Anatomy of a 1040, Class 9

Hi Friendos,

It’s the middle of August, the tomatoes are on point, you’re havin’ a summah, and it’s the perfect time to talk deductions. Student loan interest. Self-employed health insurance. Certain HSA contributions. And the biggie: Itemized vs standard. This one teaches you why mortgage debt and charitable donations probably have no impact on your taxes (so just decide what’s best for you on the merits).

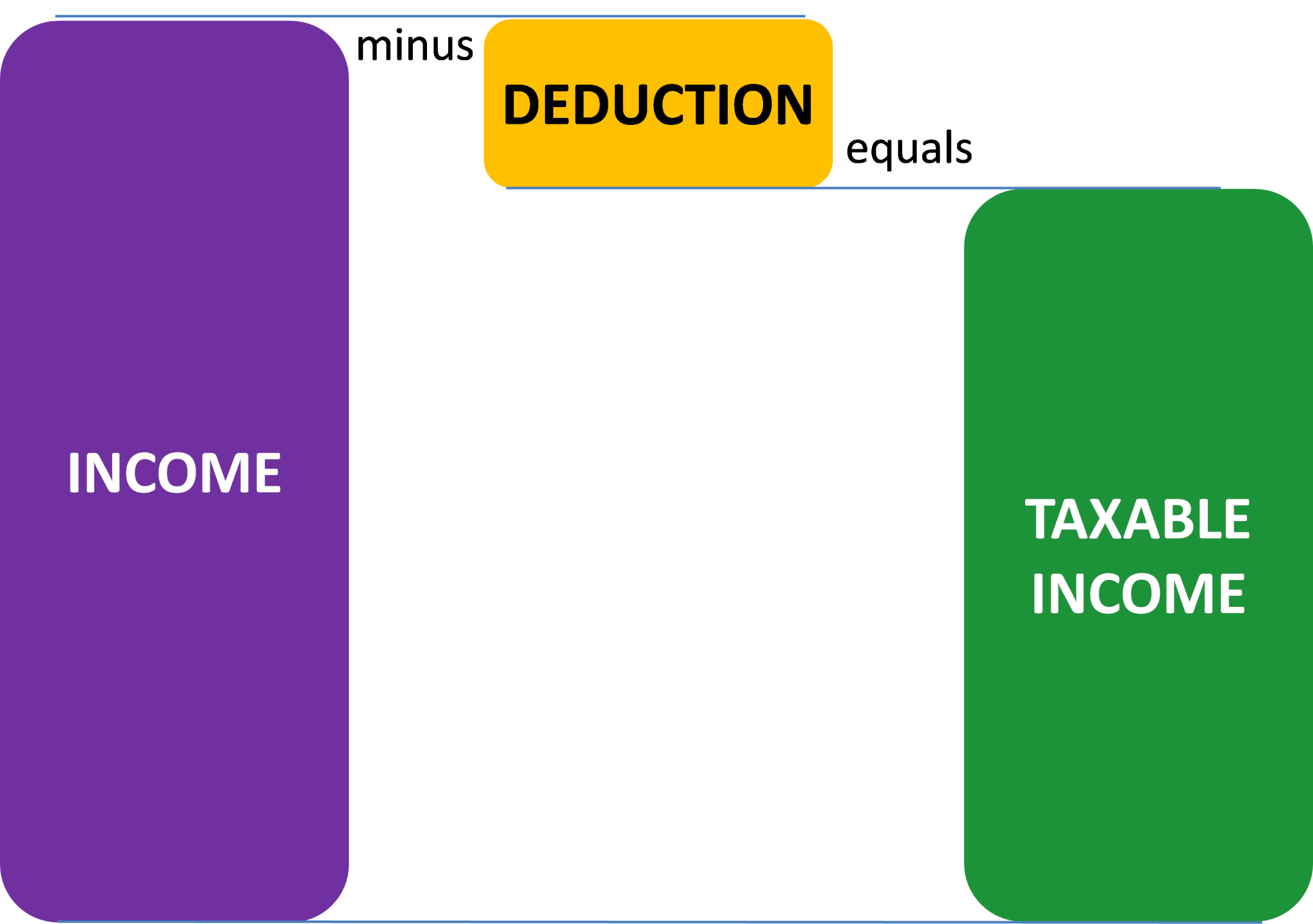

We’ve talked about the many types of income you might have, and how the IRS wants you to declare all of it. Good news though, Congress has decided that we don’t have to pay tax on every dollar of income. We have some “adjustments” that flow into line 10 on Form 1040, and then “deductions” that flow into lines 12 and 13. They all reduce the $ of income on which you have to pay tax. Like this:

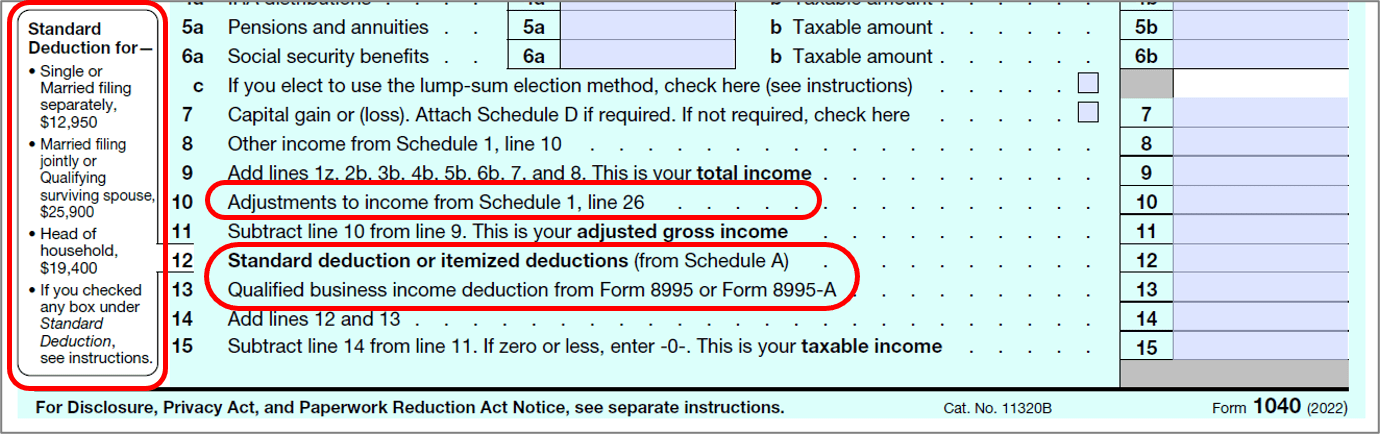

Here is where you see this on Form 1040 (the subtraction happens on line 15):

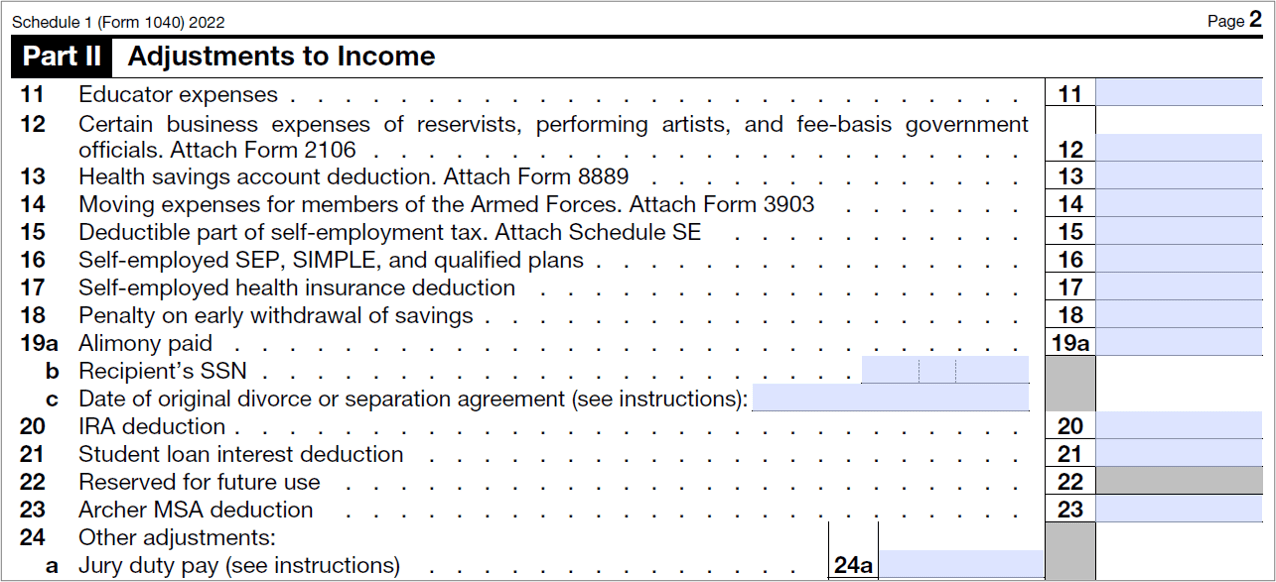

Line 10: What are these “adjustments”? Schedule 1, page 2 lays it out. Here I show the top part of the page with the more common ones:

A few highlights:

- Educator expenses, line 11: Teachers can deduct up to $300 when they spent their own money on classroom supplies or other qualified expenses ($600 if it’s a married couple filing jointly and they are both teachers). So teachers, above $300, you don’t have to save receipts. Also, I’m sorry your school doesn’t give you enough funding to meet your classroom needs.

- HSA (health savings account) deduction, line 13: if you have a high deductible health plan for insurance, you are allowed to have an “HSA” account. If you contributed directly to an HSA (like, sending in $ from your checking account, not via payroll deduction at your job), this adjustment is the mechanism by which your contributions become “pre-tax.”

- Self-employed health insurance, line 17: if you are self-employed and buy your own health insurance, you can deduct the premiums.

- Student loan interest deduction, line 21: if your income is below $85k (single, head of household, qualified surviving spouse) / $175k (married filing jointly), you can deduct up to $2500 of interest paid on student loans. It is not a tax benefit for higher education (we do have a couple of those); this one is a tax benefit for debt incurred for higher education.

After you’ve “adjusted” your income, you then pick between the “standard deduction” or “itemized deductions.” The standard deduction is just a flat dollar amount corresponding to your filing status (in 2023, $12,950 for single/married filing separately, $25,900 for married filing jointly, $19,400 for head of household). Itemized is the sum of whatever “Schedule A deductions” apply to you.

Form 1040, Schedule A lays out the potential deductions you could itemize: medical and dental expenses (up to 7.5% of your AGI), state and local income taxes, mortgage interest, gifts to charity, casualty and theft losses from a federally declared disaster, and “other.” I note that the mortgage interest deduction is a tax break for housing debt, not for housing itself. It applies to owner-occupied homes and vacation homes. Which to choose? Whichever one is larger, because that will make your taxable income smaller, and taxes owed smaller. Like this:

The picture above is an example where itemized deductions add up to more than the standard deduction. In 2018 (most recent year with available data), over 87% of tax returns used the standard deduction. Many tax returns are for a married couple, so 87% of tax returns is less than the % of people associated with those tax return. For the vast majority of people, “itemized” deductions do not impact their taxes, because they claim the standard deduction. Hence my statement above the mortgage interest and charitable deductions do not impact most people’s taxes.

It is mostly high-income people that itemize, usually because they paid more than $10k in state and local income taxes, have a lot of interest paid on their mortgage (because they own an expensive home and borrowed a lot to buy it), and hopefully also made a lot of charitable donations. This is why I think the mortgage interest deduction functions as a federal housing subsidy for rich people. That said, it is not that hard for non-super-high-income people to have selected years when they itemize for medical expenses (e.g., transitioning, IVF) or for someone with chronic medical needs to itemize for that reason.

If you have a year when you will itemize anyway, you might be able to move other itemized deductions to that year, rather than the year before or after. Charitable donations are a good example of this – if you typically make donations in December, you could delay one year’s donations until the following January and then also capture the following year’s December donations in the same calendar year.

That’s all for today, see you next week!

-Stephanie

5 replies on “The Boring Newsletter, 8/13/2023”

[…] income (this is 10% for grad school loans). “Discretionary income” is defined as AGI (adjusted gross income from your tax return) minus 225% of the federal poverty level (FPL, a dollar amount that varies […]

LikeLike

[…] most people, they claim the standard deduction so they owe no taxes on $12,950 of their income. Another way to say that is: $12,950 of their […]

LikeLike

[…] on an exchange because you are self-employed and deduct premiums on your tax return (as an adjustment on Schedule 1 of Form 1040), you also pay with pre-tax dollars and have tax savings on premiums. If your job does […]

LikeLike

[…] Truth: Ok, this is not a total myth, but did I get your attention? Fewer than 10% of Americans get any tax benefit from these deductions, even if they did give to charity and even if they do pay interest on a home mortgage. That is because over 90% of people take the “standard deduction” and do not “itemize” their deductions (I wrote about this in a prior newsletter). […]

LikeLike

[…] file their tax returns; they do not itemize. I gave a detailed explanation of these mechanics in this newsletter. Well, effective this year there is a new “above-the-line” deduction for charitable giving, up […]

LikeLike