Anatomy of a 1040, Class 1

Hi Friendos,

Welcome to your first summer school class, Anatomy of a 1040. Each week we’ll break down an aspect of U.S. federal taxes by examining a different part of the Form 1040, which is the form you or your tax preparer fills out at tax time each year. As I’ve said before, for most people in the U.S., taxes are our biggest expense, so it is truly in our interest to understand them. Tax laws are the result of our political process and an expression of our collective values, and they can have a massive impact on people’s lives.

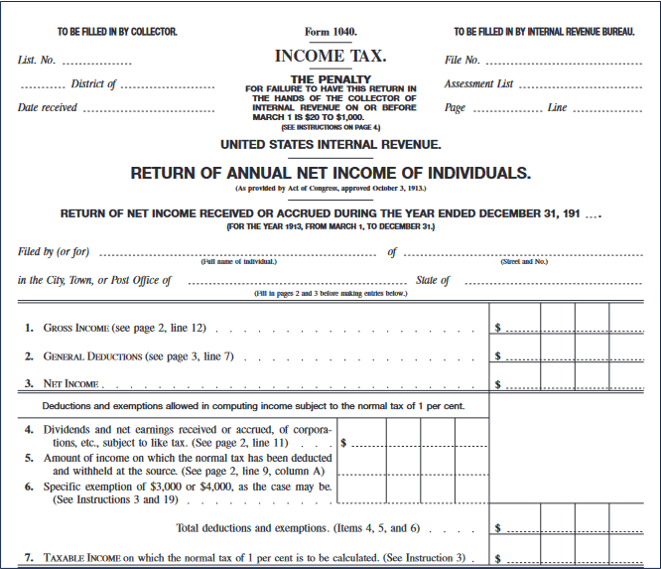

Today we begin with a little history and then take a high-level tour of today’s 1040. The first Form 1040 came out in 1914, to report income earned in 1913:

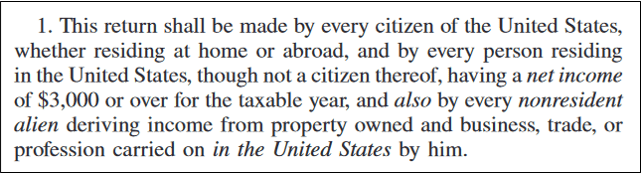

People who earned “net income” over $3,000 had to file a tax return:

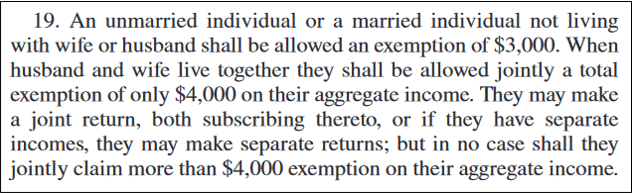

The tax law contemplated U.S. citizens living abroad and non-citizens living in the U.S. The 1913 Form 1040 uses he/him pronouns as “universal.” It does recognize that a wife could have income distinct from a husband:

Marital status has impacted income taxes since 1913, as have deductions for state and local taxes, and deductions for business expenses.

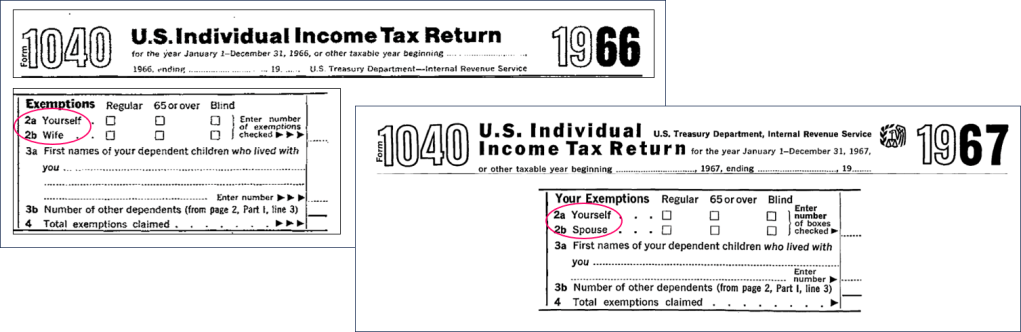

Each year, Form 1040 is updated to reflect changes in tax law. Sometimes the format, style, and language of the form is updated as well. For a married man and woman filing a joint tax return, until 1966 the IRS did not contemplate that the “wife” would fill out the form (thinking about my own marriage to a man…ha!). In 1967, the IRS vocabulary expanded to “spouse.”

Today’s Form 1040 has a similar look and feel to those of the last several decades, but styles have incremental updates all the time.

The Helvetica typeface, introduced in 1957 (and explored in an excellent 2007 documentary), is now the primary font used in IRS publications, as memorialized in the IRS Revenue Manual, a detailed set of guidelines for IRS agents and examiners. Section 1.17.7.2.3.1 (!) states, “Official IRS standard fonts include the Helvetica and Times Roman font families. Times Roman is legible and highly recommended for text-heavy documents or publications.” Also: “Do not use fonts that look similar to Helvetica and Times.” Strict!

And of course, there are updates to reflect new technology, such as electronically-fillable PDFs (the 1997 Form 1040 had this).

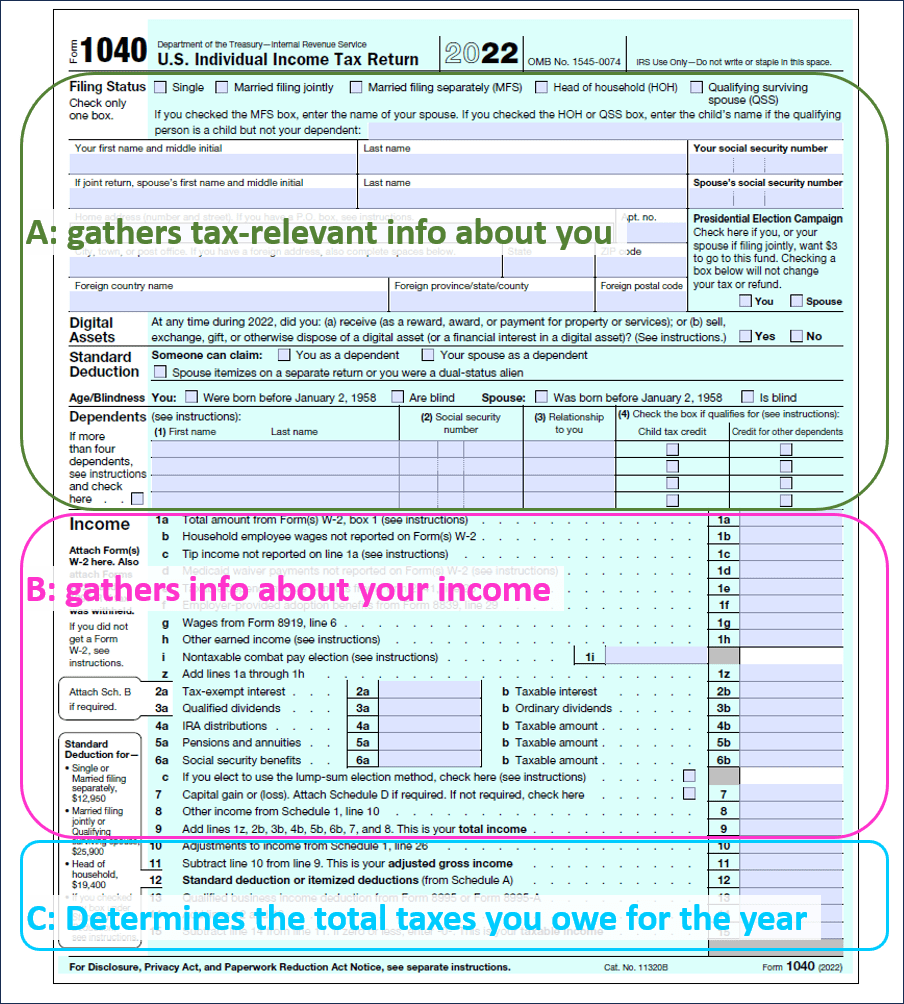

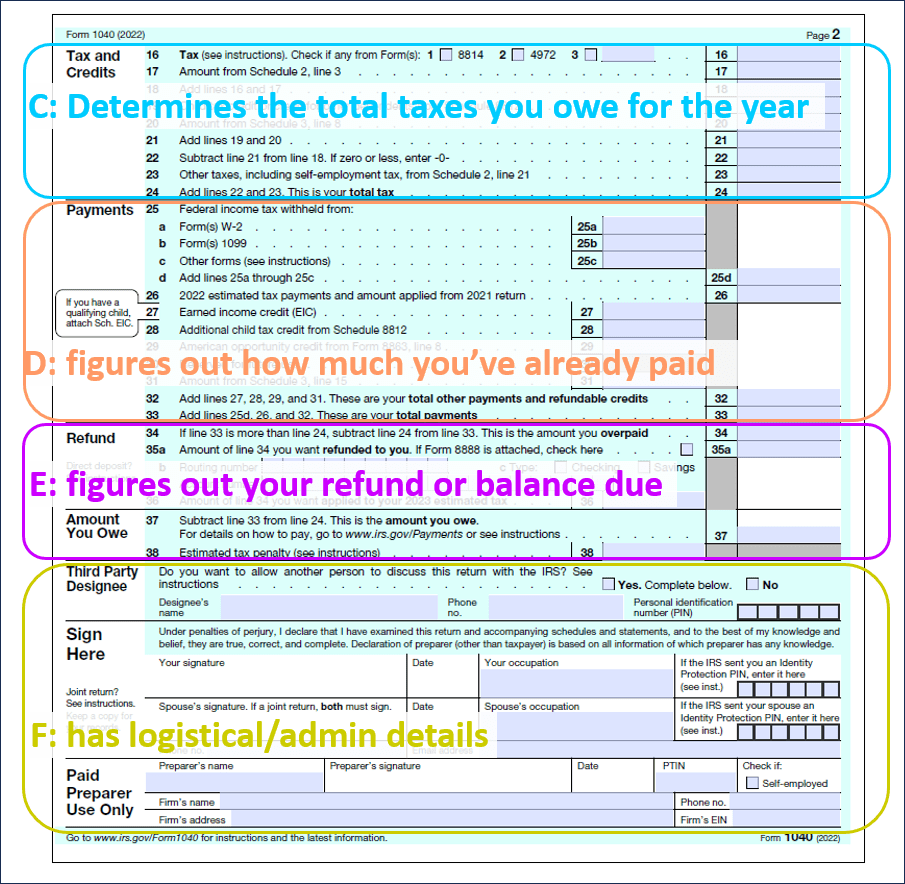

Which brings us to today’s 2-page beauty (not counting the 113-page instruction publication). There are lots of schedules and worksheets that are also part of the 1040, and we’ll get to some those later in the summer. We can think of a 1040 as having 6 areas which I’ll label A-F: [A] gathers tax-relevant info about you, [B] gathers info about your income, [C] determines the total taxes you owe for the year, [D] figures out how much you’ve already paid [E] figures out your refund or balance due, and [F] has logistical/admin details. You’ll see in the version I labeled below that [C] spans page 1 and page 2.

Next week we’ll talk about some of the tax-relevant information requested in [A] at the top of the form.

Class dismissed!

-Stephanie

2 replies on “The Boring Newsletter, 6/17/2023”

[…] to our second session of summer school! Last week we ended with an overview of the Form 1040, and broke it down into six areas: [A] gathers […]

LikeLike

[…] to our fourth summer school class. During our first three classes, we discussed the top half of Form 1040 p. 1, which gathers tax-relevant information […]

LikeLike