, so that is why I recommend checking in on this once a year or so.

With my own SSA account already set up, it usually takes me under 15 minutes to log in, pull an updated statement, check the most recent year’s info, and file it in my records. If you’ve never done this, consider making it part of an annual financial wellness practice. You’ll be more informed about your own financial future and a more informed citizen.

-Stephanie

2 replies on “The Boring Newsletter, 12/10/2023🏦🫰”

[…] month I started a discussion about Social Security retirement benefits. I’ll continue on this theme for […]

LikeLike

[…] 12/10/2023: I encouraged you to establish an online account with the SSA, review what the SSA thinks your earnings were in prior years, and contact the SSA to fix any errors you spot. Then, log on once a year to check the most recent info. […]

LikeLike