Anatomy of a 1040, Class 3

Hi Friendos,

Welcome to our third session of summer school! Last week we discussed the top section of Form 1040, which gathers tax-relevant information. We discussed “filing status,” the very first item at the top of the form, as well as how taxpayers without social security numbers can use an ITIN instead.

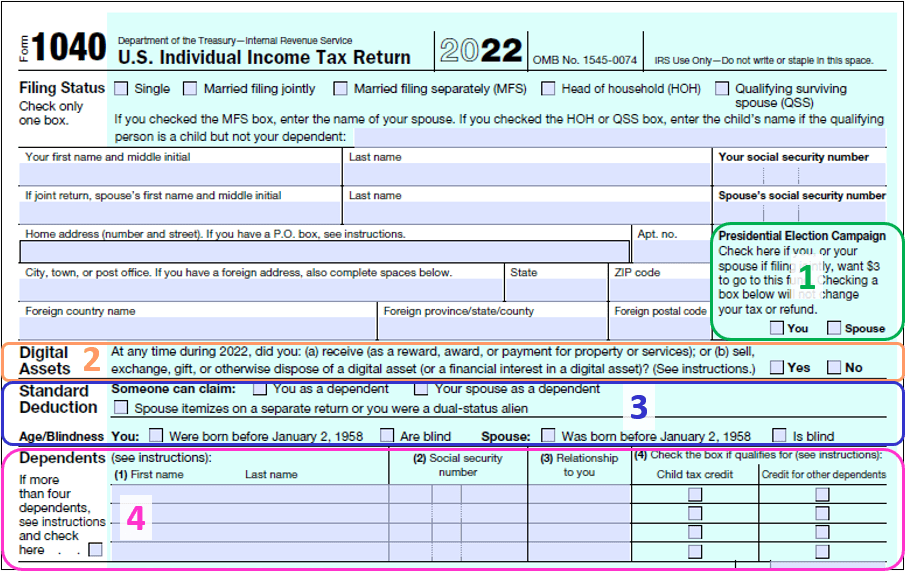

This week we’ll finish the discussion for this section of the form, examining (1) the $3 Presidential Election Campaign question, (2) the digital assets question, (3) the standard deduction questions, and (4) the section on dependents.

1: The $3 Presidential Election Campaign question

Your answer to this question does not impact the amount of tax you owe. If you say yes, $3 of your taxes will go into an account that provides public funding for presidential campaigns. What to know more? The Federal Election Commission has you covered.

2. The digital assets question

If you buy crypto currency and sell it for more than your purchase price, that is a capital gain and you owe tax on that (same as with mutual funds or stocks). If you bought it and still own it, there are no tax consequences – it is only when you “realize” a gain that you would owe tax. The IRS has a nice FAQ on crypto that gets into other scenarios such as if you gifted digital assets, paid for work in digital assets, and more. Overall, the tax treatment is the same as for other types of assets or income.

3. The standard deduction questions

These questions are relevant to the dollar amount you can claim as a “standard deduction.” If you claim the standard deduction, as the vast majority of taxpayers do, you don’t have to pay any federal income tax on your income up to that amount. For example, if you file “single,” your standard deduction in 2022 was $12,950 and you owe no tax on your first $12,950 of income. If you file “single” and are also blind, your standard deduction in 2022 was $16,450, and you owe no tax on your first $16,450 of income. If you file “married filing separately” and your spouse itemizes, your standard deduction is $0.

My mom checks the box for “blind” so that one has always interested me. A report by the Congressional Research Service summarizes its history, explaining that it dates from the Revenue Act of 1943 when Congress provided a tax break for “expenses directly associated with readers and guides.” The report accurately notes that “this extra amount arguably does not meet the tax tests of horizontal equity and effectiveness [actually aiding those in need of tax relief]. The provision has not been extended to other taxpayers with handicapping conditions because of administrative difficulties and the loss of additional federal tax revenues.”

We’ll discuss the standard deduction and itemized deductions more when we talk about how “taxable income” is calculated.

4. The section on dependents

The main ways that dependents impact taxes are:

- filing status (e.g., for a given level of income, someone with “head of household” pays less tax than someone with “single” for filing status),

- amount of earned income tax credit, if that applies, where someone with more dependents receives a larger credit

- claiming the child tax credit, additional child tax credit, and/or credit for other dependents

Determining whether someone is the “dependent” of someone else for tax purposes is sometimes straightforward and sometimes complicated. One rule is: a qualifying child must have lived with the taxpayer for more than half the year. A qualifying relative does not have to meet a residency requirement, e.g., you support your parents but don’t live under the same roof. Another rule is: a qualifying child must be under age 19, unless they are a full-time student, in which case under age 24, unless they are “permanently and totally disabled” in which case there is no maximum age. If you financially support another person who lives with you, and they are very low income, they may be your qualifying relative, even if they aren’t part of your family tree (e.g., you live with and financially support your ex-partner’s child from their prior relationship). A child could qualify as the dependent of more than one person, in which case there are tiebreaker rules.

As with determining filing status, the administrative burden is greater for those that do not conform to our dominant culture notions of “family.”

That all for today’s class. I hope everyone gets to enjoy the July 4th holiday as much as IRS Publication 4012.

-Stephanie

One reply on “The Boring Newsletter, 7/2/2023 🎇”

[…] to our fourth summer school class. During our first three classes, we discussed the top half of Form 1040 p. 1, which gathers tax-relevant information about you. Now […]

LikeLike