Anatomy of a 1040, Class 2

Hi Friendos,

Welcome to our second session of summer school! Last week we ended with an overview of the Form 1040, and broke it down into six areas: [A] gathers tax-relevant info about you, [B] gathers info about your income, [C] determines the total taxes you owe for the year, [D] figures out how much you’ve already paid [E] figures out your refund or balance due, and [F] has logistical/admin details.

Today we’re discussing that top area [A]:

Before we dive in, I will mention that not everyone with income has to file a tax return. The instructions for Form 1040 provide the details. Even if someone is not required to file, they may want to file anyway in order to claim a tax refund.

Now, you probably know what to do with the boxes asking for your name, address, and Social Security number. People who are not eligible for a Social Security number, which includes people living in the U.S. with and without legal status, can obtain an “ITIN” (individual tax identification number) and put that in the space labeled “social security number.” An ITIN may help someone open a bank account or obtain other services. The IRS is generally prohibited from sharing data with other federal agencies such as the Department of Homeland Security. For 2019, the IRS received 2.5 million tax returns where the primary taxpayer used an ITIN, with total tax paid of ~$2.8 billion.

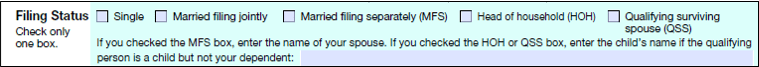

Looking back up to the top, the first thing Form 1040 asks about is “Filing Status.” There are 5 options to choose from: single, married filing jointly, married filing separately, head of household, and qualifying surviving spouse.

As the IRS describes it, “filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct tax.”

If you look on the lower left of Form 1040 p. 1, you can see one way filing status impacts the numbers, with different standard deductions for different filing statuses (we’ll talk about the standard deduction more later this summer):

Marital status and whether you financially support people who live with you determine your filing status. It is possible for a person to meet the definition of more than one filing status! In that case, they can pick the one that requires the lowest tax.

I’ve worked as a volunteer tax preparer in the IRS VITA program and appreciate this flow chart from the volunteer guide (see p. B-10 if you want to read the footnotes):

If you have never been married and do not financially support anyone else, you are “single.”

If you are married, your most favorable tax status is most likely “married filing jointly.”

Some people who are married pick “married filing separately” and each spouse files their own tax return. The IRS cautions that if you use married filing separately, “you will usually pay more than if you use another filing status for which you qualify.” People might choose it anyway due to, for example: not wanting to have both spouses’ income considered for a student loan income-based repayment plan, high medical expenses for one spouse result in lower taxes when filing separately, financial infidelity does not allow one spouse to trust information from the other and they do not want liability for signing a false return. If you are married and wonder: Which filing status is better for me? You can run the numbers both ways to find out.

If your spouse died, you file married filing jointly for the year in which they died. For the two years after that, if you do not remarry and are paying more than half the cost of keeping up your home and are supporting a dependent child (and meet other requirements), you are “qualifying surviving spouse” which is like married filing jointly from a numbers perspective.

If (1) you are unmarried or are married but did not live with your spouse the second half of the tax year and (2) pay more than half the cost of keeping up your home and lived with your child/children (or another “qualifying person”) then you are “head of household,” a more favorable filing status. I’ve prepared tax returns for a lot of single moms who used this filing status. There are a lot of requirements to claim this status and it is complicated. A “qualifying person” for head of household is different from a “qualifying child” or “qualifying relative” to claim a “dependent.” The administrative burden is intense.

Life is complicated. People have children with non-spouses. People live with non-spouses, sometimes with relatives, sometimes with other people, sometimes with their children (who may themselves be married and/or have children). Citizens marry non-citizens. Children are fostered, adopted. There is child support (or not). Our tax code financially rewards (punishes) different situations differently.

That’s all for today. Class dismissed!

-Stephanie

2 replies on “The Boring Newsletter, 6/25/2023”

[…] to our third session of summer school! Last week we discussed the top section of Form 1040, which gathers tax-relevant information. We discussed […]

LikeLike

[…] to our fourth summer school class. During our first three classes, we discussed the top half of Form 1040 p. 1, which gathers tax-relevant information about […]

LikeLike