Hi Friendos,

Today I am pleased to bring to you a tax-avoidance technique that is only available to low and moderate earners – high income people, you are excused! This technique is called capital gains harvesting and takes advantage of the 0% capital gains tax bracket. There is never a bad time to do this, but with only 5 weeks left in the year, this is the perfect time to see if you are a candidate for this and if so, to make sure you get it done before calendar year end.

This entire discussion only applies to “regular” investment accounts, not to traditional or Roth IRAs, not to traditional or Roth 401Ks, and not to any other type of tax-advantaged account (403B, 401A, etc.). Only regular brokerage accounts.

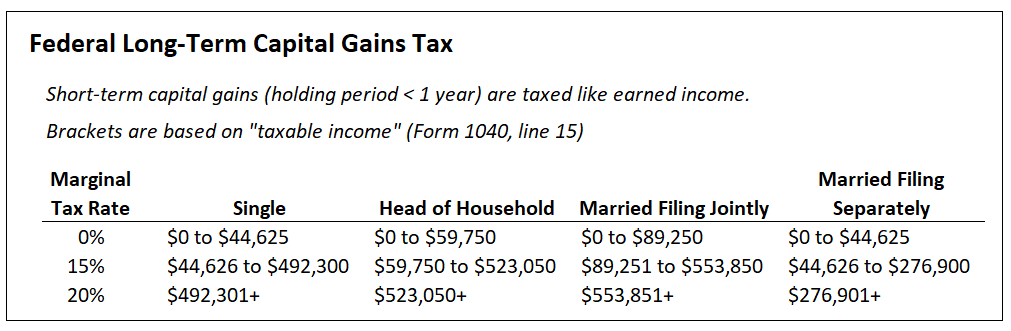

If you’d like a little refresher on investment income and how interest income and capital gains are taxed, you can revisit lesson 6 from our Summer School series on Form 1040. In that article, we looked at federal tax brackets, including the separate bracket for taxation of long-term capital gains. Here is what those brackets look like for 2023:

These brackets are based on “taxable income” which you can find on line 15 of Form 1040. Not all income is taxable. For example, imagine a single person in 2023 with these details:

- Gross income from their W-2 job of $55,000,

- Realized capital gains (in their regular brokerage account) of $600,

- Contributed $6k to a traditional IRA ($500 a month, nice work), and

- Paycheck deductions of $5k for medical and dental insurance.

This person’s total income is $55,600 but their taxable income is much lower: subtract off the standard deduction of $13,850, subtract the $6k traditional IRA contribution, subtract the $5k of payroll deductions for insurance, leaves them with only $30,750 of income subject to taxes in 2023 and putting them squarely into the 0% bracket for long-term capital gains.

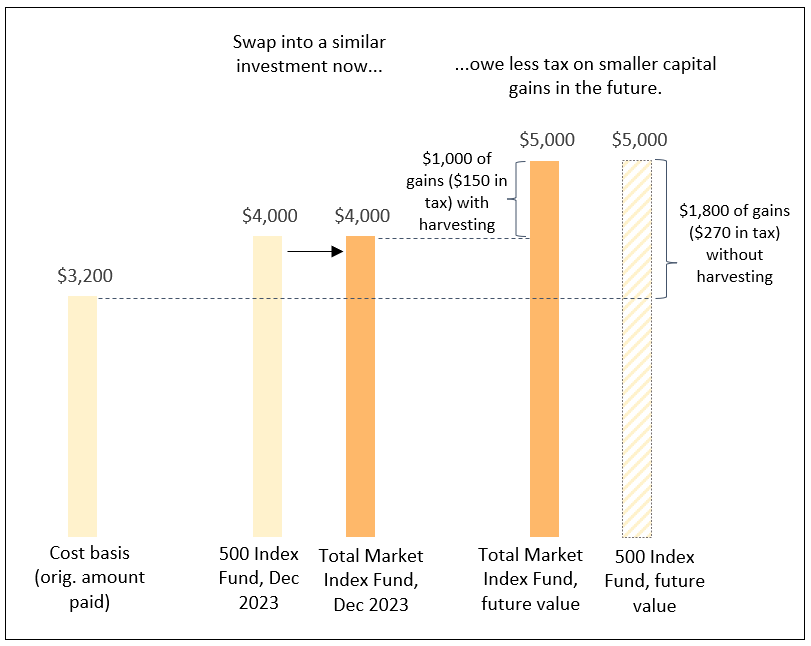

This person could realize an additional $13,875 of capital gains (=$44,625 – $30,750) and not owe any additional taxes. What if they want to remain invested in the market? Just find a “partner” investment that closely tracks whatever they currently own. Example: in my regular Fidelity investment account I own the Fidelity 500 Index Fund and the Fidelity Total Market Index Fund. These funds have very, very similar (but not identical) investment performance, so if I trade some $ from one to the other, that’s just fine.

Imagine our taxpayer is a dedicated index fund investor (smart) and when they log into their Fidelity brokerage account, they see the current value of their Fidelity 500 Index Fund holdings is $4,000 (all purchased more than a year ago) but their cost basis is only $3,200. They are sitting on $800 of unrealized capital gains. They can exchange all of their current holdings for Fidelity Total Market Index Fund, and realize those gains, remaining fully invested in the market, and owe no additional tax.

Why bother? Maybe next year this person gets an amazing promotion at their job and their new salary is $75,000. They won’t be in the 0% capital gains bracket any longer, but they have managed to “step up” their cost basis, minimizing taxes for their future self.

I know the tax savings of $120 in this example may not sound like a thrilling amount. But you can imagine larger amounts involved and greater tax savings, and also the additive benefit of doing this for many years. If your income varies from year to year, you may want to put this on your year-end tax planning checklist.

-Stephanie