Anatomy of a 1040, Class 4

Hi Friendos,

Welcome to our fourth summer school class. During our first three classes, we discussed the top half of Form 1040 p. 1, which gathers tax-relevant information about you. Now we’re ready to move on to the next section, which gathers information about your income.

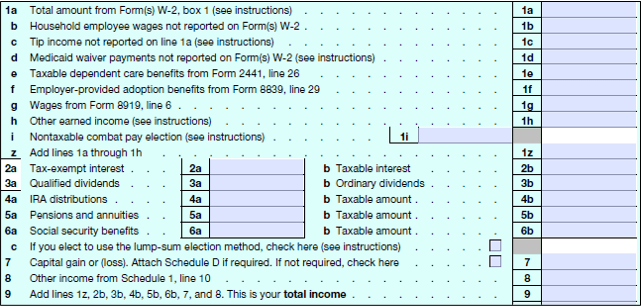

Lines 1-8, and their subparts, report your various types of income, and then line 9 adds it up to arrive at your “total income.” Know that if there is any kind of tax form you get in the mail summarizing income you received (actually, any tax form you get at all, income-related or otherwise), the IRS and your state tax authority also get a copy of that form.

Today we’ll focus on W-2 income, reported on line 1a of Form 1040. Self-employed people, don’t sneak out the back! Some of the concepts discussed here apply to parts of your world too.

If you have multiple W-2 jobs within a year, you add up amounts across all the W-2’s (“box 1”) and show the total on Form 1040.

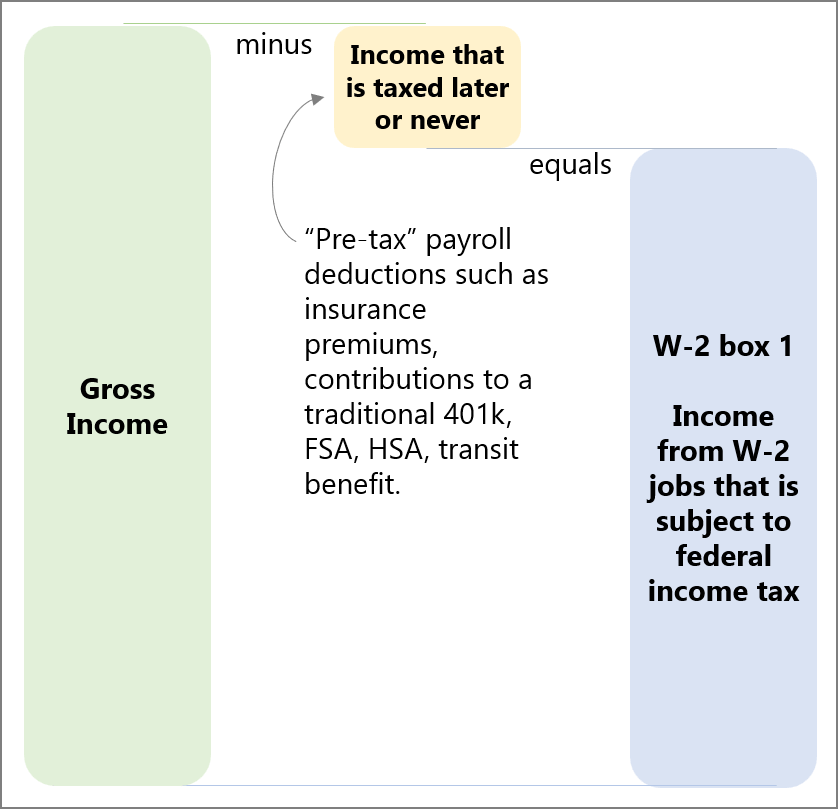

This amount may not be the same as the gross income you were paid (annual salary plus any bonuses/commissions). This is because any “pre-tax” money your employer takes out of your paycheck (e.g., health insurance premiums, contributions to a traditional 401k, transit benefit, etc.) is not subject to federal income taxes and will cause your gross income to differ from your taxable wages. Like this:

Those payroll deductions are, in economic terms, sheltering a portion of income from federal income taxes. So your employer (their payroll provider) is doing some important tax math for you when they prepare your W-2.

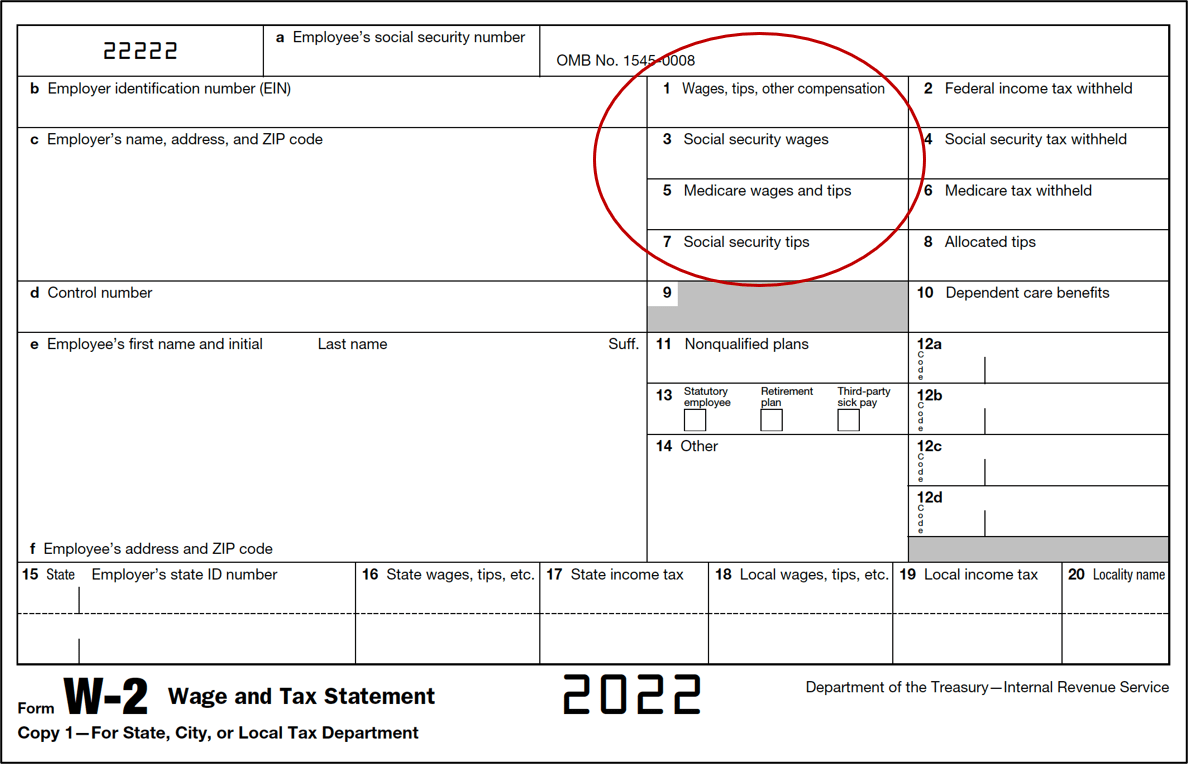

You might notice that a W-2 has separate boxes for “Wages, tips, and other compensation,” “Social security wages,” “Medicare wages and tips,” and “Social security tips.” These amounts can all be different from each other! It is so confusing!

There are three different taxes on W-2 income imposed by the federal government: (1) Social Security tax, (2) Medicare tax, (3) federal income tax. Those first two taken together, Social Security and Medicare taxes, are called “payroll taxes” or sometimes “FICA” (Federal Insurance Contributions Act, the 1935 legislation that introduced these programs). Conceptually, all 3 of these are federal income taxes in the sense that they are taxes, on income, imposed by the federal government. We only label one of them “federal income taxes.”

A comment on the politics of this: lots of right-leaning people love to say that nearly half of Americans pay no federal income tax. This is endlessly repeated in the press. That statistic is only true if you pretend like Social Security and Medicare taxes don’t exist. Lots of working people pay no “federal income tax” but pay loads of payroll taxes (and pay federal gas taxes when they buy gasoline, and pay federal taxes on their utility bills, etc.). Denying that someone pays taxes is a way to deny the legitimacy of their participation in our democracy. Not cool.

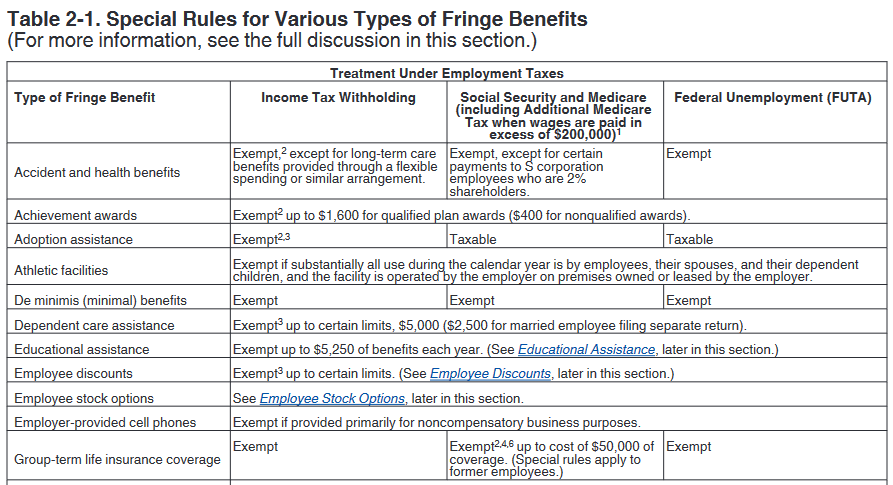

Some payroll deductions reduce income subject to federal income tax but not payroll taxes, such as a contribution to a traditional 401k or 403b. Some items shelter income from both payroll taxes and federal income taxes, like most health insurance premiums paid by an employee. Different fringe benefits are subject to different tax rules, as this snapshot shows:

So this is why a W-2 has more than one box to report wages and tips.

That’s all for today. Class dismissed!

-Stephanie

One reply on “The Boring Newsletter, 7/9/2023”

[…] week we talked about W-2 income that gets reported on line 1 of Form 1040. This week we’re going to line 2 and covering interest […]

LikeLike