Hi Friendos,

Last April I wrote about The Checklist I go through each January as a sort of household financial tune up. The Checklist lives in a “Family Finances Binder” I promised I’d write more about. That fine day has finally arrived!

When I was a single gal in my early 20s, I heard a few stories about women who were widows and their husband had handled all the finances (very gender normative). Now these ladies were grieving AND they had to figure out all their money stuff. Sometimes they didn’t know where their money was or if they had certain insurance or what to do about the property tax bill that just arrived in the mail.

Well! I would never be an old lady who did not know about her money stuff!

But I also never wanted to be a spouse whose partner ended up in such a bad place. After I got married and our money management got more enmeshed over the years (I ended up doing more and more of it), I experimented with different things to keep my partner in the loop. I tried to institute monthly family finance meetings…oh boy those did not last long, but the Binder + Annual Checklist system has worked for us.

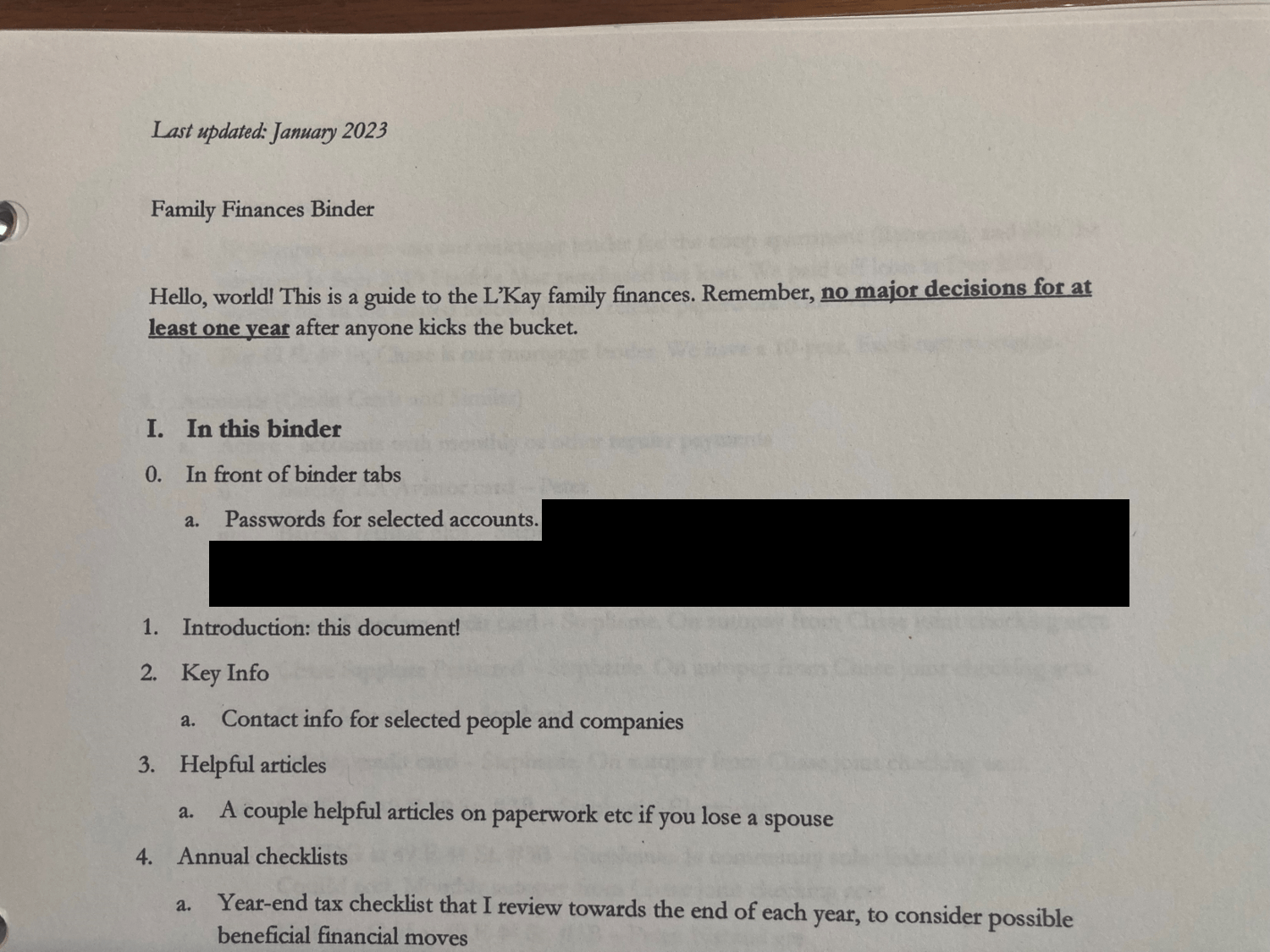

I also take comfort knowing that the Family Finances Binder would be a great resource if I ended up in the hospital for a while and couldn’t manage our money during that time. If you don’t want to totally DIY it, Emergency Binders provides a great option (I bought from them years ago to help ensure we’d covered all our bases). Our Binder starts with some charming pictures from our honeymoon.

Then there’s an introduction that explains what is in the binder.

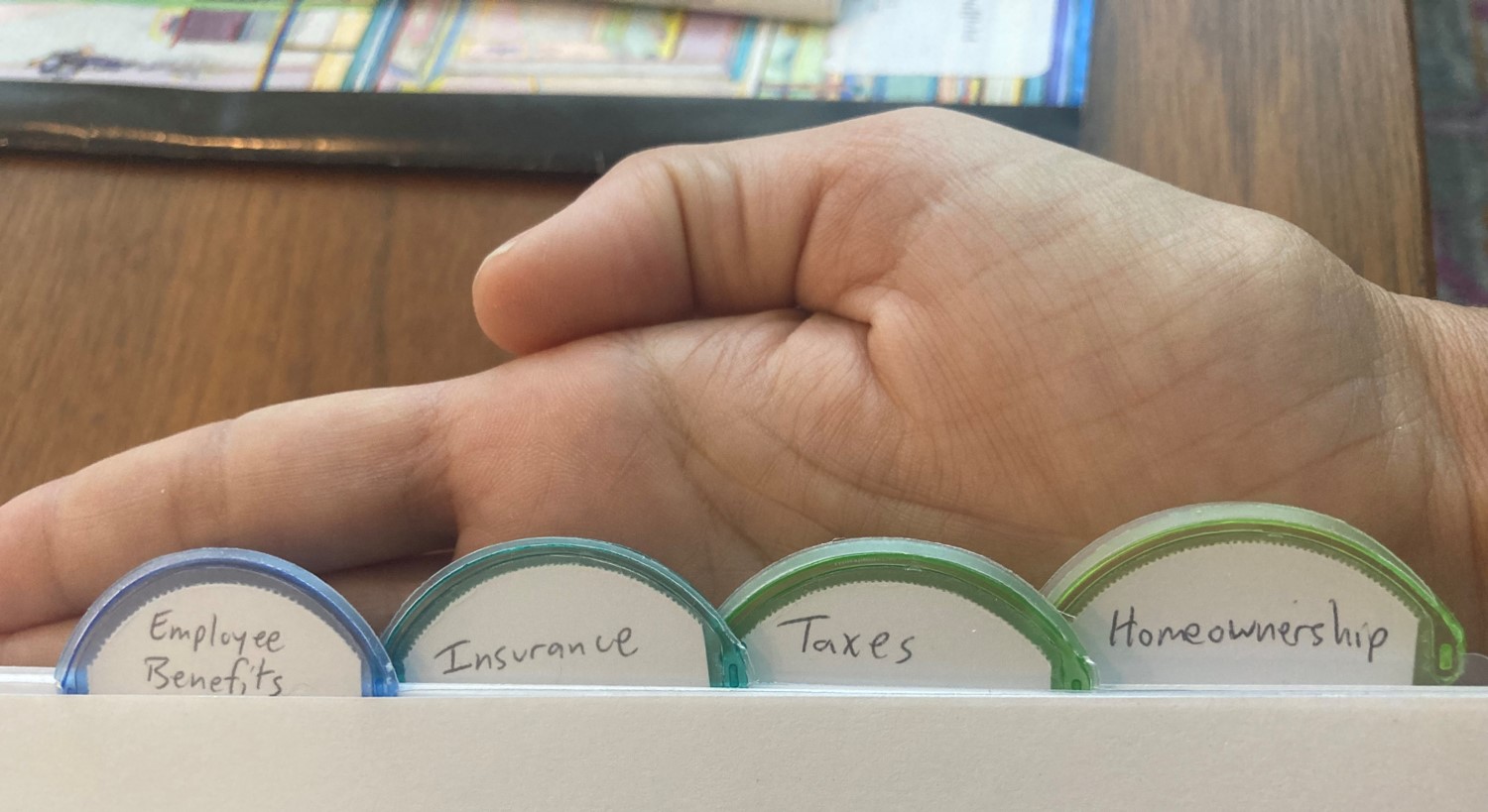

Then there are tabs for each key area I wanted the binder to cover: introduction, key info, helpful articles, annual checklists, employee benefits, insurance, taxes, homeownership, active accounts (like, our electric, internet, etc.), checking and savings accounts, investment accounts, pension (from one of my old jobs), social security. Wow you are thinking, this sounds really boring to put together. Indeed.

When I first made the binder, I think it only had tabs for investment accounts – no intro, no guidance info, just a printout of each account’s most recent statement. I added to the binder incrementally over time when I thought of something else that would be useful.

The employee benefits tab has printouts to show what kinds of coverages our jobs offer (e.g., disability coverage, group insurance policies). The insurance tab has printouts for each of our active policies (homeowners, auto, flood). The idea is that my spouse (and any trusted friends or family members helping him) could review whatever was in the binder and figure out next steps from that.

More than once I’ve considered going digital with this, but for various reasons, I continue to think analog is better for us (your mileage may vary).

I don’t think you need a spouse for a binder like this to be a good idea. Anyone handling your affairs after you die will really appreciate this kind of information. Preparing it is an act of love.

-Stephanie

4 replies on “The Boring Newsletter, 9/17/2023”

[…] September I wrote about my family finances binder. The “Social Security” tab has my and my spouse’s most recent statements from the Social […]

LikeLike

[…] year! I hope you had a nice holiday season. Because it is January, I am updating my family finances binder, including working through its checklist, and developing my savings/investing plan for the year. […]

LikeLike

[…] New Year! As usual at the beginning of the year, I am tackling an update to my Family Finances Binder, which includes running through a financial checklist (rebalance my investment portfolio? done!) as […]

LikeLike

[…] some point, consider creating a version of a Family Finances Binder. I wrote about that in this article and this […]

LikeLike