Anatomy of a 1040, Class 10

Hi Friendos,

Welcome to our tenth and final summer school class for Anatomy of a 1040! Today’s lesson is about the actual payment or refund that goes along with filing a 1040. Here’s an overview of everything we’ve covered this summer:

- Class 1: A little history of Form 1040 itself and an overview of the 6 parts that comprise today’s form.

- Class 2: First discussion of the tax-relevant info gathered at the top of Form 1040, including filing status and SSN/ITIN.

- Class 3: Second discussion of the tax-relevant info gathered at the top of Form 1040, including digital assets (crypto), and dependents.

- Class 4: All about W-2 income and how this relates to the stated salary for a job and what shows up on paystubs.

- Class 5: All about interest income.

- Class 6: Dividends and capital gains, that along with interest income comprise the investment income trifecta.

- Class 7: All the many kinds of other income the IRS wants you to report.

- Class 8: Self-employment income.

- Class 9: The standard deduction and itemized deductions.

- Class 10: Today’s discussion of the payment or refund associated with filing Form 1040.

So the first 9 lessons were about page 1 of Form 1040, and today we’re going to blaze through page 2.

Big picture, page 2 is figuring out the total amount of tax you owe for the year (“total tax,” line 24) and comparing that to the amount you’ve paid so far (“total payments,” line 33). If “total payments” are more than “total tax” you get a refund and if they are less, you owe. It is a true-up process, like this:

How is your “total tax” figured? This amount, the total you owe for the year, mostly consists of multiplying your $ amount of income by whatever tax rate applies to that income. Sometimes there is a tax credit that reduces the amount of total tax owed for the year (e.g., the child tax credit, line 19). These are called non-refundable credits, because they can reduce your tax down to $0, but they can’t make it go below $0 (that’s why line 22 says “If zero or less, enter -0-”).

How are total payments figured? This amount, the taxes you’ve already paid during the year, mostly consists of taxes withheld from income (e.g., if you have a W-2 job, your employer withholds taxes from your paycheck) and estimated taxes you sent in to the IRS (e.g., if you are self-employed, you pay quarterly estimated taxes). Sometimes there is a tax credit that we say counts as a payment, even though you didn’t actually send in cash (e.g., the earned income credit, line 27). These are called refundable credits, because they can result in the IRS sending you a check. The Earned Income Tax Credit is the largest welfare program in the U.S., outstripping food stamps back in the mid-1990’s and growing substantially since then.

After you figure out your refund or additional amount owed, the bottom part of the form gets your bank account info, signature, and info of your paid tax preparer if you are using one (in 2018, 53% of tax returns used a paid preparer). Also, if you opted for an Identify Protection PIN (an anti-fraud measure I do recommend for everyone), you provide that number also.

And that’s it. The basic anatomy of Form 1040.

The U.S. tax system is enormously complicated and during these last ten weeks I kept getting upset about this. Complications often serve a role of hiding tax cuts put in place by wealthy electeds in Congress and their wealthy benefactors. Or they allow politicians to act like they are providing benefits for everyone, but the associated administrative burden functions as a rationing device. My view is that taxes, most people’s largest expenditure, which we all must pay, should be understandable by an ordinary person. The tax system should be for the people.

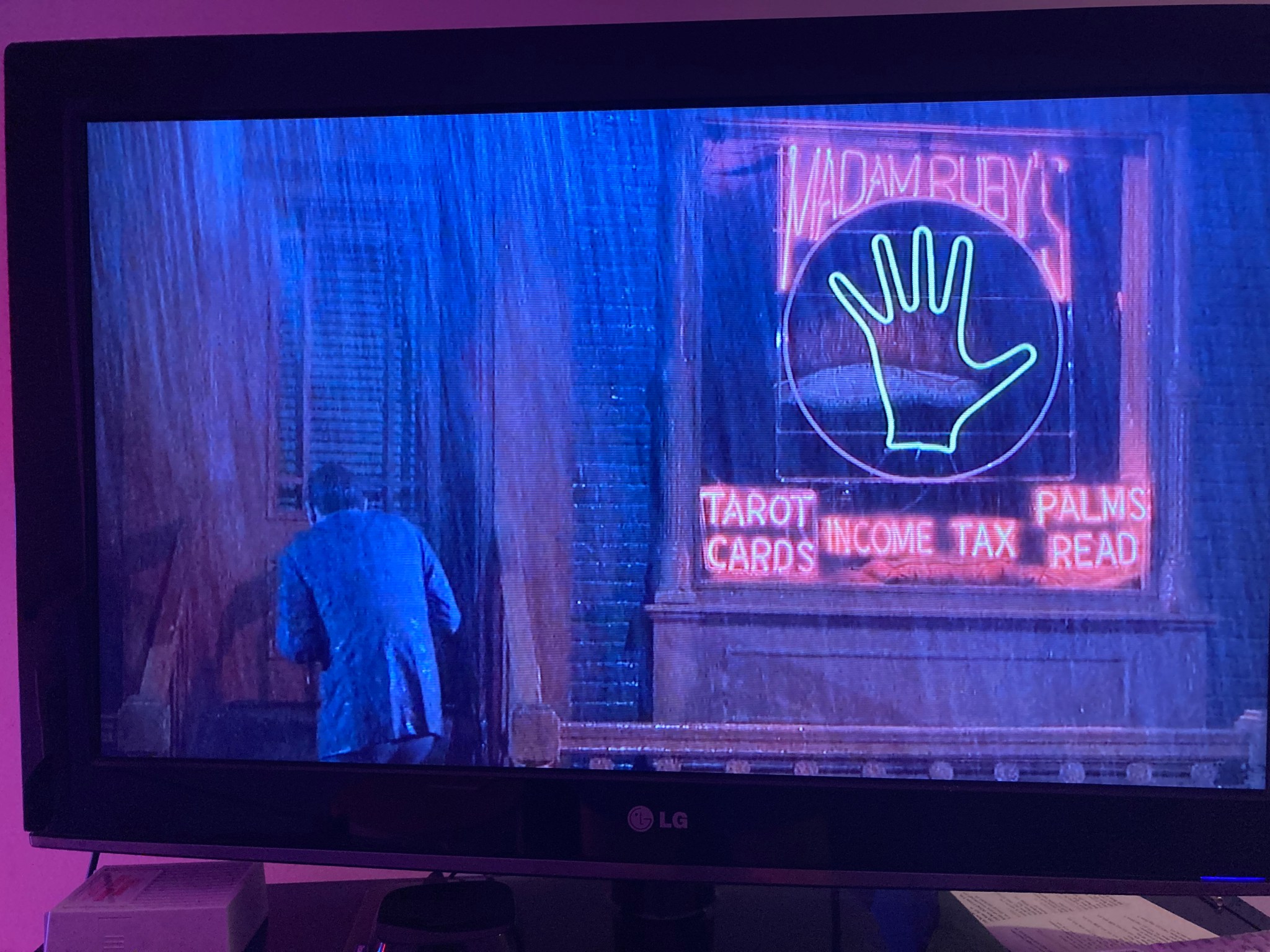

Over here at Frequently Taxed Questions, I’m trying to do my little part so that next spring, none of you will go to Madam Ruby when you’re getting ready to file your return!

-Stephanie