Anatomy of a 1040, Class 7

Hi Friendos,

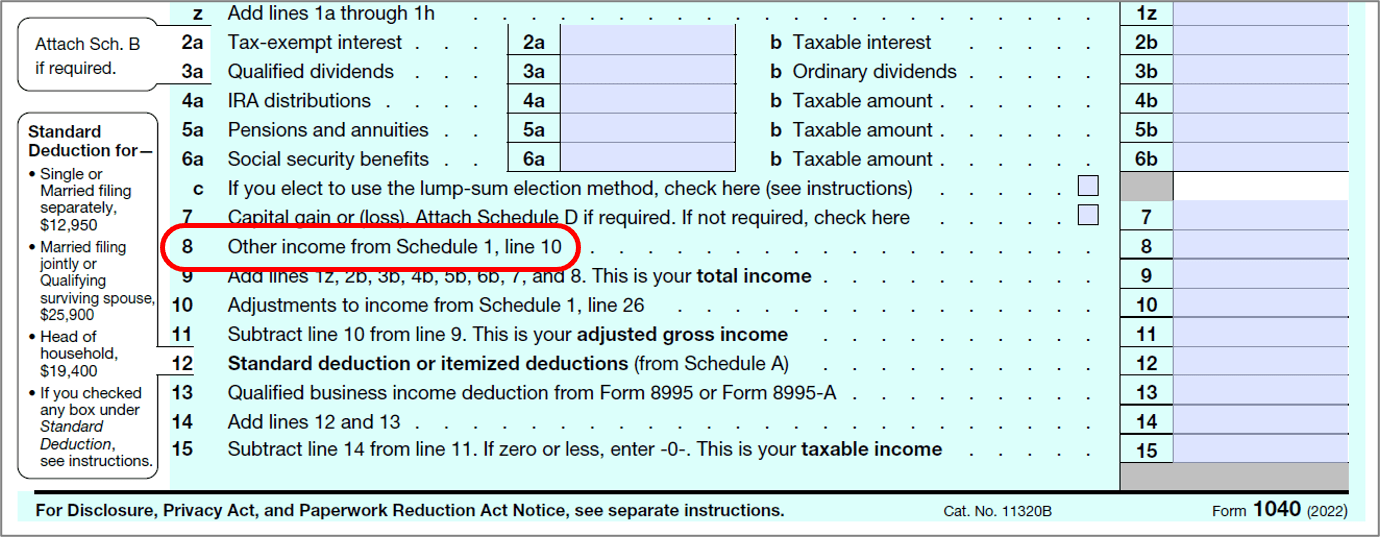

Today in our seventh summer school class, we’ll discuss just one line of Form 1040. Line 8 sounds so simple, “Other income from Schedule 1, line 10,” but there is so much action there! By the time we get to line 8, we’ve already provided information about several types of income, including W-2 income, tip income, and investment income. Schedule 1 covers everything else and is our last stop before we calculate “total income” in line 9.

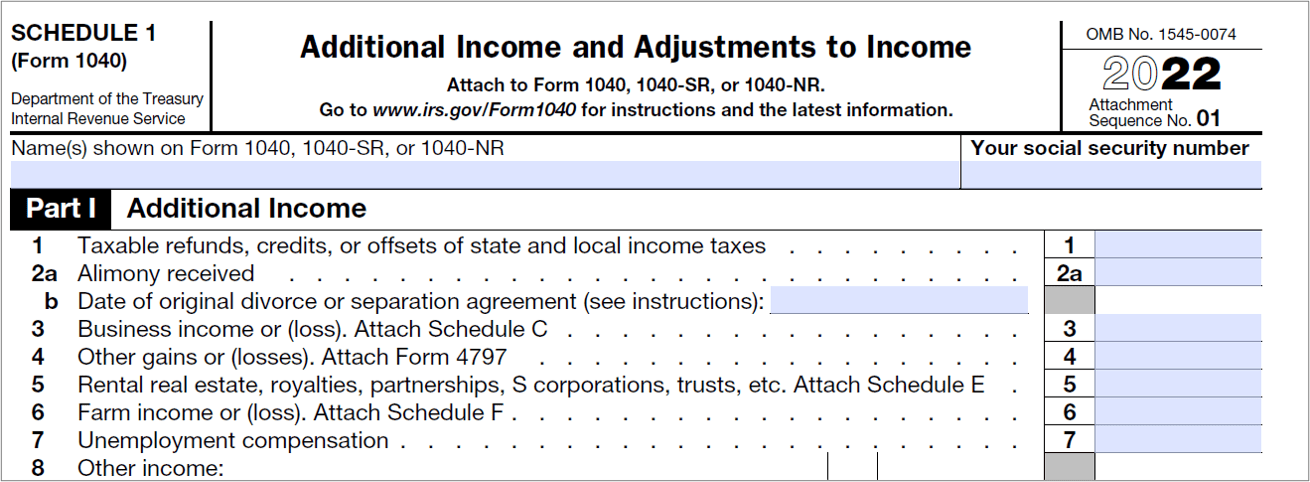

To understand line 8, we need to look at the first page of Schedule 1, “Additional Income.” Here is what the top part of the page looks like:

You might look at that first line and wonder: “How can a tax refund be income? That makes no sense, it’s just returning a prior overpayment.” Well, let’s say that when you prepared your 2021 tax return you were owed a refund on state income taxes. Also, let’s say in 2021 you itemized deductions (we’ll discuss “itemizing” vs the “standard” deduction in a future class) and your state taxes paid were part of those itemized deductions. This means that in 2021, you itemized the full amount of your 2021 state taxes, both the amount you actually owed and the amount you overpaid, and all of that sheltered income from federal taxes. Now in 2022 you got back that overpayment from your state, and the federal government says you no longer can use it to reduce your federal taxes. So line 1 is all about no double-dipping on a deduction for state and local income taxes.

What other kinds of income might you have to pay tax on? Alimony, but only if its from a divorce/separation agreement from before 2019. The Tax Cuts and Jobs Act of 2017 (Trump’s tax bill) changed taxation of alimony. Previously it was a tax deduction for the person who paid it, and taxable income to the recipient (although many people receiving alimony do not actually owe any federal income taxes due to having very low income). The 2017 Tax Act changed things so now it is neither a tax deduction for the payor or taxable income for the recipient. That deduction helped encourage payment of alimony owed. Marital status is deeply embedded in our tax code.

Line 3, for “Business income,” is where a self-employed person reports their income. We’ll discuss Schedule C next week!

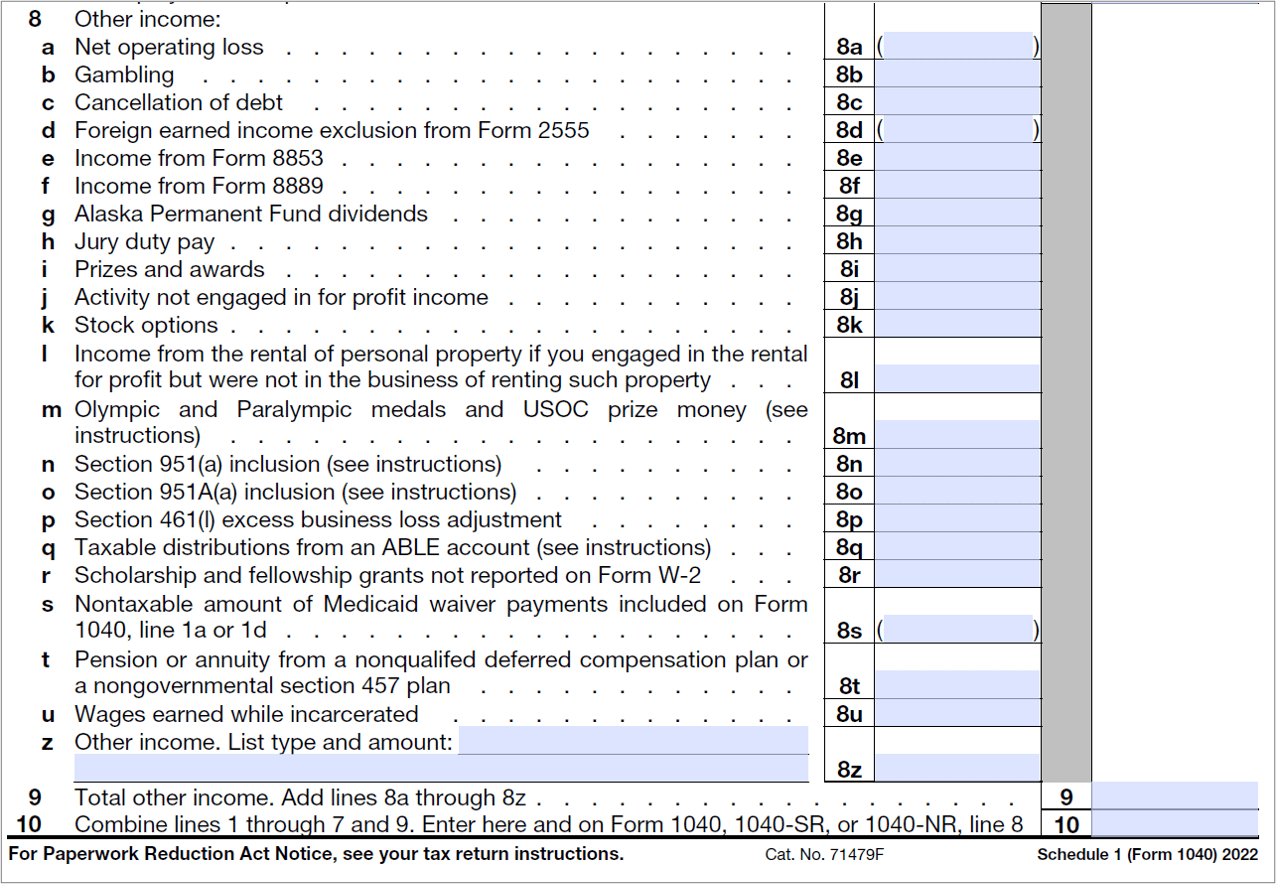

What other kinds of income do you report? Rental real estate, income from trusts (dare to dream), farm income, unemployment (you would get a 1099-G). What else? Line 8 wants to know so much more:

Did you win money in the lottery or on a sports betting app (gambling, line 8b)? That’s income, you have to report it. Did you get paid for jury duty (line 8h)? That’s income too. Managed to get some debt cancelled (line 8c)? Income, report it. You WON THE OLYMPICS (line 8m)? Congratulations! Also…income, report it (but only taxable if your adjusted gross income is over $1 million, phew!) And just in case all these different types of income don’t fully capture every dollar of income you received… line 8z has you covered for “any taxable income not reported elsewhere on your return or other schedules” (per the instructions to Form 1040).

Next week we’ll wrap up our discussion of income with our discussion of Schedule C. See you then!

-Stephanie

One reply on “The Boring Newsletter, 7/29/2023”

[…] talked about the many types of income you might have, and how the IRS wants you to declare all of it. Good news though, Congress has […]

LikeLike