Hi Friendos,

Health insurance open enrollment is coming up in a few weeks so this month I’ll write about some related topics. This week is about explaining the financial benefit from FSAs and HSAs (“flexible spending account,” “health savings account”), specifically, how they save you money. Next week I’ll talk about how much. This helps you identify your best options at open enrollment.

FSAs have been around for decades, HSAs since 2004. I don’t see them going away any time soon, so if you have medical expenses and like saving money, it’s worth it to understand these things. If you’re still not sure you’d like an FSA or HSA, you can take my one-question pop quiz to find out (I first gave this last March):

Imagine you are getting ready for a road trip and want to buy a deluxe first aid kit ($40) and a couple tubes of nice sunscreen ($30). Do you:

A. Pay $70 from your checking account, or

B. Use a $15 discount code from the federal government and pay $55 from your checking account.

(it is not a trick question)

Let me recap those options.

A. Pay $70 from your checking account:

B. Pay $55 from your checking account (plus the $15 discount code from the federal government):

It’s B! The answer is B!

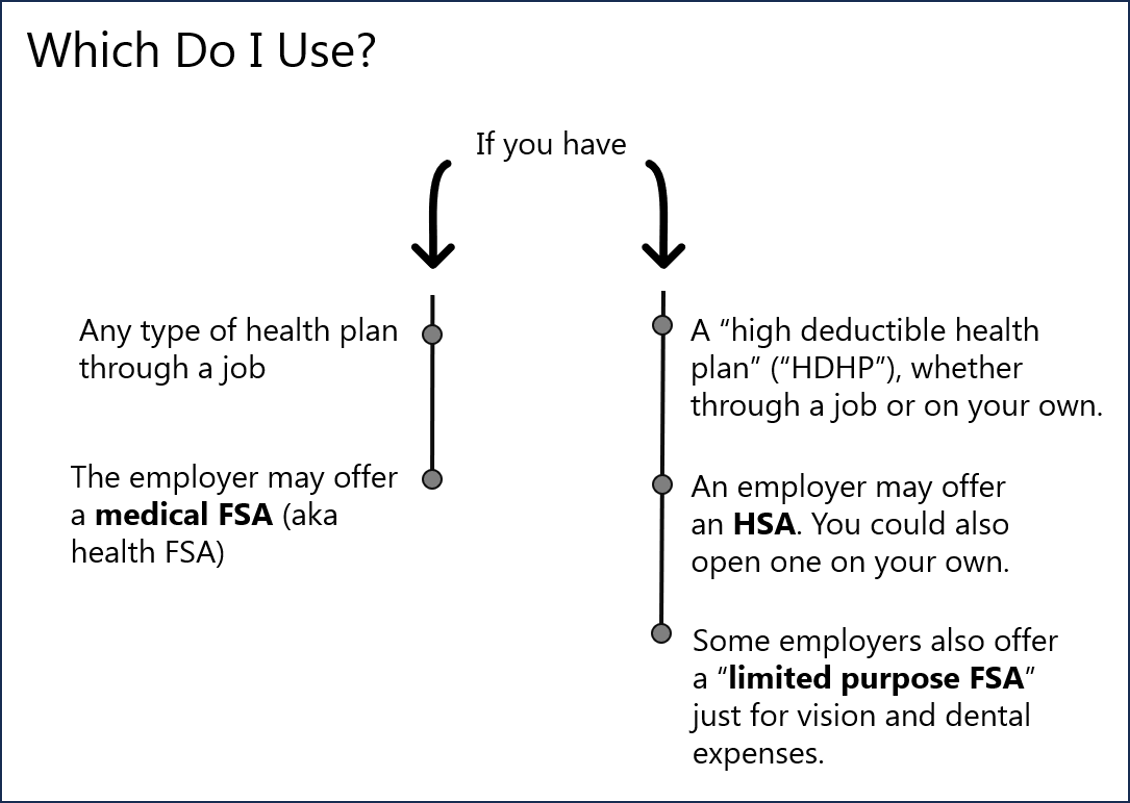

A key to success here is that you were going to buy the items anyway, so using the FSA or HSA helps you buy them at a lower cost. If you weren’t actually going to buy the items…well, we all know that even the “greatest deal” is not so great if you’re overspending. Here’s a quick roadmap of whether you’d use an FSA or an HSA, as this is generally an either-or situation.

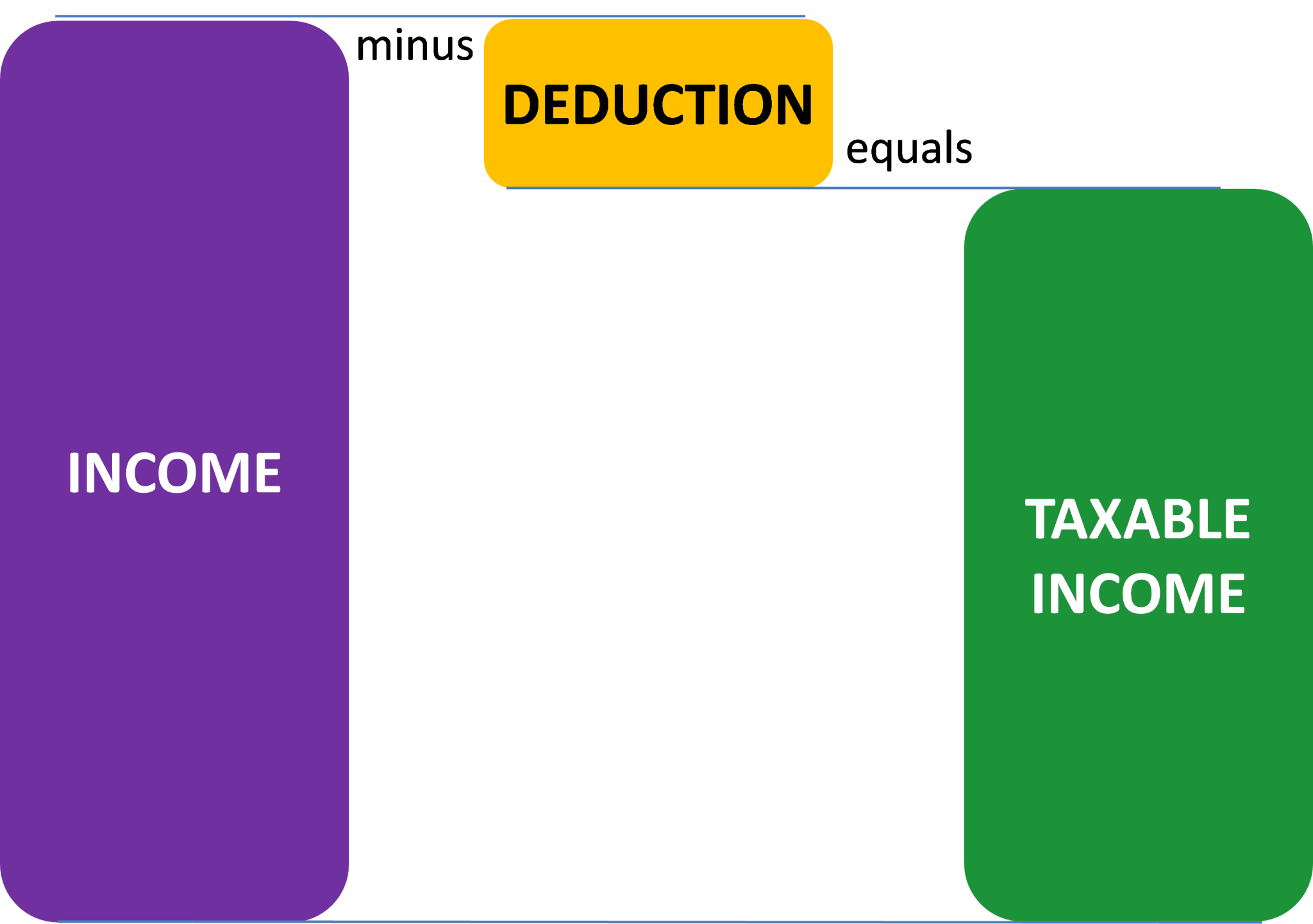

How do they save you money? Short answer: by reducing your income taxes.

Long answer: reducing your income taxes (employer-edition):

If you’re doing this through an employer, you make contributions to the FSA or HSA through payroll deductions (FSAs are only offered through employers). You tell your employer how much of each paycheck you want to send to your FSA or HSA (do a paystub audit to make sure this is happening as you expect). Your paystub may show “gross” pay and “FIT taxable wages” (FIT = federal income tax) and the difference between the two will be equal to the amount of your FSA/HSA contributions plus all other “pre-tax” payroll deductions (such as contributions to a traditional 401k and the premiums you pay for medical insurance). It is just like other kinds of tax deductions, although here, all the action happens via paychecks (not when you prepare your tax return):

When you get your W-2, the amounts on the form will be like the green bar in the picture above, and will entirely exclude the amounts you contributed to the FSA or HSA.

These kinds of payroll deductions let you realize the benefit of tax savings right away, because your employer will withhold less in taxes each paycheck.

Long answer: reducing your income taxes (on-your-own-edition):

You might contribute to an HSA directly where you send $ into the plan yourself. This could be because you buy health insurance on an exchange, so DIY is your only option. It could be because your employer’s HSA plan stinks (high fees, maybe), so you want to go with a better plan. If could be because you didn’t set up the payroll deductions for some reason (oops) but still want to contribute for that year.

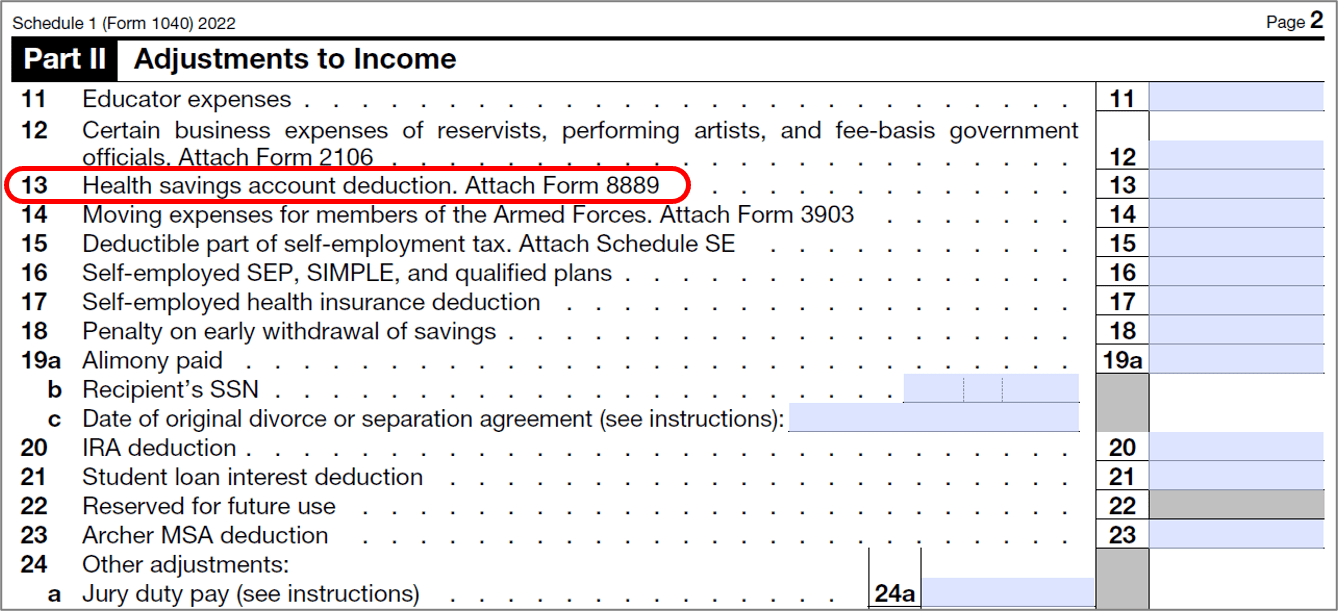

If you contribute yourself, the tax benefit happens when you prepare your tax return. You let the IRS know how much you contributed on Schedule 1 to Form 1040:

And that flows through to page 1 of Form 1040 as an “adjustment” that reduces your taxable income:

So when you contribute to an HSA on your own, you don’t realize the tax benefit until you do your taxes, when it reduces your taxes owed (or increases your tax refund).

Next week we’ll talk about how much these contributions can reduce your taxes, to help you decide if they’re worth it to you.

-Stephanie

3 replies on “The Boring Newsletter, 10/8/2023”

[…] Last week I wrote about how FSAs and HSAs save you money (lowering your taxes), and I promised to talk this week about how much they can save you, so you can decide if putting your $ in one is worth it to you. This week is a deep dive on FSAs. Next week we can get into HSAs. Then we can put it all together with an analysis to choose among different insurance options (with or without an FSA or HSA). The administrative burden of understanding and using these accounts is real, so you’ll want to know if it’s worth the bother. […]

LikeLike

[…] How FSAs and HSAs save you money, here. […]

LikeLike

[…] the tax benefits of these health plans and I’ve written about them in the past, explaining how the tax benefit works and quantifying it in dollars (here for FSAs and here for […]

LikeLike