Anatomy of a 1040, Class 8

Hi Friendos!

Today, Summer School Lesson 8 is all about self-employment income, and our last discussion of the “income” portion of the tax return. We’re in the home stretch: next week we’ll talk about the standard and itemized deductions, and then our final lesson will be about tax payments and figuring a refund or amount owed.

There are so many interesting aspects of self-employment income! Today I want to just touch on two: (1) that you only owe taxes on business “profits,” and (2) the distinction the IRS makes between a “business” and a “hobby.”

You might have your own business but not really think of it that way, especially if it is not your primary job. You don’t need to have an LLC or an S Corp or any employees or even a bank account for the IRS to consider you as having your own business. It does not matter whether you are paid by Venmo, e-check, paper check, or paper cash, the IRS wants you to declare net income from your business and pay tax on it. The action here happens on Schedule C of Form 1040.

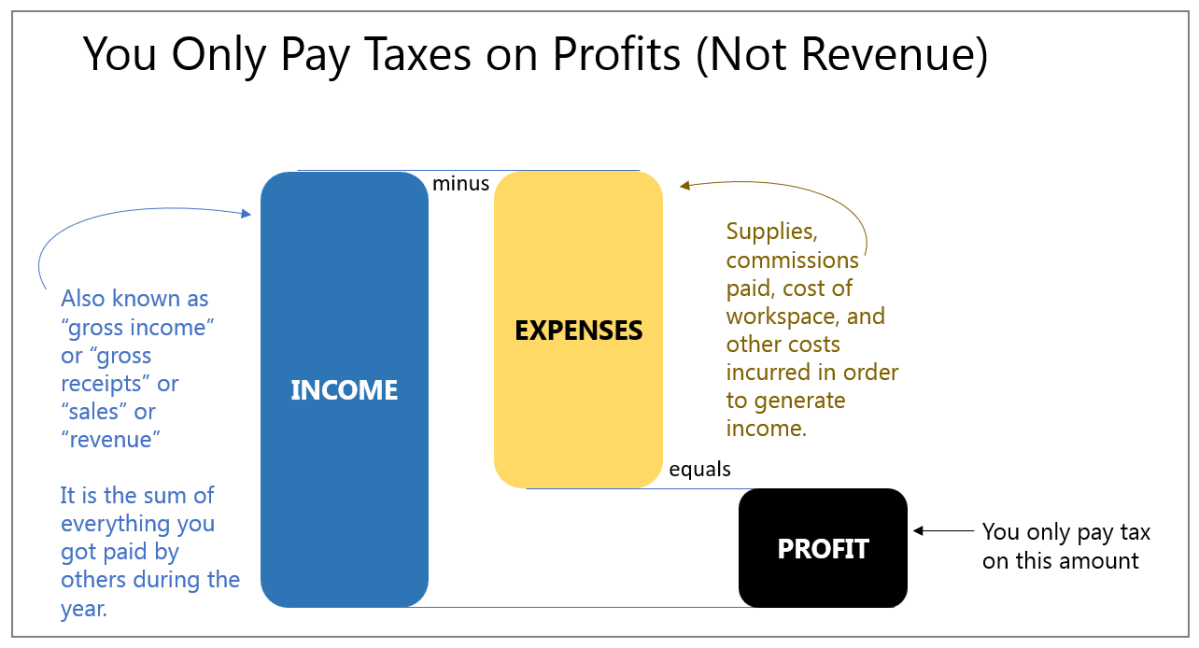

Schedule C has you figure out the “Income” and “Expenses” of your business, and then the difference between the two is the “net profit” on which you must pay tax. I think Schedule C was first introduced in 1955, and that year’s instructions, explain: “The law taxes the profits from a business or profession—not its total receipts.”

Like this:

If expenses exceed income, you have a loss and therefore there is nothing to pay tax on. You would report the loss to the IRS and the amount you lost can be used to offset against other taxable income.

You may have noticed that the loss is a red bar, and in the profit image above, the profit is a black bar. If you’ve ever heard the expression of a business being “in the black,” or “in the red,” this is literally what it means – that the business has made a profit or a loss. The current spin on the phrase “Black Friday” is that for retailers, the day after Thanksgiving is commonly the first day of the year when they are in a net profit position for the year to date (the original meaning of the phrase is different).

When people talk about something being a “deduction” or a “tax write off” they often mean something that is an expense for self-employment income. That’s because each $ of expenses reduces the amount on which they have to pay taxes. So are “write offs” fabulous and you should want more them no matter what, like Kramer on Seinfeld seemed to think? No! If your business spends $100 on an unnecessary expense it might save you $30 on taxes, but you are down $70 on net.

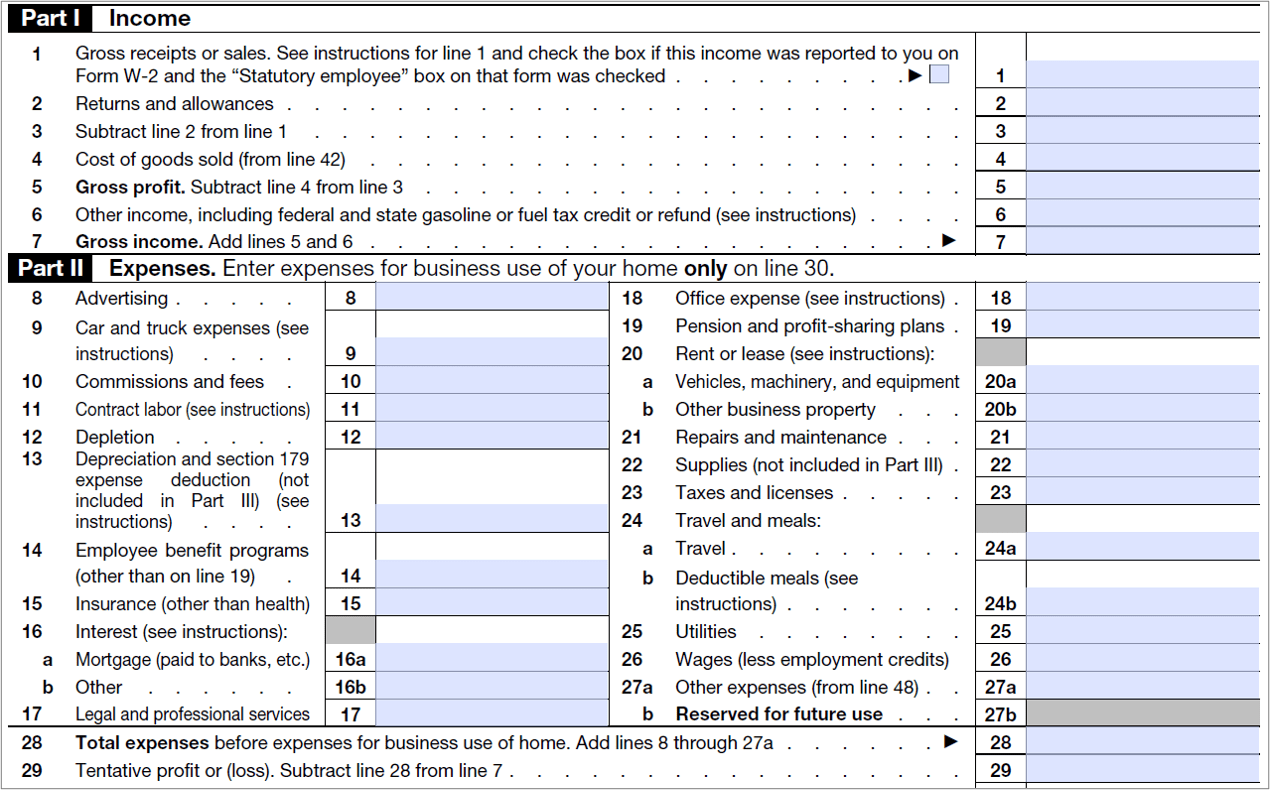

Schedule C has a Part 1 section for Income and a Part 2 section for Expenses. They look like this:

And then right below this, you report expenses for the business use of your home, and finally arrive at “Net profit (or loss).” Why is one type of expense reported in the income section (cost of goods sold, line 4), and another type of expense reported below the expense section (expenses for business use of your home, line 30)? Conceptually they are both expenses. Gross profit (line 5) is a common metric for analysis of a business, so I imagine the IRS set up Schedule C to mimic a typical income statement of a business. Why is business use of a home reported on its own? It was moved below the rest of the expense section in 1991. My guess is that the move was prompted by this being an area of abuse and/or confusion among taxpayers, but I don’t know the history.

What if you work from home but don’t have your own business (you are a W-2 employee)? (Thanks to Helen who wrote in about this.) No home office deduction for you! This provision is set to expire after 2025, so we’ll have to see what Congress does with it in the future.

So Schedule C is where you figure out the amount of profit on which your business has to pay taxes. Schedule C flows into Schedule 1 (Line 3), and Schedule 1 flows into Form 1040 (Line 8).

How do you know if you have income from a hobby or a business, and why does that matter? (Thanks to Darby who wrote in about this topic.) The distinction matters because you are can deduct expenses for figuring business income but cannot do so with hobby income (hobby expenses previously had some deductibility, but this changed effective 2022).

The IRS has some guidelines that help you determine if something is a hobby or a business. Some distinguishing factors is whether you carry out the activity in a business-like manner (keeping books and records), and whether you put in time and effort, showing you intend to make the activity profitable. As with other IRS determinations, this is based on all the “facts and circumstances.” If you have business with losses too many years in a row and you are audited by the IRS, they might scrutinize things and decide you actually had a hobby and not a business, and have to pay back taxes. Hobby income gets reported on Schedule 1, line 8j (activity not engaged in for profit income).

See y’all next week!

-Stephanie